Shanghai move sparks speculation that Li Ka-shing is to quit China

Updated: 2015-08-04 16:40

(chinadaily.com.cn)

|

||||||||

|

|

Hong Kong tycoon Li Ka-shing (C), his son Victor Li Tzar-kuoi and managing director of Hutchison Whampoa Canning Fok (R) attend a news conference in Hong Kong January 9, 2015.[Photo/Agencies] |

Cheung Kong Property, backed by Hong Kong tycoon Li Ka-shing,is to sell an office and retail property project in Shanghai for in excess of $2.6bn, according to the Wall Street Journal.

Although many foreign potential buyers have expressed interest no final deal has been reached, the report says but the move has sparked further speculation that Asia’s richest man has lost confidence in China due to its sluggish economic performance and intends to seek more opportunities in Europe.

Liao Baoping, a critic with a Sina column, said Li sold assets in China’s mainland as well as Hong Kong but the move should not be interpreted as a sign of “exiting the market” because it was simply commercial decisions intended to maximize profits.

The “exiting” began in 2008 and since 2013 he has sold more than 20 billion yuan worth of commercial properties in Shanghai, Beijing and Guangzhou, media reported.

Li announced the merger of Cheung Kong and Hutchison Whampoa earlier this year and later split the conglomerate into two listed companies based in the Cayman Islands, a move not only for tax avoidance but also for internationalizing Li’s family business.

Housing prices in China’s mainland have peaked in the past 10 years and profit margins have shrunk. Li’s decision to sell mainland properties is simply to optimize the distribution of resources and seek more profits, Liao said.

Outspoken Hong Kong economist and commentator Lang Hsien-ping pointed out that Li is purely a businessman and would intensify his investment in high-earning projects while abandoning those with short margins.

Why does Li invest so much in the UK? Because infrastructure construction is the second most important among Li’s businesses, including natural gas, water and electricity and rates of return stand as high as about 42 percent, Lang explains.

According to Lang, now is a golden time to invest in the UK on the grounds that prices are cheaper due to the sluggish economy.

Tsingtao gets ready for huge beer festival in China

Tsingtao gets ready for huge beer festival in China

Stunning Shu brocade and embroidery techniques

Stunning Shu brocade and embroidery techniques

Kazan games: Diving in the sky

Kazan games: Diving in the sky

Torrential rain wreaks havoc in Jinan

Torrential rain wreaks havoc in Jinan

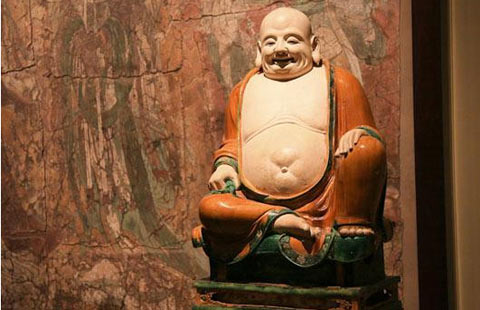

A glimpse of Chinese cultural relics in foreign museums

A glimpse of Chinese cultural relics in foreign museums

Flying Tigers show in New York

Flying Tigers show in New York

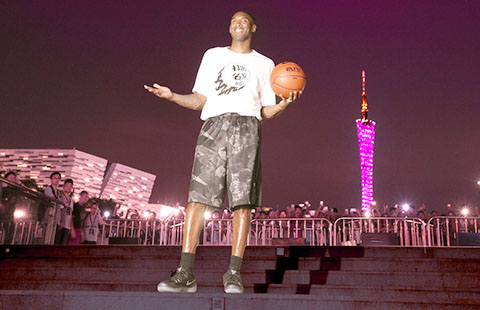

Kobe Bryant frenzy grips Guangzhou

Kobe Bryant frenzy grips Guangzhou

Three generations keep traditional lion dance alive

Three generations keep traditional lion dance alive

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Obama issues challenge on climate change

GOPs begin pivotal debate week

Negotiation seen as key to China, US cyber solution

Beijing plans 'Silicon Valley' park for traditional culture

Obama issues challenge on climate change with power plant rule

China role crucial in UN plan

Biden associates resume discussion about presidential run

Malaysia seeks help to widen search for MH370

US Weekly

|

|