-

-

China Daily E-paper

William Daniel Garst

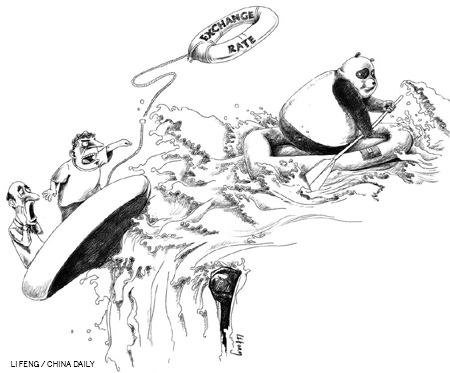

Don't have yuan for the road

By William Daniel Garst (China Daily)

Updated: 2010-03-10 07:59

|

Large Medium Small |

China's central bank will keep the yuan's exchange rate relatively stable this year and deepen coordination with other countries on major policy issues. China opposes politicizing monetary issues, central bank governor Zhou Xiaochuan said on Saturday in response to growing foreign pressure to ease the yuan's exchange rate because it is hampering trade and could be slowing down global recovery.

China's swift rebound from the global financial crisis has fueled growing foreign hostility. At the beginning of this year, Nobel Prize winning economist Paul Krugman wrote in the New York Times that China's exchange rate policy "drains much-needed demand away from a depressed world economy". He argues that other countries were being victimized by China's "mercantilist" economic strategy and could respond by adopting protectionist policies.

Let's begin with some basic figures on China's exports (all from recent articles in the Economist) during the global downturn. In 2007, merchandise exports accounted for 36 percent of China's GDP; it plunged to 24 percent in 2009. Its surplus, too, fell from 11 to 6 percent of GDP. These sharp drops reflect the 14 percent decline in the country's exports through most of last year.

True, other countries have suffered greater setback in foreign trade - which perhaps helped China to overtake Germany as the world's second largest exporter last year. But their exports dropped largely because of two factors, both unrelated to China's exchange rate policy. First, declining incomes and greater job insecurity in wealthier economies have shifted consumer demand toward less expensive goods. Second, last year saw the end of the European Union and US quota on the import of Chinese textiles and footwear, which used to be a crucial provision of the long-standing Multi-Fiber Agreement. So even without a managed currency, China would have had a strong comparative advantage in these areas.

China achieved a robust 8.7 percent growth last year despite a significant drop in its exports. Actually, exports contributed 4 percent less to its GDP but that it was more than offset by domestic demand, which added 12 percent. Domestic demand, in turn, has been boosted by the government's $586-billion economic stimulus package. Compared to the size of their economies, the Chinese government's package is much bigger than Obama's stimulus program, which Krugman has criticized for being inadequate. The Nobel laureate says that though Obama's stimulus package prevented a full-fledged depression, it was too small to generate a strong recovery and reduce America's 10 percent jobless rate significantly.

Its rising domestic demand has made China a motor for rather than a drag on the world economy for the past year. Anti-China critics focus on the country's exports but conveniently ignore the import side of its trade equation. Take the first 11 months of 2009, for example. China's imports increased by a whopping 27 percent during the period even as its exports slumped.

Michael Taylor, chief economist with London-based China Economic Policy Research Center, says China's rising imports "threw a much needed lifeline to the rest of Asia" and East Asian exporters "benefited hugely" from its rapid and domestic market-centered economic turnaround.

The same can be said for the US, for which China is the third biggest trade partner. America's exports to China rose by 13 percent during the first 10 months of 2009. But its exports to Canada and Mexico, its two biggest trading partners, fell by 14 percent.

Apart from boosting China's imports, the government's stimulus package has helped "rebalance" the global economy. This "rebalancing" has made China save less and spend more. The government is raising domestic consumption not only by providing incentives on purchase of durable goods, but also through substantially higher outlays on education and healthcare. Ordinary people will save less and spend more if they are assured of medical care in need and better education for their children at lower costs.

And finally, though many Americans believe their economy, particularly US manufacturers, would benefit if the yuan is revaluated against the dollar, the gains from such an adjustment would be enjoyed mainly by non-US economies. This is because China imports very few products that US manufacturers make. A stronger yuan would only force American consumers to pay more for Chinese imports or buy them from China's competitors such as Vietnam.

Given America's high jobless rate and sluggish economic recovery, a revaluated yuan can only hurt its consumers. This, therefore, is one area in which the Obama administration should be clear about its priorities.

The author is an American corporate trainer in China.

(China Daily 03/10/2010 page10)