No change in monetary policy: central bank

Updated: 2015-03-12 15:06

(chinadaily.com.cn)

|

||||||||

The Silk Road Fund will target medium- and long-term projects that have strategic significance to support the "One Belt, One Road" initiative, Jin said.

It will invest particularly in projects involving ecological solar panel manufacturing, clean energy and ecological remediation in China and other countries along the belt.

"We will support our domestic high-tech companies to cooperate with countries along "the belt and road" and realize the mutual development and prosperity," Jin said.

Jin said the Silk Road Fund aims to cooperate with other private equity funds instead of competing with them or replacing them.

"The projects in general need a mix of debt and equity financing and provide more financing choices to projects that can achieve stable business returns in a medium- and long-term," Jin said.

PPI under control

China's producer price index (PPI) fluctuates wildly due to the country's “new normal”, as well as being influenced by changes in global commodities trade, Zhou said.

China's existing monetary policy guarantees liquidity in the financial market, but is still moderate, Zhou said.

China will continue to keep an eye on the PPI trend. Downward pressure on PPI will be controlled by a proactive fiscal policy and monetary policy, Yi added.

Background information

The central bank, following an earlier cut in November last year, announced a 25 basis point cut in benchmark interest rates from March 1, lowering the one-year lending and savings rate to 5.35 and 2.5 percent respectively.

The cut coincide with the weak economic data which showed the country's economy fell to its lowest level of growth in the first two months of the year since the financial crisis.

Christie's to auction landmark Chinese collection

Christie's to auction landmark Chinese collection

Chinese manufacturers keeping Apple Watch ticking

Chinese manufacturers keeping Apple Watch ticking

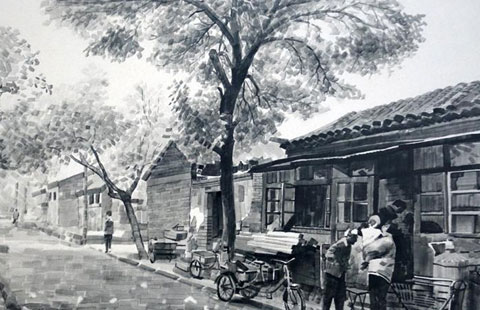

Hutong culture captured on porcelain plates

Hutong culture captured on porcelain plates

Foreigners at the 'two sessions' over the years

Foreigners at the 'two sessions' over the years

Top 10 most valuable airlines brands in the world

Top 10 most valuable airlines brands in the world

Qipao beauty in Chinese oil paintings

Qipao beauty in Chinese oil paintings

Daily snapshots of 'two sessions' - March 10

Daily snapshots of 'two sessions' - March 10

Scroll revives cheongsam beauty in New York

Scroll revives cheongsam beauty in New York

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Clinton emails breathe new life into Benghazi panel

No change in monetary policy: central bank

Chief justice expresses self-reproach for wrongful convictions

Alibaba ploughs $200m into Snapchat in latest startup deal: source

De Blasio pressed on Lunar New Year

Domestic jet 'to make maiden flight later this year': official

Shambaugh China essay rebuffed

Arkansas U. to expand China ties

US Weekly

|

|