Initiative has made significant headway

|

|

MA XUEJING/CHINA DAILY |

Since the launch of Belt and Road Initiative (the Silk Road Economic Belt and 21st Century Maritime Silk Road), China has reached cooperation agreements with more than 30 countries along the Belt and Road.

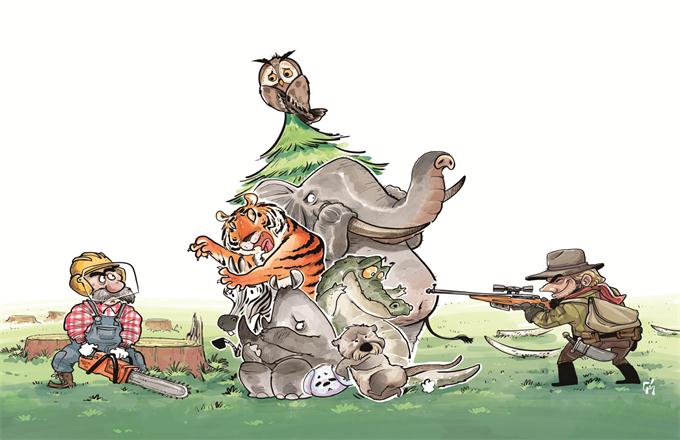

Infrastructure is a key priority of the Belt and Road Initiative to promote transport connectivity between regions. Work on many cross-border projects, including railway networks, highways and ports, has already started, while other projects are in the pipeline. The Belt and Road projects could potentially channel China's savings, production capacity and construction expertise to other countries to help reduce their infrastructure bottlenecks and promote regional development.

The initiative has boosted trade and investment growth. Trade between China and countries along the Belt and Road exceeded $1 trillion in 2015, a quarter of China's total trade value. The initiative also accelerated China's shift from the world's biggest goods exporter to a major capital exporter. China's outbound direct investment to economies along the Belt and Road grew 23.8 percent year-on-year in 2015 and nearly 60 percent in the first half of 2016.

China has also made efforts to reduce trade barriers, by developing more than 50 overseas economic and trade cooperation zones with countries along the Belt and Road and expanded its free trade zones' trial to seven more provinces, in order to strengthen industrial cooperation and enhance liberalization with other countries.

The implementation of the Belt and Road Initiative has also facilitated the renminbi's internationalization and financial cooperation. China has expanded its bilateral local-currency swap program to 21 countries along the Belt and Road, granted renminbi Qualified Foreign Institutional Investor quotas to seven countries and set up renminbi settlement banks in eight countries along the Belt and Road.

Key multilateral organizations have begun operations and new financing mechanisms are being set up. The Asian Infrastructure Investment Bank, BRICS New Development Bank and the Silk Road Fund, together with China's policy banks, have taken the lead and started participating in cross-border investment projects.

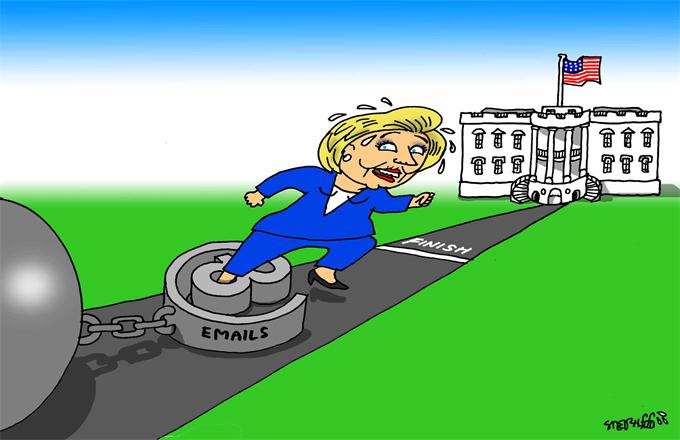

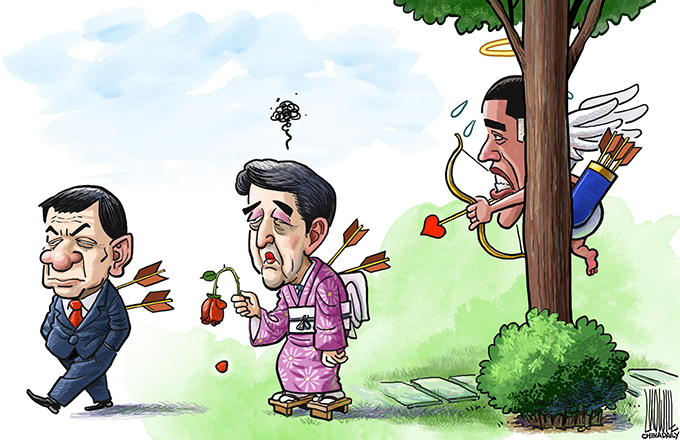

But despite the progress made in the past three years, the Belt and Road Initiative face risks and challenges at both the country and corporate levels, with strategy alignment and cost-sharing between participating countries being the main challenges. Some projects in foreign countries have been suspended or deferred highlighting the obstacles China faces in implementing the initiative. To remove these obstacles, China needs to align its strategy with those of other Belt and Road countries, and effectively address these countries' doubts and concerns.

We think proper strategy alignment and dispute settlement procedures will reduce the probability of project suspension even in case governments change. China needs to ensure mutual benefits from the initiative, as it is a commercially oriented project, not a foreign aid program. And it requires participating countries to make long-term commitments and invest to gain mutual benefits and joint development.

To be successful, China must make other countries fully aware of the economic logic and mutual benefits of the initiative, and demonstrate through existing projects that it will create jobs, improve local areas' connectivity with the rest of the world, and enhance their welfare.

Chinese companies investing in Belt and Road projects are also facing risks, including general debt risks, foreign currency risks, local policy risks and geopolitical risks, because of the lack of experience and knowledge in operating and investing in other countries. To mitigate these risks, they need to conduct professional project assessments and devise risk management systems before venturing into those countries, while effectively using credit insurance and overseas investment service platforms to improve the management of their foreign projects.

Furthermore, the government should encourage participation from multilateral institutions and continue to promote the renminbi's internationalization to help private companies better control their risks. Dealing with these challenges should provide useful lessons for the development of the Belt and Road Initiative.

The author is an economist at Standard Chartered China.