伪金融创新(wěi jīnróng chuàngxīn): Pseudo-financial innovation

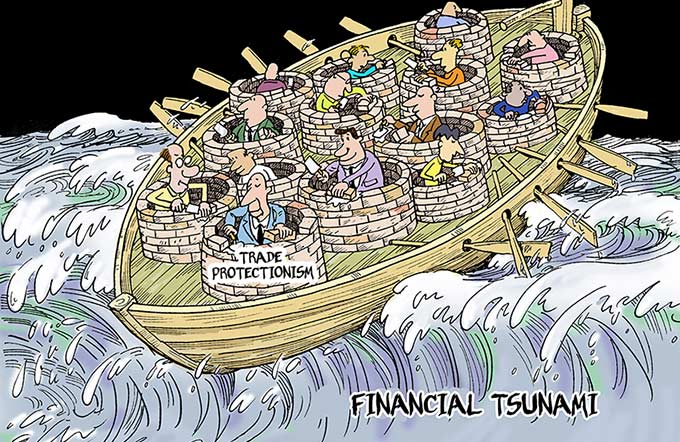

Preventing financial risks is of great significance to social and economic stability and security. To address the potential hazards and financial risks they pose, China's financial regulators tightened their regulation of digital currencies recently. The People's Bank of China, China's central bank, issued a document on Sept 4 cautioning that trading in virtual currencies presents huge financial risks and may involve illegal fundraising and money laundering.

As a result, BTC China, the country's biggest bitcoin exchange, announced on Thursday it would stop trading this month, and China's other major cryptocurrency platform Yunbi followed suit on Friday.

Finance is the blood of the real economy, and the financial sector has the responsibility to serve the real economy.

At a forum on Sept 15, officials of the central financial regulators pointed out that the authority should prevent the trend that finance focuses on the virtual economy while being divorced from the real economy.

Financial innovation should serve the real economy and be in accordance with the requirements of the financial sector. And the financial regulators should resolutely fight against any pseudo-financial innovation that enables illegal financial activities or poses risks to the country's financial system.

- Shanghai announce Financial Innovation Award winners

- Accelerate Financial Innovation to Build China into a Strong Global Manufacturing Power

- Lujiazui summit delves into financial innovation and reform

- Hong Kong may be at risk of losing out when it comes to financial innovation

- Internet-led financial innovation key to structural reforms