Alibaba quarterly revenue disappoints, shares fall

Updated: 2015-01-30 00:56

(Agencies)

|

||||||||

|

|

The logo of Alibaba Group is seen inside the company's headquarters in Hangzhou, Zhejiang province early November 11, 2014. [Photo / Agencies] |

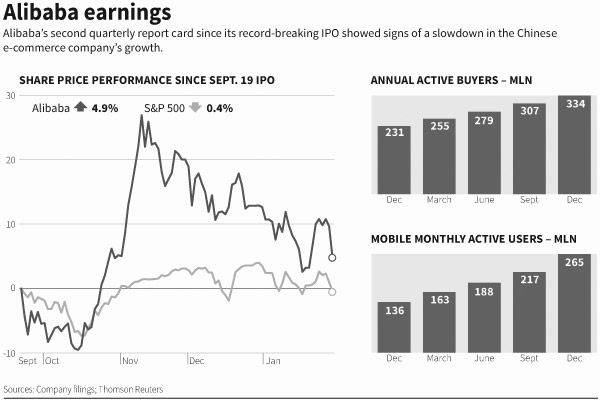

Alibaba Group Holding Ltd's shares fell more than 10 percent early on Thursday, wiping more than $25 billion of market value after third quarter revenue at the Chinese internet giant fell short of analysts' expectations.

Revenue at the world's largest e-commerce company rose 40 percent to $4.22 billion in the December quarter, short of the average analyst estimate of $4.45 billion, according to Thomson Reuters I/B/E/S.

Earnings per share (EPS), calculated to exclude one-off and extraordinary items, beat estimates of $0.75, coming in at $0.81.

But investors appeared to have other concerns, four months after the company's $25 billion IPO.

"Today's (stock price drop) is not about EPS, it's about the top line growth," said Tian Hou, a Beijing-based analyst with TH Capital.

"When Alibaba said they were expanding, investing, people's expectations were for top line growth and the bottom line would shrink. However they did the opposite, so that was contradictory to expectations."

Even strong numbers for mobile revenues and total value of goods sold on smartphones, closely watched metrics in the world's biggest smartphone market, weren't enough to stop the Wall Street-listed stock being hammered as trading began on the New York Stock Exchange.

Shares were down almost 10 percent at 10:28 a.m. ET at $88.75.

Alibaba did not address Tuesday's announcement that its second-biggest shareholder Yahoo Inc plans to spin off its 15 percent stake in the Chinese company.

But Alibaba's Executive Vice Chairman Joe Tsai did use the post-results conference call to take a shot at a Chinese regulator, after the watchdog called out the company in a report published on Wednesday for failing to do enough to stamp out illegal business on its platforms.

Tsai said the report was "flawed" and assured listeners that Alibaba had not seen the report before it was published, nor had it requested its publication to be delayed. The report by the State Administration for Industry and Commerce (SAIC) sparked concern that Alibaba had failed to disclose risk factors to its investors prior to its bumper listing in September.

SLIPPING GROWTH

Revenue growth, at its lowest level since at least 2013, and margins slipped as sales through mobile devices, typically smaller-ticket items, accounted for a bigger slice of total sales than in the previous quarter.

Gross merchandise volume (GMV), or the sum of all Alibaba's online commerce transactions, rose 49 percent to $127 billion. Mobile GMV continued to grow, accounting for 42 percent of total GMV, up from 36 percent in the September quarter.

The number of mobile monthly active users nearly doubled from the same quarter the previous year to 265 million. Overall annual active buyers grew 45 percent to 334 million from 307 million in the September quarter - exceeding the population of the United States.

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Alibaba quarterly revenue disappoints, shares fall

'Nightmare' incompatible with China-US relations

Alibaba adjusted profit tops estimates, revenue falls short

US ambassador to China calls for Flying Tigers movie

Taobao locks horns with regulator

China to expand Shanghai FTZ policies nationwide

China's train makers to court investors on road show

US, China expected to lead on climate talks

US Weekly

|

|