Bank of America finally exits CCB

Updated: 2013-09-05 07:23

By Yang Ziman (China Daily)

|

||||||||

Reasons differ over time of deal that netted $1.47 billion for US firm

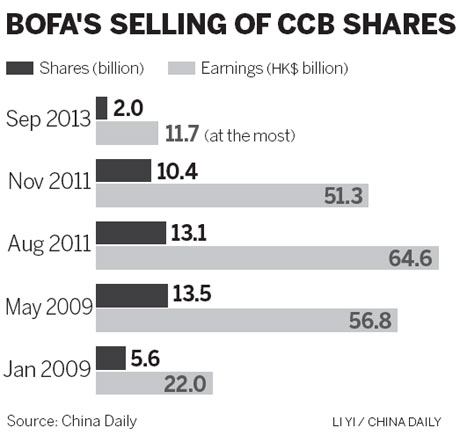

The sale of a stake in China Construction Bank Co Ltd held by Bank of America Corp was prompted by the latter's capital shortage rather than concerns over the Chinese finance house's profitability, said its spokesperson on Wednesday, one day after the US bank cleared 2 billion Hong Kong-listed shares of CCB for about HK$11.7 billion ($1.47 billion).

Bank of America told CCB that it has been downsizing the Chinese bank's H-shares to pump up its assets because of stricter requirements on capital quality by US banking regulators, said the spokesperson.

The two banks will continue their partnership based on a strategic agreement renewed in 2011 until 2016.

Bank of America sold the H-shares in a range from HK$5.63 to HK$5.81 each, representing a discount of 2 to 5.1 percent on Tuesday's closing price of HK$5.93, reported The Wall Street Journal. That puts an end to the bank's eight-year investment in the Chinese lender.

The American bank has been reducing its shares in CCB since 2009, gaining nearly HK$210 billion, 1.2 times its purchase costs.

CCB's H-shares fell by 1.35 percent at the close of trading on Wednesday. Other major commercial banks were hardly affected by the sell-out. Bank of China Ltd, Agricultural Bank of China Ltd and Bank of Communications Co Ltd saw increases of 0.29 percent, 0.58 percent and 0.19 percent respectively.

Bank of America's move did not come as a surprise, said Guo Tianyong, a professor at the Central University of Finance and Economics.

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Diabetes still on the rise in Chinese adults

US faces substantial losses if Egypt aid halted

Bank of America finally exits CCB

US divided as Obama presses for Syria attack

Xi, Putin meeting to focus on 'mega projects'

Writers sue Apple for compensation

S. Korea a model for innovation: experts

Why China dominates solar panels

US Weekly

|

|