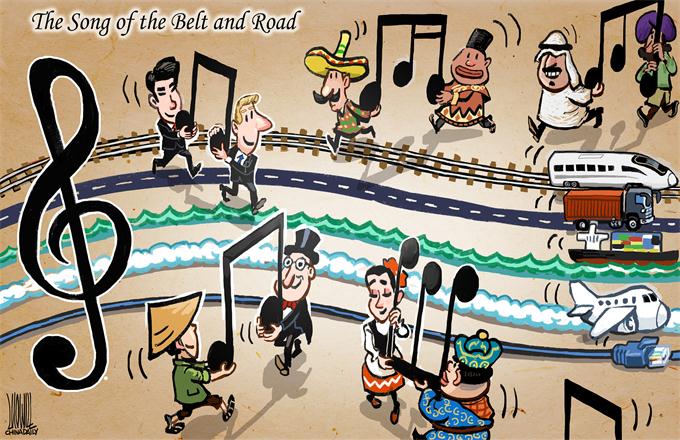

Initiative provides win-win fruits for all

Multi-channel for financing projects

|

|

Cheng Cheng, an associate research fellow at the Industrial Research Department of Chongyang Institute for Financial Studies, Renmin University of China |

"Aid" is a technical term and usually refers to official development assistance, which is different from loans or investments. Since many countries along the Belt and Road routes are developing or relatively less developed, sometimes investments or loans from China might be developmental in nature.

Public finance must play a model role in attracting private financing for Belt and Road projects, and cooperation between governments could help build a better environment for investors. If coordinated efforts are made to make sure public finance and private capital work efficiently together to improve the infrastructure in the countries involved in the initiative, the costs of operating business could sharply decline. In this sense, infrastructure is not limited to facilities such as roads, railways and power plants but extends to "soft" areas such as the legal system, consumer service, commercial data collection and capacity training. Once hard and soft infrastructure improves, private investment will start flowing in. And the increase in official loans will in turn facilitate more private investment.

- Direct flights link China with 43 Belt and Road countries

- European Investment Bank pledges support for Belt and Road plan

- Belt and Road a new platform for China, Japan: Xi

- Belt and Road documentary films promoted in Guangdong

- Belt and Road Initiative boosts Africa's infrastructural connectivity

- Research on the Supporting Feasibility of Infrastructure Construction of Those Countries along the Belt and Road Routes with PPP Mode(Special Issue No. 13, 2017)

- Is Belt and Road Initiative just political rhetoric?

- US forms Belt, Road group

- US-China trade could get Belt-Road lift