Mutually beneficial plan to balance Sino-US ties

|

|

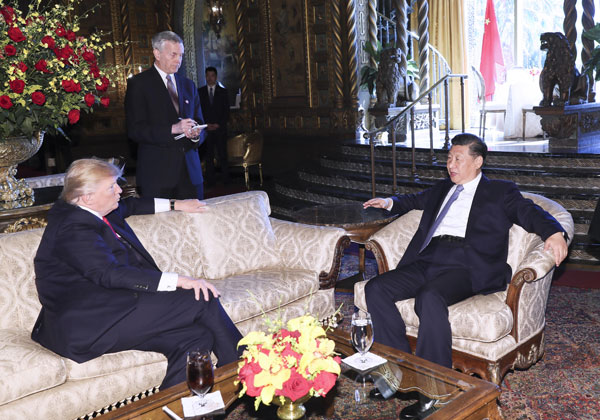

Chinese President Xi Jinping (R) and his U.S. counterpart Donald Trump (L) hold the second round of talks in the Mar-a-Lago resort in Florida, the United States, April 7, 2017. [Photo/Xinhua] |

Although the 100-day plan can be interpreted in different ways, considering it as China giving in to the demands of the United States would reflect a zero-sum game mindset. In 2001, some even claimed China had made a lot of economic concessions to join the World Trade Organization. But after more than 15 years, it is clear China has hugely benefited from the multilateral trade mechanism. Similarly, rebalancing of bilateral trade relations is necessary for not only the US but also China.

Since the 1980s China has followed export-oriented economic and trade policies, which brought Chinese enterprises huge profits and created millions of jobs. By producing goods for exports, China gained rich knowledge about global trade. But China's rapid economic growth took a heavy toll on its natural environment and natural resources. The benefits China got, in terms of research and development for example, was not definitely worth the environmental damage it suffered.

Given that China has now become the world's second-largest economy, the export-oriented growth model is not sustainable. Also, internal demand is pushing China to shift its dependence from exports to domestic consumption and R&D. And China and the US have the motivation to adjust their trade policies to achieve their respective economic goals. The US, for instance, wants to decrease its reliance on imports, by boosting its manufacturing and other sectors to meet domestic demand.

It is thus unfair to say one side has conceded to the demands of the other. If China decides to open up its products market, the US too will further open up its market to China and take more effective measures to guarantee the safety of Chinese investments in the US. The process is mutually beneficial and reinforcing.

More importantly, the increase in China's imports from the US has its own logic. Thanks to rising national wealth, China's domestic consumption is not only increasing but also changing in nature. Domestically produced goods can meet some of the new demands but imported products will be required to meet the others. For example, China still cannot make some aircraft parts-or the production cost will be much higher if it tries to do so.

China's rapid economic growth has also helped increase the country's middle class, which can afford to pay for more protein in their diets. As a result, the demand for beef in China has increased. To meet this rising demand, China has to import beef from Brazil, Australia and European countries. And since the US is also a big producer of beef, there is nothing wrong in importing beef from the country if its quality meets Chinese food safety criteria.

Moreover, by further opening up its financial service market to foreign companies, including those from the US, China will not compromise its national security. Instead, it will provide more financial options for Chinese investors and enterprises to increase their profits. By the end of last year, foreign financial banks owned only 2 percent of China's entire banking assets, less than what they did in 2001 when China became a WTO member. So China has much room to open up its financial sector.

However, despite the 100-day plan being ambitious, there are plenty of sticking points in bilateral trade, which have dominated China-US relations for many years. Still, the idea of the 100-day plan is a big achievement, as it reflects a rapid, tailored and concrete response to the trade issues, which is "a sea change" from the way China and the US had been dealing with bilateral relations.

The author is a research fellow at and director of the Division of American Economic Studies at the Institute of American Studies, China Institutes of Contemporary International Relations.

- White House: Trump-Xi summit in planning stages

- Experts: Trump-Xi call could strengthen cooperation

- Xi-Trump meeting brings high hopes

- Xi, Trump talk over phone on Peninsula, Syria issues

- 'Fruitful' Xi-Trump meeting charts course of China-US ties under global gaze

- Xi, Trump pledge to expand mutually beneficial cooperation, manage differences