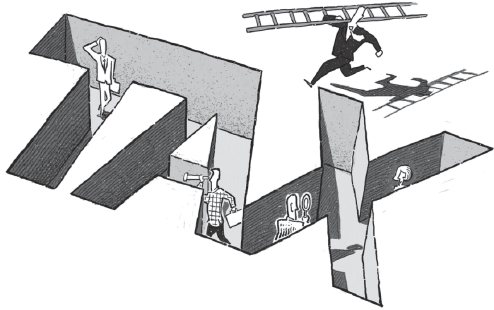

Reform can help ease tax burden of firms

|

| LUO JIE/CHINA DAILY |

Cao Dewang, chairman and founder of Fuyao Glass Industry Group in Southeast China's Fujian province, recently complained that the tax rates in China are higher than in the United States. The difference in corporate taxes in China and the US is owing to their different taxation structures. China's taxation mainly consists of indirect taxes on enterprises, while the US gets its tax revenues mainly from direct taxes imposed on individuals. That's why enterprises feel the tax burden in China is heavier.

Many have accused Cao of "running away" from the country. But since many Chinese enterprises have invested in foreign countries (or are preparing to do so), it is unfair to describe Cao's foreign investment abroad as an act of "running away" from the country, especially 65 percent of his company's market is in China.

Cao has mentioned the comparatively low taxation in the US, but he has also said the cost of human resources is higher in the US. The labor cost in China may still be relatively low but it is increasing, and the country faces the challenge of an aging population, which is expected to intensify in the future. This means China's demographic dividends are diminishing. Cao's complaint should therefore prompt the authorities to deepen the taxation structure reform.

Yet it is an exaggeration to say China imposes a very high tax rate which makes enterprises difficult to survive without evading taxes. It is difficult to say whether a certain rate of tax is high or low. Even if the macroscopic tax burden is only 1 percent, one can hardly say it is low if the taxation authorities fail to provide corresponding public services. Conversely, even if the macroscopic tax burden is 40 percent or more, one cannot say it is heavy if the government provides a sound social security system and high-quality public services. By simply comparing the tax rates in China and the US, without taking public services into account, we can only show the relative tax levels, not whether the public accepts them.

Generally speaking, people tend to accept high-level taxation if a healthy percentage of the tax revenues is used to strengthen or improve public services. But other factors, too, influence the macroscopic taxation level, such as a country's ethnic composition, history and tradition.

In 2014, China's capital export exceeded capital import, making it a net exporter of capital. Fuyao Glass went global about two decades ago, which is more sensitive to the tax differences between China and other countries. And since the international tax competition is expected to further intensify, China should review its tax structure from an international perspective.

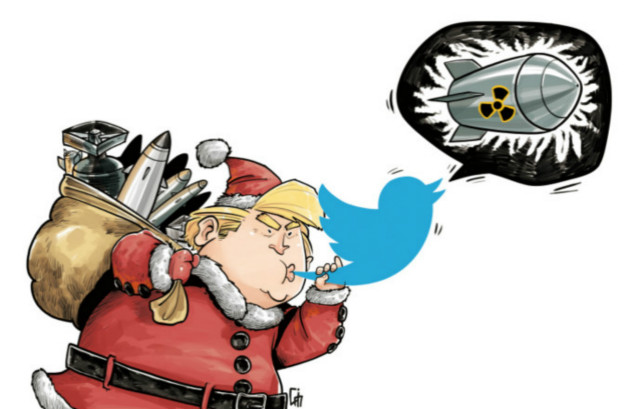

The World Bank and PricewaterhouseCoopers recently issued a report, titled Paying Tax 2017, saying China's overall tax rate is comparatively high among the 190 surveyed economies based on statistics till 2014. Besides, US President-elect Donald Trump is likely to cut taxes after taking office on Jan 20. So China should have a corresponding policy to cope with this change.

Although China has implemented a series of measures over the past two years to cut taxes, it needs to further reduce levies and administrative charges to ease the burden of enterprises, which cannot be done by only changing the taxation structure.

Reducing the ratio of indirect taxes will help enterprises develop in China, but taxation is not the only important factor for enterprises. For enterprises, the most significant factor is the after-tax return on investment, which is influenced not only by taxation, but also the market, production cost and other factors. This should remind the authorities to improve public services, as it will help improve China's business environment.

The author is a research fellow at the National Academy of Economic Strategy affiliated to the Chinese Academy of Social Sciences.