Internet technology makes today a golden era of inclusive finance: Peng Lei

(chinadaily.com.cn) Updated: 2015-12-16 17:32

|

|

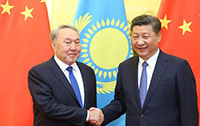

Peng Lei, chairperson of Ant Financial, speaks at a forum on the sideline of the Second World Internet Conference held in Wuzhen, East China's Zhejiang province on Dec 16, 2015. [Photo/Zjol.com.cn] |

Technology revolution and big data have made today a golden era for inclusive finance, said Peng Lei, chairperson of Ant Financial, the financial services affiliate of Alibaba Group Holding Ltd.

Speaking at a forum on the sideline of the Second World Internet Conference held in Wuzhen, Peng said that though the concept of inclusive finance had been put forward for many years, data from the World Bank last year showed that there is still a long way to go.

According to the World Bank, only 20 percent of the people who need loans in developing countries finally get the money, leaving the rest turning to private lending and illegal private banks.

Peng noted that inclusive finance faces several challenges. One is how to find balance between public welfare and commercial purposes. All financial products were created to help small companies and consumers rather than make profit, but how to maintain its benefits to the broad mass while making profits should be addressed.

After analyzing the Grameen Bank, a Nobel Peace Prize-winning microfinance organization and community development bank founded in Bangladesh, Peng said the development of mobile Internet can make finance more accessible to the public and make finance services cheaper, while big data can assist risk control.

Internet finance should be of low threshold, wide coverage, be able to build trust among people and pass on a sense of happiness, said Peng.