Cookiemaker announces plans to roll into smaller cities to build growth momentum

Updated: 2014-04-29 09:00

By Wang Zhuoqiong (China Daily USA)

|

||||||||

|

Oreo cookies in a supermarket in Xuchang, Henan province. Global snack company Mondelez International Inc, with brands that include Nabisco, maker of Oreos, and chocolatier Cadbury, has seen revenues in emerging markets increase by nearly 9 percent. Geng Guoqing / for China Daily |

Illinois-based food company Mondelez International Inc is exploring new ways to reach customers in third- and fourth-tier cities in China to combat slowing growth in the market.

Wang Haiyan, Mondelez's Asia Pacific and China biscuit category leader, said the company has expanded to second- and third-tier cities in recent years, to venues including hypermarkets as well as local convenience stores and community shops.

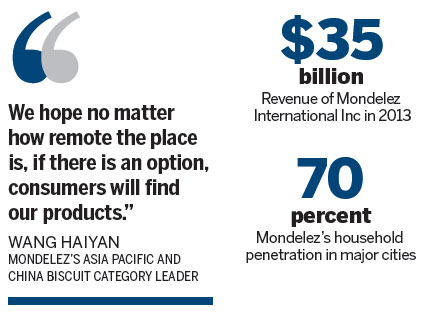

"We hope no matter how remote the place is, if there is an option, consumers will find our products," she said.

Despite weak growth in the biscuit or cookie market in the nation last year - which some say was affected by the government's austerity campaign as well as the economic slowdown - Wang says China holds immense potential as a market.

China's average consumption of cookies, as biscuits are alternately known, is currently one-fifth or fourth of that of developed countries, indicating much room for market development, Wang said.

Mondelez, a global snacking company with 2013 revenues of $35 billion and brands that include Nabisco, maker of Oreos, and chocolatier Cadbury, has seen revenues in emerging markets increase by nearly 9 percent.

China was up slightly, reflecting weak cookie results offset by strong performance in gum.

The power brands decreased 5.6 percent primarily due to Oreo cookies in China.

Mondelez's household penetration in major cities is about 70 percent, though lower in smaller cities, with 62 percent in third-tier cities and 58 percent fourth-and fifth-tier cities, which highlights the opportunities for the snackmaker to reach more consumers in the lower-tier cities, said Jason Yu, general manager of Kantar Worldpanel, the international consumer survey company.

According to Yu, the cookie market in major cities had a 46 percent household penetration rate, recording year-on-year growth of 10 percent, while those in tier 3 cities was only 31 percent with an annual growth rate of 14 percent.

Cookies available in county-level cities totaled only 23 percent but had a higher growth rate of 17 percent.

"This data suggest the high-growth prospect for lower-tier cities in China for total biscuits," said Yu.

Last year, the butter cookie segment continued to be the star performer in the market, driven by high-end Danish brands Kjeldsens and Danisa.

Wang said a mixed offering, keeping up with consumer tastes and product innovation is considered key to capturing the attention of the fast-changing Chinese market.

"New packaging or new product launches have been the motivation for our market progress," said Wang.

The company has observed subtle differences in terms of cookie sweetness and has made changes accordingly.

"Oreos in China are not as sweet as those sold in the United States," Wang said. A green tea flavor was also especially formulated for Chinese consumers.

Last June, the company expanded its production capacity by launching a factory in Suzhou for a total of eight plants in China.

The former Kraft Foods conglomerate was split in 2012 into two independent companies, including Mondelez International and the North American grocery business, as China is now the second-largest market for Oreo and Chips Ahoy cookies, after the US.

wangzhuoqiong@chinadaily.com.cn

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China's CEOs confident: PwC

Alibaba IPO could be the biggest ever

Chinese youths get their chance at stardom and recording deals

Cookiemaker to roll into smaller cities

Bill Gates urges more in China to help poor

Philippine pact gives US access to air, sea bases

Obama sets new sanctions on Russia

S China joint college goes global

US Weekly

|

|