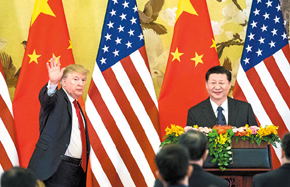

US-China trade at a global crossroads

Three scenarios

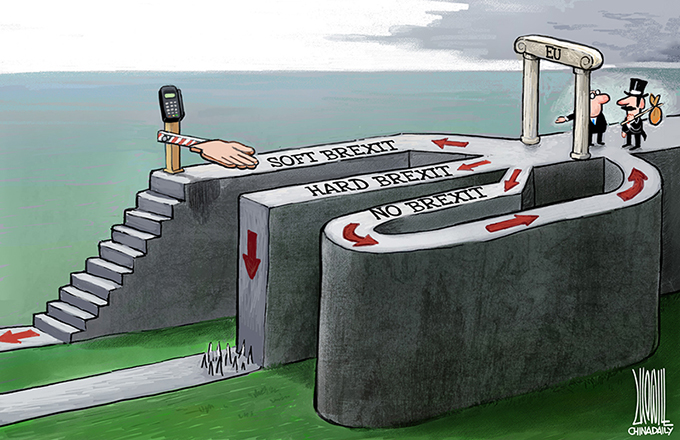

There are only three probable US-China trade scenarios, after the US directive on steel imports and national security, the recent US-Sino Comprehensive Economic Dialogue, US reliance on Section 301 of the Trade Act of 1974, and the investigation into China over US intellectual property.

In the “trade pragmatism” scenario, the White House stance would focus not just on deficits, but other critical bilateral dimensions as well. US multinationals and consumers would continue to benefit from lower costs and prices. Emulating General Electric and Caterpillar, US companies would adopt a more active role in the One Belt, One Road (OBOR) initiative. Chinese investment would contribute to jobs in America. Chinese-held US Treasurys would keep interest rates moderate. The international role of the US dollar would continue to erode, but slowly.

In the “trade war” scenario, bilateral deficits would dictate the White House’s stance, which would result in progressive deterioration of the bilateral relationship. While corporate giants with major China stakes, such as Apple and Walmart, would be crushed (which would hit the US markets hard), US multinationals would be penalized by higher costs and US consumers by higher prices. American companies would miss historical opportunities in the OBOR initiative. US would lose Chinese capital and jobs. The bilateral service surplus would shrink.

With the sales of Treasurys, rising interest rates would harm Trump’s $1 trillion infrastructure modernization. The decline of US diplomacy could threaten the dollar’s global-reserve status, especially as the US petrodollar – dollar spending based on revenues from oil exports – will soon be augmented by China's petrorenminbi, the use of Chinese yuan in oil transactions.

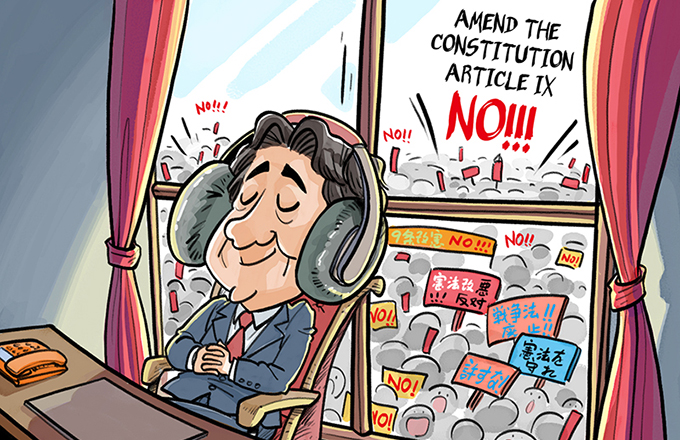

Until recently, the White House’s stance has reflected a mixture of these two scenarios. But that has come with uncertainty and volatility, which could prove challenging in crisis conditions.

US reliance on the Chinese market

Over time, America’s reliance on the Chinese market will deepen as per capita incomes in China will double by 2020. According to Credit Suisse, China overtook the US in 2015 as the country with the largest middle class at 109 million adults, as opposed to 92 million in the US.

The future translates to more of the same. Private consumption in the US is growing at only 1.6 percent per year; in China, it’s growing over five times faster.

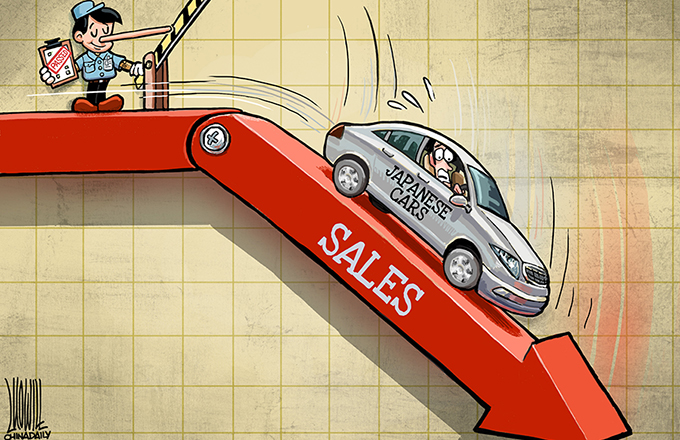

The global car industry is a case in point. In the past, American cars dominated the international market. But in 2018-9, unit sales in China will soar to 31 million, which is almost twice the size of the US market. As a result, US companies, from old players such as General Motors to new ones such as Tesla, invest heavily in China, where they sell more cars than in the US.

Other industries will follow in these footprints.

The “trade war” scenario would be a lose-lose proposition not just to the US and China. It would undermine global growth prospects – our future.

Dr. Dan Steinbock is the founder of Difference Group and has served as research director at the India, China and America Institute (USA) and visiting fellow at the Shanghai Institute for International Studies (China) and the EU Center (Singapore).