Job market is not working for some

Updated: 2012-07-26 08:44

By Ding Qingfen, Chen Jia and Yu Ran (China Daily)

|

||||||||

Signs of economic stress are increasingly apparent, Ding Qingfen and Chen Jia in Beijing and Yu Ran in Wenzhou report.

The job market has started to show signs of stress, and while the situation is nowhere near as bad as in 2008, life is getting harder for employers and employees alike.

Pugongzhong road in Wenzhou city, Zhejiang province, provides a perfect example of the problem. It was once home to more than 40 manufacturers and exporters, but now only around 10 are left and many are struggling to keep their heads above water.

Wenzhou Jinlishi Shoes Co, and its 300 workforce, is one of them. In the company's No 1 workshop, covering an area of 500 square meters, fewer than 40 workers man the production line and the atmosphere is far from hectic.

"It's hard to do business. Orders have been declining since last year. And what's worse, costs continue to increase, with both wages and raw materials surging by 20 percent," said Ke Zhongliang, the sales manager.

"We have no choice but to cut jobs," he said.

So far this year, the company has terminated the contracts of 100 employees and closed one of its three production lines.

|

|

Job seekers look for opportunities at an employment market in Lianyungang, Jiangsu province on July 21. China's job market has been showing signs of stress. Provided to China Daily |

The parlous state at Jinlishi is one of the indicators that suggest an increasing number of workers are being laid off. Moreover, economic conditions mean it's getting tougher to find employment. Economic growth has decelerated to the slowest pace in three years as a result of the European debt crisis and the government's crackdown on property speculation.

In the heavy industry sector, some of China's largest companies have laid off workers or implemented hiring freezes in the past few months. Media reports claim that Sany Group, the country's biggest manufacturer of construction equipment by revenue, has downsized its workforce in the manufacturing, sales and research divisions. The company denied the reports, insisting that it is simply controlling the growth of its 51,000-strong workforce.

In the construction sector, a large number of migrant workers are finding it hard to extend their contracts and many plan to return home.

"The three big sectors that are currently dragging on the economy - infrastructure, real estate and exports - are big employers," according to a report by Stephen Green, chief China economist at Standard Chartered Bank.

The National Bureau of Statistics said recently that China's gross domestic product slowed to 7.6 percent in the second quarter from a year earlier, the sixth straight quarterly slowdown.

Meanwhile, economists and officials have warned that the world's second-biggest economy has yet to hit bottom, predicting that expansion may further cool to 7.4 percent in the third quarter, citing weak overseas demand.

Overseas shipments in the first half gained by 9.2 percent year-on-year and imports surged by 6.7 percent, said the General Administration of Customs. The Ministry of Commerce said the outlook is gloomy, and warned that it will not be easy to maintain growth of 10 percent in foreign trade across the entire year.

Getting worse

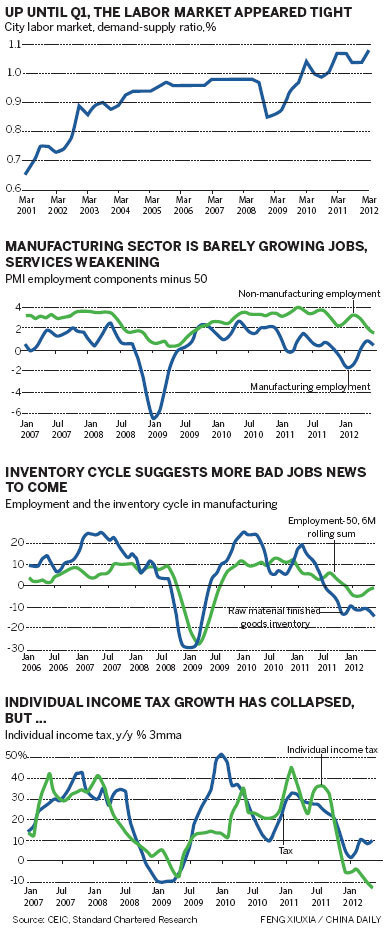

"The job situation does not appear all that serious yet, but clearly, the situation is deteriorating and will get worse in the third quarter, we believe," said Green's report.

Although the HSBC purchasing managers' index for July rose to 49.5 from 48.2 in June, "the below-50 July reading implied that demand still remains weak and employment is under increasing pressure. This calls for more easing efforts to support growth and jobs," said Qu Hongbin, head of Asian research at HSBC, quoted in the Financial Times.

But China won't loosen property market restrictions, although such a move could generate many jobs, according to a Xinhua News Agency report, citing a government source.

The registered urban unemployment rate stood at 4.1 percent at the end of June, unchanged from the end of 2011. Almost 7 million new jobs were created in the first half and nearly 3 million people were re-employed during the same period, according to the Ministry of Human Resources and Social Security.

Yin Chengji, a ministry spokesman, said on Wednesday that the employment situation will be tough in the latter half of the year, although the number of new jobs created in the first six months hit a record high.

"Some enterprises in the eastern regions are experiencing difficulties but they have not yet cut employment to sustain growth," he said, "As economic growth slows, they will face a tougher situation."

Earlier this month, Premier Wen Jiabao warned that the economic rebound lacks momentum and difficulties may persist. He also said that the labor situation will become more "severe" and more "complex", and that the government will continue to implement a more "proactive" labor policy.

"Party commissions and government at all levels should further increase awareness that job creation is extremely important and earnestly put promoting employment at a priority among all work tasks," said Wen.

However, as the European debt crisis deepens and with government efforts to stimulate the economy through increased investment and the expansion of domestic consumption yet to take off, companies are not optimistic.

"Since August, things have gone from bad and worse. Especially for small and medium-sized enterprises and exporters. We're lucky if we break even," said Jinlishi's Ke. "We cannot see any turning point or upward trend in the short term," he added.

Media reports have noted a new wave of migrant workers returning to their hometowns in the central and western provinces and even those still in employment are feeling the pinch and are not confident about future prospects.

"The price of everything is going up, and at a faster pace than our wages," said Li Liang, who works for a company on Pugongzhong Road. "Times were good before last year, but since then, I've seen little improvement in my wages. I can hardly afford the daily expenditure, including rent, food and fees for my daughter's kindergarten," said the native of Anhui province. "It's really not easy working in the city. We will probably go back home to look after the farm if things don't look up by the autumn."

Better than 2008?

So far, the Chinese labor market is in better shape than in late 2008, when the global financial crisis hit and 20 million migrant workers lost their jobs, said economists.

"Data about the jobs market (in China) is very limited, but so far, things are nowhere as bad as in late 2008," said Standard Chartered's Green in his report.

"Although economic growth slowed to a three-year low in the second quarter, the unemployment rate remains stable so far," said Zhu Haibin, chief China economist at JPMorgan Chase & Co.

"The main reason is that the recent deterioration was concentrated on the manufacturing sector. The service industry is still expanding, but that won't support relatively stable employment," he explained.

The global financial crisis drove world trade to a near standstill and in response the Chinese government unveiled a fiscal stimulus package of $586 billion to stabilize the economy. But this time round, the urban unemployment rate at the end of June stood at merely 4.1 percent.

Although that's far lower than in developed economies, many observers believe the figure doesn't tell the whole picture because figures for a national unemployment rate that includes migrant and other unregistered workers are unavailable.

Meanwhile, the job market seems to be worsening. A survey by the People's Bank of China showed that sentiment about employment prospects fell sharply in the second quarter, close to the lowest level since 2009.

The Ministry of Human Resources and Social Security estimated that the ratio of job openings to job seekers has fallen from 108 to 105 during the past three months.

Moreover, according to the Federation of Hong Kong Industries, more than 2,000 Hong Kong-owned factories in the Pearl River Delta may close this year, hit by a decline in export orders and rising wages.

"The increase in the unemployment rate may happen. But will lag behind economic cooling in the second half. Many companies, especially in the east coast area, have already seen a sharp drop in orders," said JPMorgan's Zhu. "The ongoing policy fine-tuning is very important and the government should keep a close watch on the economic indicators in August and September."

Meanwhile, rising labor and raw material costs during the past three to four years have been, and will continue to be, a major cause of job losses.

Surging wages have squeezed profit margins and even driven some manufacturers to look for better conditions in other parts of Southeast Asia.

Adidas has said it will close its factory in Suzhou, Jiangsu province, which employs 160 people, at the end of October. Nike closed its only Chinese footwear factory, also situated in Suzhou, in 2009.

A spokeswoman said the move is part of Adidas' efforts to restructure its business in China and is aimed at improving efficiency in the local market. The company is expected to move production to Myanmar.

The challenges ahead

"The slowdown in China's economy is expected to bring challenges to the employment status, which requires preparation on both the macro and micro level," said Vernon Bryce, director of the human resources specialist Kenexa Ltd.

On the micro level, companies are expected to "react quickly to the changing situation" by creating new employment models, such as mixed full- and part-time working, to improve "employment engagement" and reduce labor costs, he said.

Manpower Group, the workforce solutions and services provider, said in a survey released in April that a mere 3 percent of the 4,242 companies questioned choose to cut jobs in the third quarter, while others plan to stabilize their workforces or employ more staff.

Many companies said they are opting for a wide range of solutions to address the problem and ride out the economic slowdown.

"High-tech companies like Juner set a high threshold on recruitment, so we don't often cut jobs in a massive way unless performance is very bad," said Chen Xiaomin, chairman of Zhejiang Juner New Material Co, which has reduced the cost of raw materials and laborers and recruited more experienced and qualified staff.

The company has also "renewed its performance evaluation system," to reward the best performers and encourage staff to innovate and improve product quality.

Many foreign companies have adjusted their employment strategies. In response to a relatively rapid decline in client numbers, KPMG, the global accountancy company, has instigated a reward system for high-quality employees and designed a rapid-promotion passageway to encourage staff. Meanwhile, Siemens AG, the electrical engineer, is "paying more attention to the development of talent as the economic environment changes".

Government policy

Yin, from the Ministry of Human Resources and Social Security, said China will undertake "active" polices, such as providing more training, providing better public services and allowing favorable tax policies to help promote employment. The ministry will also consider temporarily lowering enterprises' social insurance premiums to ease the burden.

As the country accelerates the transformation of its economic-growth mode, skilled workers in sectors such as high technology, new energy and modern services are in great demand.

There is a "mismatch" between the supply and demand in the job market, and the government should take more measures to foster talent in those sectors, said Bryce from Kenexa Ltd.

Economists also expect the government to implement policy easing to stabilize employment and maintain social stability. "Currently, unemployment is not a problem despite second quarter GDP growth dropping to 7.6 percent," said Zhang Zhiwei, chief China economist with Nomura Securities.

Vice-Premier Li Keqiang said this month that China should implement structural tax reductions and encourage and guide private investment, according to Xinhua.

In July, the country announced the second reduction in interest rates in a month and has lowered the reserve requirement ratio the amount that banks must set aside as reserves - three times since November to boost lending.

Chen Xin in Beijing contributed to the story.

Contact the reporters at dingqingfen@chinadaily.com.cn, chenjia@chinadaily.com.cn and yuran@chinadaily.com.cn