More options needed for a healthy realty market

|

|

Prospective buyers attend a real estate trade fair in Chengdu, capital of Sichuan province, on Oct 3, 2016. [Photo/For China Daily] |

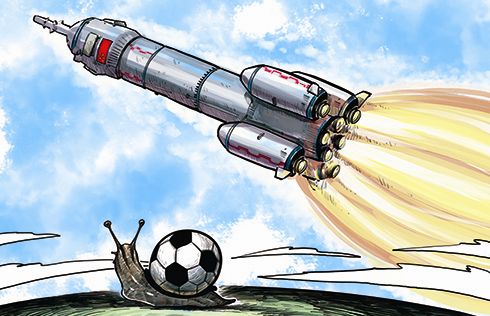

To stimulate or not to stimulate the real estate market, that is the question the government has continually had to answer over the past more than a decade.

Over those years, government real estate policies have flip-flopped between stimulating or restraining the real estate market. When the market has cooled, the government has lifted almost all the restrictions on purchasing properties and when prices have increased too rapidly, it has done the opposite.

Now, with house prices in major cities on a soaring upward trend, the governments in about 20 major cities issued policies in the week around the National Day holiday to set limits on the number of properties a household can purchase and increased the down payments required of homebuyers.

Given the rapid increases in house prices in many of the provincial capital cities and big metropolises such as Beijing, Shanghai and Shenzhen, such moves are more than necessary to cool their housing markets.

House prices have risen by 20 percent in the last six months in some major cities. It is no exaggeration to say that the annual profits of many listed manufacturing companies have not been as much as the cost of an apartment in Beijing, Shanghai or Shenzhen.

Before the new measures, there was no sign that the house prices would return to a reasonable level in the foreseeable future or even stop going up.

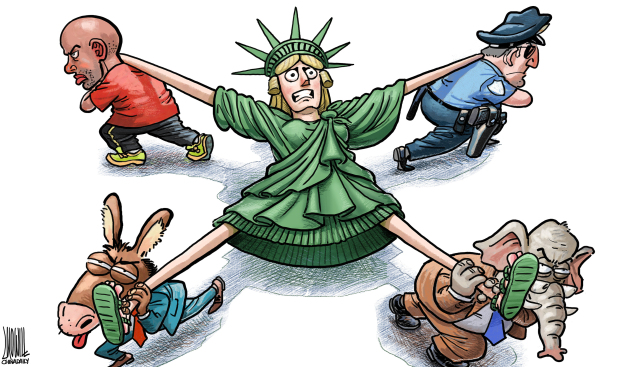

The expanding bubble in real estate market has had two consequences-it has made it difficult for many to buy a property, and made all other industries unattractive to investors.

It goes without saying that the real estate market is an important pillar sustaining China's economic growth. Yet, what has been even more terrifying is the fact that the economy cannot be deemed to be healthy when realty is the sole sustaining engine of the economy.

When house prices continue to increase in a rapid manner and most bank loans have gone to real estate, it is indeed necessary for the government to be cautious lest the economy be hijacked by this single industry.

It seems the government has fallen into a vicious cycle of setting and lifting restrictions on the conditions for the purchasing of properties.

More options such as a property tax are needed to set a healthy and steady track for the development of the real estate market.