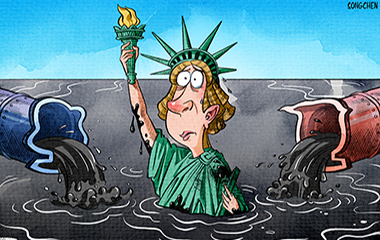

资产泡沫 (zīchǎn pàomò): Asset bubbles

When the Chinese economy was growing extremely fast, many industries produced good returns for investors. Now that the economy is going through restructuring pains, the investment returns from many industries have decreased, and hot money and speculators have turned to the real estate industry for profits.

The government is promoting innovation and entrepreneurship as the main drivers of the transformation and sustainable development of the economy. However, the real estate industry throughout the country has so far proved more attractive to capital especially, in main cities and surrounding suburbs.

Some listed technology companies even divert their limited funds-which could otherwise be invested in research and development-to speculate in the property market.

But the competitiveness of a city lies in its industry, not in its artificially inflated housing market, which yields little added value. If the governments are addicted to the immediate gains from land sales, it will be very difficult for them to plan a city's economic and industrial development in the long run.

Local government revenues should come from the tax on competitive enterprises in innovative industries, not land sales. Otherwise, the government actually shows its acquiescence to the estate bubbles, and the Chinese economy will lose out in the restructuring contest with other countries.