|

|

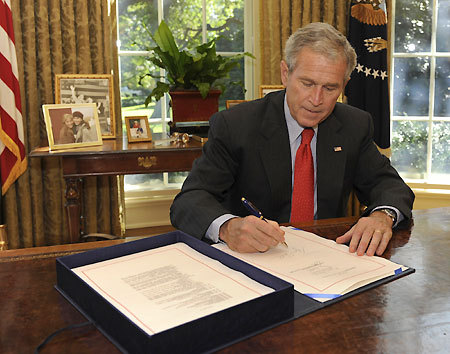

US President George W. Bush signs the Emergency Economic Stabilization Act of 2008 in the Oval Office after the House passed the $700 billion financial rescue legislation in Washington, October 3, 2008. [Agencies]

|

WASHINGTON - With the US economy on the brink of meltdown and elections looming, a reluctant Congress abruptly reversed course and approved a historic $700 billion government bailout of the battered financial industry on Friday. US President Bush swiftly signed it.

The 263-171 vote capped two weeks of tumult in the US Congress and on Wall Street, punctuated by urgent warnings from Bush that the country confronted the gravest economic disaster since the Great Depression if lawmakers failed to act.

"We have acted boldly to help prevent the crisis on Wall Street from becoming a crisis in communities across our country," Bush said shortly after the plan cleared Congress, although he conceded, "our economy continues to face serious challenges."

His somber warning was underscored on Wall Street, where enthusiasm over the rescue gave way to worries about obstacles still facing the economy, and the Dow Jones industrials dropped 157 points. The Labor Department said earlier in the day that employers had slashed 159,000 jobs in September, the largest cut in five years.

The historic vote was a striking turnaround from the measure's spectacular failure earlier in the week, which had triggered a massive stock sell-off and prompted jittery lawmakers -- fearing a crushing economic contagion that was spreading to their constituents -- to reconsider.

"Let's not kid ourselves: We're in the midst of a recession. It's going to be a rough ride, but it will be a whole lot rougher ride" without the rescue plan, said Rep. John A. Boehner, the minority leader, as he prepared to cast his vote for the most sweeping federal intervention in markets in decades.

US Treasury Secretary Henry Paulson pledged quick action to get the program up and operating.

The bailout, which gives the US government broad authority to buy up toxic mortgage-related investments and other distressed assets from tottering financial institutions, is designed to ease a credit crunch that began on Wall Street but is engulfing businesses around the nation.

"In these past two weeks, we've seen things we never thought we would see before in terms of the economic insecurity of our own country," said House Speaker Nancy Pelosi. She said the measure would "begin to shape the financial stability of our country and the economic security of our people."