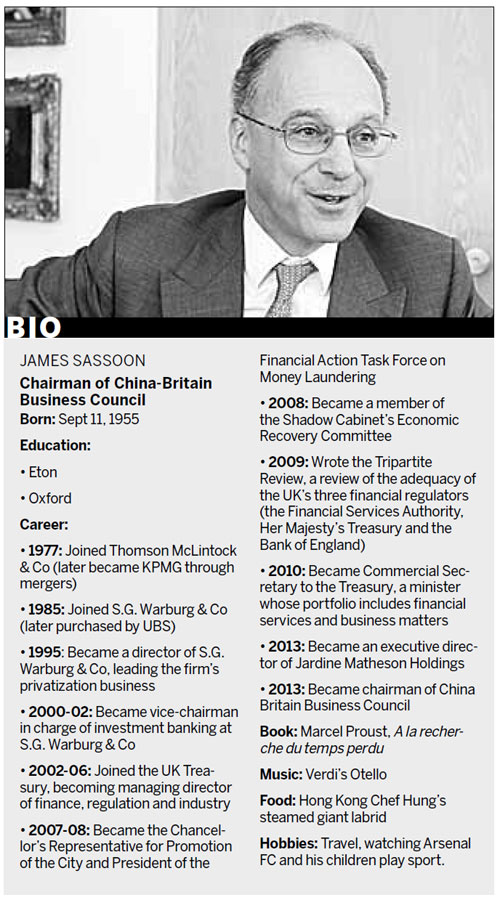

Trade and investment between China and the UK will skyrocket as the world's second-largest economy increasingly moves into service-based industries including finance and architecture, preeminent British business expert Lord James Sassoon has predicted.

A former British government minister and the current chairman of the China-Britain Business Council, Sassoon says the increase in economic ties will be driven by China's inevitable expansion into industries that align with the UK's field of financial expertise and commercial experience.

The 57-year-old says the catalyst will be China's rise in the so-called "invisible" sectors such as financial services, design, engineering, legal services, architecture, healthcare and education.

"The UK has great expertise in invisible sectors," Sassoon says. "As China moves increasingly toward becoming a consumer-based society, its needs as a nation will match what the UK has to offer."

Sassoon led a British delegation to Xiamen for the 17th China International Fair for Investment and Trade, held from Sept 8-11.

Law firm DLA Piper, engineering firm Arup Associates and architecture firm Foster + Partners will be among the heavy hitters in the delegation, which is expected to include representatives from more than 30 businesses.

"Over the past 16 years, this fair has become one of the most important for Chinese and British businesses to identify and secure investment opportunities in both of our countries," he says.

Sassoon says while the British focus at the fair will largely be to facilitate negotiations between businesses, he is looking forward to meeting Chinese officials to make the UK's expertise and economic credentials better known.

Government representatives from Chinese provinces including Fujian, Henan, Hunan and Hubei are among those he is eager to meet because he says these provinces represent a large part of China that is becoming increasingly connected.

Optimistic about his upcoming visit, Sassoon was quick to point out the UK and China's bilateral trade reached record levels earlier this year.

British government statistics released in June showed UK exports to China have doubled since 2009 and, based on current trends, China could become the UK's fourth-biggest goods export market within the next five years.

In the first quarter of this year, the value of UK exports to China averaged more than 1 billion pounds ($1.56 billion) per month, an unprecedented figure.

But despite the positive data and projections, Sassoon says Britain "wants to do better".

While the mutually advantageous economic boom service-based industries could bring is still largely on the horizon, Sassoon says Britain's manufacturing sector is already making inroads into the Chinese market.

Although at first glance the UK appears to lag behind other countries such as France and Germany in terms of exports to China, Sassoon argues that British exports to Asia's economic powerhouse are often understated because they are bundled in with exports made by other European nations.

The Airbus Aircraft for instance, a popular French import that is increasingly a regular feature in the skies above China, runs on engines made by Rolls Royce in the UK.

In April, Sassoon says, he was in Beijing to discuss trade matters with Vice-Premier Wang Yang. In the meeting room next-door, French President Francois Hollande was discussing further Airbus sales to China with Premier Li Keqiang.

"I said to Vice-Premier Wang Yang that we are grateful to Hollande for selling Airbuses to China, because there is more value for Britain in Airbus sales than there is for France," he says.

Sassoon says Britain's manufacturing sector has experienced a revival in recent years, largely because of an injection of foreign capital that has helped bolster struggling, iconic British brands. Notable examples include Indian conglomerate Tata's acquisition of Jaguar Land Rover and Germany's BMW buying the Mini car.

Chinese companies have also joined in on the investment bonanza.

In 2005, SAIC Motor Corp acquired British automaker MG Rover. Zhuzhou CSR Times Electric acquired British manufacturer Dynex Semiconductors Inc in 2008.

In both instances, the fresh injection of capital revitalized the British brand stalwarts, allowing them to grow their business and increase local employment.

Sassoon says both examples show when it comes to smart, foreign acquisitions, Britain is open for business.

"I think no country in the world has consistently welcomed foreign investment as much as Britain," Sassoon says proudly.

"We've been a trading nation for hundreds of years. We are a small country geographically, so we have to rely on commercial ideas and spirit. At a political level, we know this is where we can get ahead economically," he says.

Sassoon says the UK is also committed to providing a level playing field for international investors with regard to infrastructure projects. He says the nation's need of capital for infrastructure development and China's need to invest foreign reserves into projects with a steady income is a compelling and complementary match.

To date, China Investment Corp has bought 8.68 percent of the UK utility group Thames Water and 10 percent of London's Heathrow airport.

The Chinese nuclear power giant State Nuclear Power Technology Co is considering participating in the UK's nuclear project NuGen, after Spain's Iberdrola and France's GDF Suez began to look at offloading a portion of their holdings in the project recently.

Sassoon says China's investment in British nuclear projects makes sense from a business perspective.

"I know China has some very experienced nuclear operators. It's logical for those partnerships to want to get into the UK's new nuclear projects," he says.

cecily.liu@chinadaily.com.cn

(China Daily 09/09/2013 page14)