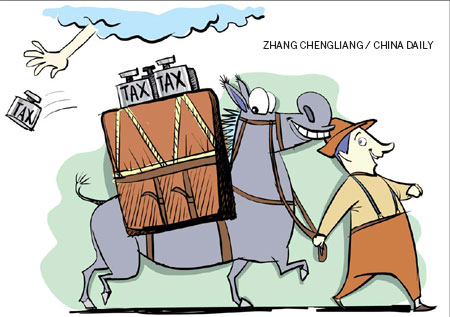

Double taxation is an extremely complex matter, but companies will now have a clearer idea of where they stand

For multinational companies investing in China, profits derived from Chinese investments need to be remitted outside China at some point, often in the form of dividends, interest or royalties. When these earnings are repatriated, they are typically subject to Chinese withholding tax as well as income tax in foreign jurisdictions.

A key objective for these companies in cross-border tax planning is reducing international double taxation and lowering the tax costs of repatriation.

For a foreign investor repatriating earnings from China, the access to a Chinese treaty mitigates the likelihood of international double taxation, and often reduces or eliminates the Chinese tax that would be imposed under China's domestic tax law.

In short, it is often vital that a foreign investor qualifies under a Chinese treaty to achieve tax efficiency.

Last month China's State Administration of Taxation made an important announcement regarding the qualifications of foreign investors for Chinese treaties. This marks a critical step and affects the vast majority of foreign investors with business connections in China.

For a foreign investor receiving dividends, interest or royalties from China to enjoy lower treaty tax rates, the Chinese treaty generally requires that the foreign investor be a resident of the treaty partner state and be the "beneficial owner" of such incomes from China.

The "beneficial ownership" requirement is intended to combat so-called treaty shopping, a type of tax abuse whereby foreign investors establish paper companies to hold their Chinese investments in jurisdictions with preferential Chinese treaties mainly to obtain lower treaty tax rates in China during repatriation.

So what does the term "beneficial ownership" mean? In October 2009 the State Administration of Taxation laid down rules on how to judge if a foreign investor is a beneficial owner of earnings from China. Essentially, it states that a foreign investor must go through a fairly complex and subjective test and show evidence that it maintains sufficient physical "substance" in the treaty partner state by having staff, business premises and operations there.

However, the beneficial ownership rules in 2009 did not provide sufficient details at the operating level. As a result, foreign companies are often unsure whether they would qualify for Chinese treaty benefits. This has often raised further questions about the tax return positions and financial statement provisions of foreign companies. So the announcement is great news to foreign investors, as it further clarifies how China's tax authorities are likely to make beneficial ownership decisions in some key situations.

Most significantly, with respect to Chinese dividends, the announcement contains a beneficial ownership "safe haven" for publicly traded foreign investors. If a foreign investor is a tax resident of a treaty location and is listed in that treaty location, it will automatically be the beneficial owner of the dividends it receives from a Chinese subsidiary.

Alternatively, subject to certain requirements, if the listed foreign parent directly and/or indirectly owns 100 percent of a foreign subsidiary that is a tax resident of the same treaty location, in many circumstances, the foreign subsidiary may automatically be treated as the beneficial owner of the dividends it receives from China.

However, there may be difficulties utilizing the safe haven rule if the listed foreign investor has different jurisdictions for share trading and incorporation. For instance, many Hong Kong-listed companies with subsidiaries in the mainland are in fact incorporated in the Cayman Islands for legal reasons and Hong Kong stamp duty considerations. These companies will first need to prove they are tax residents of Hong Kong to enjoy the safe haven rule.

At present, under the treaty between the mainland and Hong Kong, a company incorporated outside Hong Kong can be recognized as a Hong Kong tax resident if its place of effective management is Hong Kong. From our experience, the mainland tax authorities are cautious about recognizing companies incorporated in tax haven jurisdictions as residents of treaty partner jurisdictions by reason of effective management, and would require specific supporting documents from the applying foreign investors.

Another common instance of repatriating funds is where a foreign investor appoints another foreign party as an agent to receive income from China on its behalf. In this case the agent is often the registered owner of the investment in China for legal purposes due to various regulatory or commercial considerations.

Since the income from China does not belong to the agent, the Chinese tax authorities generally do not allow the agent to apply for treaty benefits. On the other hand, although the foreign investor is the true owner of the income economically, it is not the registered owner of the investment in China from a legal standpoint. So it is unclear whether the foreign investor can apply for treaty benefits.

To clarify this issue, the announcement makes the following rule on agency. Despite the lack of direct legal ownership over the income from China, the foreign investor can still enjoy preferential tax rates under the treaty between its home jurisdiction and China if the foreign investor can prove to be the beneficial owner. The key for a foreign investor to utilize this agency rule is to demonstrate that the agent is merely acting on behalf of the foreign investor when receiving income from China.

In addition to the safe haven rule and the agency rule, the announcement also amplifies the basic beneficial ownership assessment process. A foreign investor may have once been tempted to put up a theoretical argument that it did not need to possess physical substance in the treaty partner state to be considered the beneficial owner because it lacked a motive for tax avoidance or treaty shopping.

In response, the announcement stresses that, as a general rule, no foreign investors can avoid the substance-focused beneficial ownership analysis when making a treaty claim, except for situations covered by the safe haven.

Those foreign investors who had hoped for a broader safe haven rule in beneficial ownership assessment may be disappointed by this continued insistence on physical substance for seeking treaty benefits. Although the announcement provides a safe haven for multinational corporations that are publicly traded, the State Administration of Taxation does not wish to relax the substance requirement in other repatriation scenarios.

It is clear that from the start that foreign taxpayers seeking Chinese treaty benefits must maintain the relevant legal, tax and financial documents in preparation for future reviews by China's tax authorities.

The announcement marks a breakthrough in China's treaty arena and can be very useful for global companies with existing or future Chinese operations. It shows the SAT has been listening to comments and concerns from foreign investors since the issuance of the beneficial ownership rules in 2009, and is taking action to improve the tax environment and encourage foreign investment in China. Companies should keep communicating with the Chinese tax authorities to better understand the practical details related to the announcement, and continue to suggest areas for future enhancement.

The authors are partners of KPMG China. The views expressed here do not necessarily reflect those of China Daily.

(China Daily 08/17/2012 page10)