|

WORLD> News

|

|

Lenders let Chrysler join aid program

(China Daily)

Updated: 2009-04-08 08:01

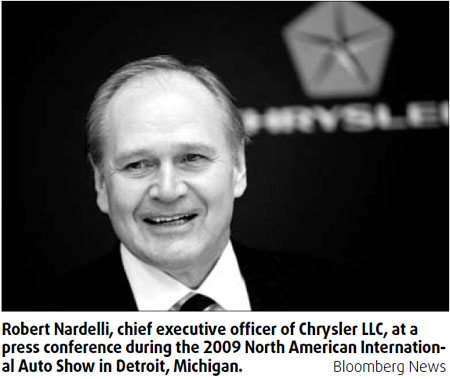

Chrysler LLC's secured lenders agreed to allow the automaker to participate in a US aid program for suppliers, signaling that banks aren't gearing up for a liquidation, a person familiar with the situation said. The banks could have stopped Chrysler from taking part in the $1.5 billion program if they believed the company would liquidate, because it would require the automaker to spend as much as $75 million of its cash reserve, said the person, who asked not to be identified because the matter is private. "That's a good sign," said Don Workman, a bankruptcy attorney with Baker & Hostetler in Washington. "From Chrysler's perspective, it indicates there is something for them down the road. There's cooperation to be had with the secured lenders." After having its restructuring plan rejected by the Obama administration last week, Chrysler has until the end of the month to cut most of its debt, rework its United Auto Workers union contract and forge an alliance with Italian automaker Fiat SpA. The US Treasury began talks with Chrysler's lenders last week, ending three months of inaction on a debt exchange. A tie-up with Fiat is the primary condition of receiving $6 billion more in US loans after getting a $4 billion loan in January. Chrysler, owned 80.1 percent by Cerberus Capital Management LP, has said it would liquidate its assets in bankruptcy. Talks with the Treasury and the lenders over Chrysler's $6.9 billion in debt are still in the early stages, the person said. Chrysler had made no progress in arranging a debt-for-equity swap with its secured lenders, which would be repaid first in a bankruptcy, since getting its US loan. Chief Executive Officer Robert Nardelli told CNBC last month that the Treasury would take the lead on negotiations. Bloomberg News (China Daily 04/08/2009 page16) |