NYSE chief Thain takes on Merrill mantle

Updated: 2007-11-16 06:51

|

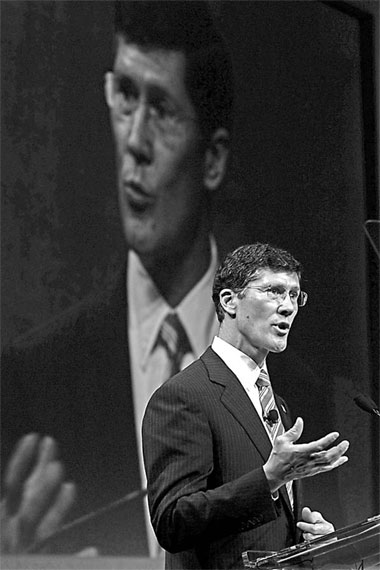

| NYSE Group CEO John Thain speaks to the annual meeting of the Securities Industry and Financial Markets Association in Boca Raton, Florida. Richard Sheinwald/Bloomberg News |

The 52-year-old Thain, who graduated with an engineering degree from Massachusetts Institute of Technology on the way to becoming president of Goldman Sachs and chief executive officer of the New York Stock Exchange, is the first CEO in Merrill's 93-year history to have nothing to do with the world's largest brokerage until Wednesday (local time), when he agreed to join the 64,200-employee securities firm on December 1.

For Merrill, which used to pride itself on its ability to groom its leaders from within in a so-called Mother Merrill culture, Thain's appointment is a recognition of the mess made by predecessor Stan O'Neal, who disclosed a record $7.9 billion of writedowns related to wayward mortgage investments before he was ousted after a 21-year Merrill career, including the last five years as CEO during which he forced out most of his would-be successors.

For Thain, who left Goldman in 2004 when the NYSE was embroiled in its own leadership crisis following Richard Grasso's resignation under pressure, managing Merrill is an opportunity to "restore a sense of pride" and "morale" that made it the most famous icon on Wall Street, according to Winthrop Smith, a former head of Merrill's international brokerage.

Merrill on October 24 reported a $2.24 billion loss that was six times what the company forecast three weeks earlier.

The same day, the Securities and Exchange Commission began an inquiry into matters related to the subprime mortgage portfolio, according to a regulatory filing from the company this month.

'Sickening'

The firm may face another writedown of as much as $10 billion, Deutsche Bank AG analyst Michael Mayo estimates.

Former CEO Daniel Tully, who tripled Merrill's share price during his four-year tenure in the 1990s, called the losses "sickening" and lamented the board of directors' need to look outside the firm for its next leader.

Merrill's stock is the worst performer this year of the five biggest US securities firms. Its 38 percent plunge has wiped out more than $30 billion of market value.

Standard & Poor's, Moody's Investors Service and Fitch Ratings have cut Merrill's debt rating and are considering further downgrades.

Mortgage-bond underwriting was one of several businesses O'Neal, 56, entered as he sought to copy Goldman's strategy of taking bigger bets with the firm's capital to increase shareholder returns. O'Neal also put money into private-equity investing, energy trading and hedge funds.

Trading prowess

By choosing Thain, after a two-week search led by board member Alberto Cribiore, Merrill's directors signaled that they aren't ready to restrain the firm from risk-taking, said Adam Compton, an analyst who helps manage $150 billion at RCM Capital Management in San Francisco, including about 700,000 Merrill shares at the end of September.

"Thain comes from Goldman, where they're built around taking risk but getting paid for it," Compton said.

"He may keep the proprietary risk businesses that Merrill has built up over the last two or three years but with better risk controls."

Goldman Sachs's trading prowess has helped it become the most profitable firm in Wall Street history. Chief Executive Officer Lloyd Blankfein, as well as his two top deputies, ran trading divisions as they rose through the ranks.

Revenue from fixed-income, currencies and commodities, the firm's biggest unit, rose 71 percent in the third quarter as the firm profited from bets on declining prices for securities linked to mortgages.

"It's not that trading is bad for Merrill Lynch, it's that trading is bad for anybody without the requisite risk controls," said Roy Smith, a finance professor at New York University's Stern School of Business and a former Goldman Sachs partner. "Thain's an expert at that, so in a sense he's a fixer."

Doctor's son

The son of a family doctor and a housewife, Thain grew up in Antioch, Illinois, and joined Goldman Sachs in 1979 after graduating from Harvard Business School in Boston.

He started a mortgage-trading desk at the firm in the mid-1980s at a time when that market was dominated by Salomon Brothers, and was promoted to co-president in 1999, serving under then-CEO Henry Paulson, now US Treasury Secretary.

Thain took over at the NYSE in January 2004, after Grasso was ousted amid a furor over his $140 million pay package. In April 2005, Thain hammered out an agreement to purchase Archipelago Holdings Inc, transforming the exchange into a for-profit company.

A year later, he negotiated the $14.4 billion purchase of Paris-based Euronext NV, creating the first trans-Atlantic stock exchange.

Bloomberg News

(China Daily 11/16/2007 page16)

|

|

|

||

|

||

|

|

|

|