Global Biz

G7 reassures on Greece, talks tough on banks

(Agencies)

Updated: 2010-02-07 13:00

|

Large Medium Small |

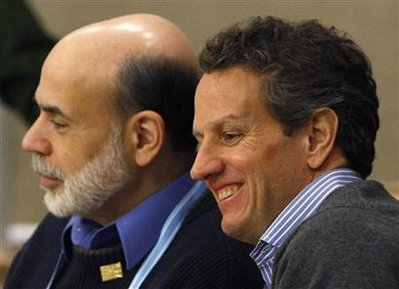

US Treasury Secretary Tim Geithner (R) and Federal Reserve Chairman Ben Bernanke take part in a meeting at the G7 finance ministers' meeting in Iqaluit, Nunavut, February 6, 2010. [Agencies] |

Last month the Obama administration stunned the banking industry with tough reform proposals that took other countries by surprise too.

"We all share a deep commitment to try to move forward and reach agreement on a strong, comprehensive set of financial reforms on the timetable we all committed to last September," Geithner said.

"That means agreement on...a new set of capital requirements for large global institutions by the end of this year."

Iqaluit, the town that hosted the meeting, was the most exotic and inaccessible location for a G7 meeting to date, offering unique extracurricular activities like dog-sledding and food that included Arctic char and muskox minestrone.

|

||||

Geithner said the G7 underscored its commitment to reinforcing recovery, while Canada's Jim Flaherty said the global economy was improving but still needed government help.

"We do not have a firmly established recovery yet, but there are signs," he said. "We need to continue to deliver the stimulus to which we are committed and begin to look ahead to exit strategies and to move to a more sustainable fiscal track."

Debtor paradises

The United States and other big economies are also saddled with debts, having spent heavily to stave off a depression.

Ratings agency Moody's Investors Service this week said the United States must do more to keep its AAA rating after the Obama administration said it expected a deficit equivalent to 10.6 percent of gross domestic product in 2010, more than three times the level considered sustainable by economists.

But Japan, which also faces a yawning budget gap, admitted it had got off lightly.

"I explained Japan's fiscal situation to the G7 and frankly expected more discussion about it. But much time was spent exchanging views on Greece," said a clearly relieved Japanese Finance Minister Naoto Kan, speaking to reporters after a dog-sledding adventure which he described as moving.

Ministers said the G7, which issued no formal communique on Saturday, stuck by the statement it made last October on foreign exchange, when it said it was monitoring markets and would cooperate as appropriate.

Lagarde said under the new, more informal format of the G7 meetings, the group had decided to issue separate statements on currencies only when it had something new to say.

But others said discussions of foreign exchange policy need not be limited to the G7. While some European members like France said the G7 was the best forum, Japan's Kan suggested that if discussions were to involve China's yuan, for example, then talks could take place in the wider Group of 20 developed and emerging economies, which includes key players like China.

The Iqaluit meeting could be the last standalone gathering of a group that dominated international finance for decades but became less relevant as emerging markets gained power.