China: Industry fuels more pick up in growth amid ongoing rise in leverage

GDP growth picked up further to 6.9% percent year on year in Q1, with nominal growth at a remarkable 11.8%, percent, as the industrial sector was boosted by better exports and strong real estate activity amid continued rapid credit growth.

We expect the external setting to remain conducive in the rest of 2017 but think that domestic demand momentum will ease on slowing real estate activity and a somewhat less accommodative macro policy stance. Looking further ahead, the question is when the leadership will move toward a more significant slowdown in credit growth to put growth on a more sustainable footing.

China’s GDP growth picked up further to 6.9% percent year on year in Q1, as the industrial sector was boosted by better exports and strong real estate activity.

While the headlines point to rising nominal fixed asset investment (FAI) growth in Q1, it decelerated in real terms from 6.9% percent year on year in Q4 to 5.4% percent in Q1 as prices of investment goods rose materially. In particular, while infrastructure investment remains buoyant, corporate investment is held back by still ample capacity in industry. Housing sales growth declined significantly to 11.1% percent year on year in March, affected by the housing purchasing restriction in most large cities. However, responding to strong sales earlier on, housing starts rose 22.2% percent year on year and real estate investment momentum remained solid.

Goods exports growth grew a hefty 16.5% percent year on year in real terms last month, lifting growth in Q1 to 9.6% percent year on year, a sharp turnaround from 1.5% percent in Q4, supported by strengthening global demand momentum. Household consumption growth remained robust, with real retail sales growth edging up to an estimated 8.6% percent year on year/y in Q1. This is despite a slowdown in car sales to 6% percent year on year in Q1 following the cut in the excise tax for small cars early this year.

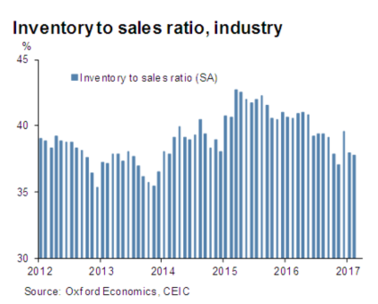

Previous inventory developments supported industrial production in Q1. The fall of inventories since early 2016 – the inventory to sales ratio in industry fell from 40.5% percent at thein end of February 2016 to 37.8% percent at thein end of- February this year – stimulated production in recent months. In all, growth of industrial value added (VA) accelerated to 7.6% percent year on year in March, lifting the average for Q1 to 6.7% percent year on year in Q1.

Consumer price inflation eased notably in Q1, rising only 0.9% percent year on year in March. Meanwhile, though, PPI inflation rose from 3.3% percent year on year in Q4 to 7.4% percent in Q1, driven by rapid increases of prices of coal, steel and in some other heavy industry sectors. Higher output prices in industry helped support profits while boosting nominal GDP growth to 11.8% percent year on year in Q1 and that of fiscal revenues to 14.1%. percent. Nonetheless, we expect PPI inflation to come down in the coming quarters as prices of coal and steel have been falling sequentially and there is very little spill-over onto output prices in light industry and machinery and equipment. We also forecast CPI inflation to remain comfortably below the likely target of 3% percent in 2017, suggesting no major monetary policy implications.

We expect the external setting to remain conducive in the rest of 2017. Recent indicators show continued improvement in global demand momentum. While downside risks remain, we think the risk of drastic trade tension with the US has come down after the recent meeting between the presidents Trump and Xi last weekend. In all, the prospects for exports are reasonable.

Nonetheless, we expect domestic momentum to ease later in 2017. Infrastructure investment should remain robust in a year of a major leadership reshuffle. And corporate investment should benefit somewhat from renewed profit growth. But the tightening of housing purchasing restrictions in many large cities will start to weigh on real estate investment. More generally, as underlined by the recent rise in short term interest rates, the macro policy stance will this year be somewhat less accommodative than in 2016.

Indeed, while still strong, credit growth eased somewhat in early 2017. New credit extension, which is subject to seasonal patterns, was slower than a year ago in Q1. New bank lending was broadly the same as a year ago. Off balance sheet lending (via entrusted loans, trust loans and bankers’ acceptance bills) was much stronger. But that was offset by a large slowdown in corporate bond financing, following efforts by policymakers to rein in the bond market. Moreover, provincial bond issuance declined in Q1. In all, the stock of overall credit (total social financing excluding equity financing but including local government bond issuance) rose 15.6% percent from a year ago, compared to 16.3% percent in Q4 2016.

Looking ahead, we estimate that the overall credit growth target for this year is 14.8%, percent, a modest slowdown from 16.1% percent in 2016. With nominal GDP growth picking up, the addition to the credit-to-GDP ratio should moderate, from 15 ppts in 2016 to 9.4 ppts this year. But, on current trends, China is still far away from stabilizing the credit-to-GDP ratio. The big question going forward is when the leadership will start to move towards significantly reining in credit growth, and accepting a slowdown in GDP growth that is necessary to put the growth trajectory on a more sustainable footing.

The author is the Hong Kong-based head of Asia economics for Oxford Economics.