Death and taxes may be certain, but a tax on dying certainly isn't

A MEMBER OF the National Committee of the Chinese People's Political Consultative Conference, the top political advisory body, recently proposed amending the inheritance tax. The Ministry of Finance has replied that the government has never collected such a tax. Beijing News commented on Thursday:

Rumors that an inheritance tax was being levied have arisen occasionally since Shenzhen in South China's Guangdong province was said to be piloting such a tax. Although the Shenzhen government refuted the rumor, there is still speculation about a "death tax".

The Ministry of Finance's reply should directly dispel such suspicions.

However, some experts suggest the government should levy an inheritance tax, saying that some developed countries have taxed the transfer of the estate of a deceased person for a long time. But the Chinese authorities should be prudent in levying any new kinds of taxes. Other countries' practice is an important reference, but the decisive factor should be the real conditions in China.

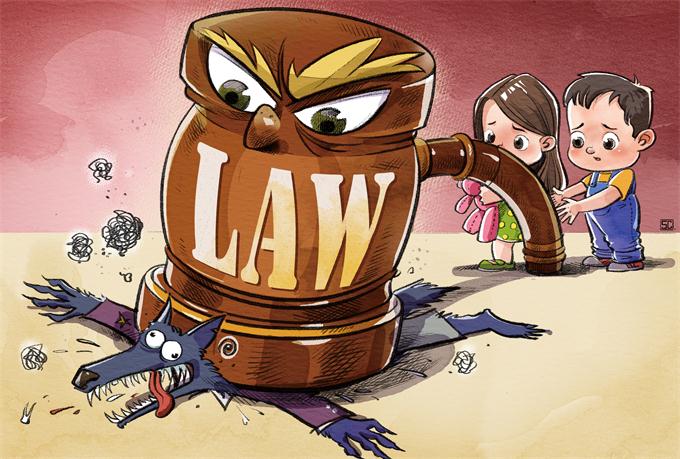

Although such a tax could play an important role in bridging the income gap, which has increasingly become a challenge to China's development, it is too early for the government to persuade people to pay a death tax because it does not help the accumulation of social wealth, which China still needs. The government's policies to encourage entrepreneurship and innovation indicate that China wants people to pursue the fast increase of personal fortune through innovations.

Even the authorities do not deny the tax burden on individuals and companies is already heavy. The government should ease the burden by cutting taxes in order to promote research and development and stimulate consumption.

Some developed countries, including Canada, Italy and Australia, have already stopped collecting the tax, as the past experience shows that the inheritance tax can prompt the outflow of capital, resulting in heavy losses for the country.