Borrowers face costly payback

Updated: 2012-02-14 07:56

By Li Jing and He Na, and Xu Junqian (China Daily)

|

||||||||

|

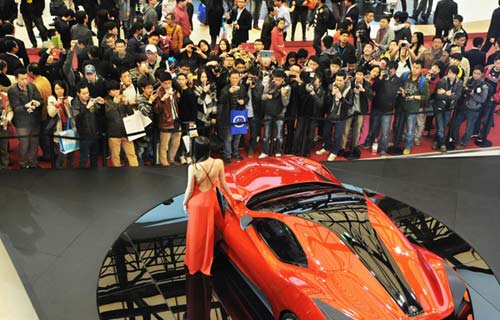

Fan Jianping / for China Daily |

Death sentence for ex-tycoon fuels debate over private lending, report Li Jing and He Na in Beijing, and Xu Junqian in Zhejiang.

Wu Ying used to be one of the richest women in China. Today the former billionaire is on death row.

In the eyes of many people, particularly the judge who threw out her appeal last month, Wu is a fraudster who swindled her friends and business partners out of 770 million yuan ($122 million).

Yet, others oppose the sentence and say her case highlights a major issue in China: the reliance among small- and medium-sized enterprises on high-interest loans from private lenders.

From loan sharks and underground banks to pawnshops and auction houses, the private lending chain is huge and diverse, according to economists, who blame the situation largely on the struggles experienced by entrepreneurs in getting startup funds through authorized channels.

After 30 years of ongoing reforms, experts are now adding their voices to calls for China's financial sector to be opened up even further.

On Jan 18, Zhejiang province's high court upheld the death penalty handed down to Wu, insisting that the 31-year-old had purposefully cheated lenders between 2005 and 2007, using false financial statements and promises of large returns.

"Her intention was to defraud, this was more than just illegal fundraising," said presiding judge Shen Xiaoming on Feb 7, in a statement issued in response to public opposition to the sentence.

Yet, Hu Xingdou argues differently. The professor of economics at the Beijing Institute of Technology said that as tightened monetary policies have made it tough to get bank loans, borrowing money from relatives, friends and acquaintances on the promise of high returns has become the only option for many Chinese entrepreneurs.

Most long-term lending by commercial banks only goes to government-backed projects, which carry less risk, he said. All that is available to small and medium-sized enterprises, such as those run by convicted tycoon Wu Ying, is short-term capital that cannot be invested in fixed assets.

Although it is illegal and unregulated, he said private financing might actually be complimenting the official system.

"Interest rates are sometimes much higher than those set by State-owned banks, but the 'application' process is flexible and straightforward," Hu added.

Tightened policies

Xinhua News Agency recently reported on a survey of 2,835 SMEs in Zhejiang province done late last year that found almost all of them had had difficulty getting loans. (The report did not reveal who conducted the study.)

About 15 percent had seen applications to commercial banks either rejected or "downsized", it said. And for those who did get loans, 86 percent said there were "additional conditions", such as a requirement to buy financial products or pay high consulting and service fees, which pushed up the cost.

Ultimately, the findings in the Xinhua report showed companies are being pushed into the arms of private lenders, who offer fewer rules but higher interest.

The Supreme People's Court deems private lending illegal when the interest rate is four times higher than that of a commercial bank. Yet, while the current average is from 6 to 7 percent a year, some underground banks are lending at an annual rate of up to 90 percent.

According to the survey of Zhejiang businesses, roughly 9 percent of respondents said they "frequently" borrow from private lenders to ensure cash flow, with 47 percent doing it "occasionally".

The most recent data from China's central bank also supports this theory. It stated that private lenders had loaned 3.38 trillion yuan ($536 billion) last year by May.

One of Zhejiang's most vibrant industrial hubs is Wenzhou, where economists say underground banks have become a lifeline for small businesses.

Despite a robust economy and a large collection of nouveau riche, the city's largely light industry relies heavily on labor, and therefore is often passed over for loans by official financial institutions.

"In Wenzhou, 90 percent of enterprises need private lending to get their production lines running. It's high time to legalize private lending," said Zhou Dewen, director of the Wenzhou Small and Medium-sized Enterprises Development Association. "It's not that businesspeople prefer private lending to (commercial) bank loans, but they have little option."

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|