Raising a red flag: trading mishap reveals flaws in securities sector

Updated: 2013-08-19 10:47

By Chen Jia (China Daily)

|

||||||||

Design flaws in China Everbright Securities' trading system triggered an unexpected huge buy, causing the Shanghai stock market to rise more than 5 percent at noon on Friday, the top securities watchdog said on Sunday.

It was the first extreme and individual case since the establishment of a capital market in China, which raised red flags for the entire securities sector, the China Securities Regulatory Commission said in a statement.

The commission said an initial investigation showed that mistakes in application commands and failures of the payment quota control system led the securities company to send a 23.4 billion yuan ($3.83 billion) order to the Shanghai Stock Exchange and close deals valued at 7.27 billion yuan on Friday.

Later that day, the brokerage sold 1.85 billion yuan of shares in terms of exchange traded funds and launched short selling of 7,130 board lots of stock index futures contracts, to hedge its losses.

"China Everbright Securities has obvious defects in internal controls, and the information system management exposed serious problems," the statement said.

"We have not yet found any human errors," a spokesman for the CSRC said on Sunday.

An anonymous source close to the securities company said that so far, no staff or top managers have been suspended.

The Shanghai Composite Index surged 5.96 percent in three minutes at around 11 am on Friday, led by State-owned financial and oil companies, with the trading volume increasing 80 percent.

"According to laws and regulations, the whole-day stock trading on Friday was valid. The whole clearing system was running normally," the CSRC said.

Meanwhile, the Shanghai securities regulatory bureau has stopped the brokerage's related business and continued to investigate who is responsible.

The CSRC also announced the start of the official investigation and will take the next step according to the result.

China Everbright Securities also released a statement on Friday, saying that the error could have led to a trade loss of 194 million yuan. "The final loss and the influence on company's financial situation may change afterwards according to the market", the statement said.

This event has pushed the brokerage across the "regulatory red line", and the company may receive warnings or a punishment.

"It may also restrain the business performance and damage our brand," the statement said.

Wu Weijun, a partner at PriceWaterhouseCoopers in Beijing, said that the incident has exposed the weakness in risk management control of the brokerage, and that those controls should be checked as soon as possible.

Wu suggested hiring an independent, third-party institution to conduct a professional investigation and provide advice on improving risk management to recover the market confidence.

Analysts said that it is difficult to know how much investors lost because of the error, and whether there is clear legal support for seeking compensation.

"For the loss that investors may suffer from the event, our company will fulfill the responsibility and obligation in accordance with the law," the brokerage said.

chenjia1@chinadaily.com.cn

(China Daily USA 08/19/2013 page1)

Ride to fly on the top of mountains

Ride to fly on the top of mountains

Nadal beats Isner to win first Cincinnati crown

Nadal beats Isner to win first Cincinnati crown

Wild Africa: The new attraction to Chinese tourists

Wild Africa: The new attraction to Chinese tourists

Azarenka beat Williams for Cincinnati title

Azarenka beat Williams for Cincinnati title

500th eruption of Sakurajima Volcano in 2013

500th eruption of Sakurajima Volcano in 2013

A cocktail that's a treat for the eyes

A cocktail that's a treat for the eyes

Private sector to care for the elderly

Private sector to care for the elderly

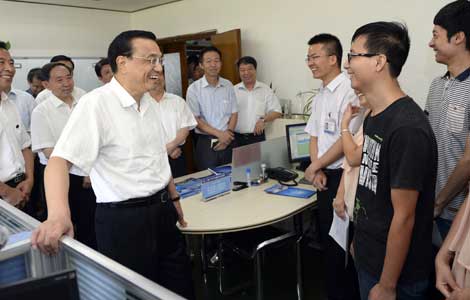

Be innovative, Li tells graduates

Be innovative, Li tells graduates

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China defense chief in DC

Trading mishap reveals flaws

Senior care opens wide for investors

Iran signals willingness to resume nuclear talks

Baby formula sales to be shifted to pharmacies

CIA document release acknowledges Area 51

36 killed in Egypt's prison truck escape attempt

Be innovative, Premier Li tells graduates

US Weekly

|

|