Local govts should cool housing market

The central bank and the housing and land authorities recently convened a conference in Wuhan, capital of Hubei province, on local governments' real estate policies. Only the officials from some key provincial-level regions were summoned to attend the meeting. Southern Metropolis Daily commented on Wednesday:

The conference conveyed the unmistakable message that the local governments should continue to strictly control house prices in big cities while preventing sharp falls, and ensure that low-income people have access to the government-subsidized houses, as well as taking steps to promote the healthy development of the real estate industry.

The meeting was timely, as the housing markets in some cities are continuing to heat up, an indicator of the people's expectation that housing prices will rise higher.

As required by the central authorities, some local governments have set a ceiling price for new houses, which is markedly lower than the price of a secondhand house. Buyers of new houses, after securing the deal, can make a fortune by selling them in the market as second-hand houses, as prices are not controlled when reselling a property.

As a result, after the central bank made it difficult for speculators to buy homes through mortgage loans in some cities with overheating real estate markets, some investors have resorted to short-term bank loans to enable them to buy property. Although it is forbidden to use such loans to buy houses, the ban is not strictly implemented or supervised.

The number of personal loans more than tripled year-on-year from January to October, while the growth in retail sales of consumer goods dropped, suggesting that much of the loan money has entered the housing market. This is a noteworthy sign of local authorities' reluctance to cool the housing market, because if they were wholeheartedly trying to do so they would have tightened the conditions for issuing personal loans.

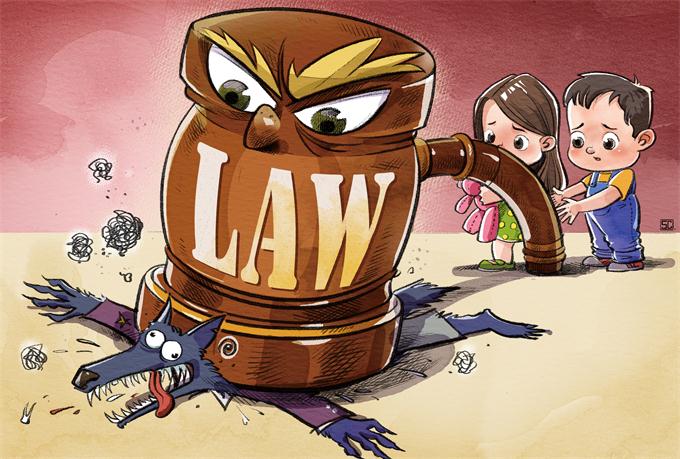

Hopefully, the recent meeting will have awakened local governments to the potential risks.