Coming to a screen near you

By Zhang Yuchen ( China Daily ) Updated: 2013-04-03 07:28:12

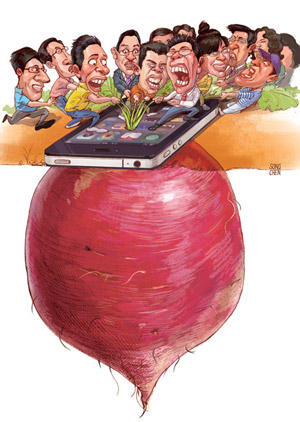

Independent Chinese app developers face a struggle for survival in the domestic market, despite its size and growing revenue, as Zhang Yuchen reports from Beijing.

A gleam of hope may have lit up the eyes of independent mobile application developers in response to the news that 17-year-old Nick D'Aloisio has officially earned his seat at the cool kids' table by selling his news-aggregator app, called Summly, to the tech giant Yahoo! for a reported $30 million in cash and stock.

The success of the UK-based high school student, who will also work for Yahoo! at its London base while he continues his studies, has encouraged a legion of small-scale entrepreneurs to create more apps.

However, the success enjoyed by foreign whiz kids such as D'Aloisio seems a long way off for independent developers in China, even though the country has overtaken the United States to become the world's biggest market for mobile devices. Sales of Android- and iOS-based smartphones and tablets in China are estimated to have reached 246 million devices by January. The US came a close second with 221 million.

In recent years, the growth rate for sales of mobile devices has rocketed by 209 percent annually in China, and 150 million new smartphones were sold between January 2012 and January this year, according to a report by the app analytics company, Flurry.

Given the data, it seems strange that even in this successful market local developers are struggling. So how difficult is life for small app developers in China?

Quite difficult, apparently. Most indie developers earn around 1,000 yuan ($161) a month on average. "Unless the app is a big hit in the market, like Summly, it won't bring the riches most people imagine," said Zhang Junming, an independent developer of game apps in Shanghai. Unlike D'Aloisio, whose app summarizes the main points of news stories, few domestic app developers can expect to achieve overnight success. While they are easily able to evaluate the increasing value and opportunities presented by the Chinese market, they also acknowledge that it has specific characteristics, which makes getting rich quick an unlikely scenario.

Of the 400,000 apps available on Apple's iTunes app store, games generate close to 70 percent of the annual revenue. A similar situation exists for rival stores that provide apps for operating platforms such as Android.

The game app industry has gone mainstream in China during the past 12 months; revenue grew by 140 percent year-on-year, accounting for one-eighth of the total 5.2 billion yuan revenue generated by the market, according to iResearch, an Internet monitoring and survey company.

Statistics provided by iResearch suggest that users spend an average of 45 minutes a day playing games on their devices, but only 15 minutes making calls, so it seems that smartphones are as much games platforms as communication devices.

But local developers said their passion for creating a successful app is as important a factor in their decision to enter the industry as the potentially large revenues on offer.

Ready? Steady? Go!

Whenever he's waiting for a bus or subway train, Zhang Junming takes out his smartphone and spends a few minutes playing a game. Usually, he favors games that are available as free downloads.

As the train or bus approaches his stop, Zhang finishes playing the game and uploads his score to see how he ranks among other players. Although his ranking improves almost every time he plays, Zhang seems indifferent to the result. He will play again when he gets another few minutes of free time.

|

Inside story The small fry Ling Yun, part-time independent app developer. We offer services to solve technical problems that others find difficult to deal with, often concerning Flash Player and similar programs. Usually, PC programming projects are easier to handle, and app development can be undertaken using the same principles. Four core team members deal with apps problems on a part-time basis. They all work for IT companies as their day jobs. Some of them work for companies such as Baidu and Wanmei, one of China's biggest online game websites that started trading on the NASDAQ Global Select Market in 2009. However, we don't receive as many orders as we would like and so we can't quit our day jobs and become really independent. The big fish Jim Lee is general manager and publisher at EA Mobile China. Because mobile gaming is a mainstream entertainment, many of the characteristics of mainstream entertainment apply. First, brands matter. Thousands of movies are made each year in Hollywood, but only a handful of blockbusters take the lion's share of the box office. Second, quality matters: No matter what platform you are looking at, once the novelty wears off, the high-quality games stand out. Naturally, Games is a different media (to movies) and has its own idiosyncrasies. One of them is being interactive. So the business model really matters. Making a game is difficult, but making a brand is truly difficult. Many Chinese gamers grow up with brands such as The Sims and Need for Speed. They love those brands. Many Chinese developers are at the cutting edge of business model innovation and we respect them for that. But by marrying brand, quality and learning from Chinese developers on business model innovation, I believe EA is in a unique position to be successful in this market. We value our customers' loyalty greatly. Our next game will be free-to-play and customers will find many Chinese elements there that will delight them. Ling Yun and Jim Lee spoke to Zhang Yuchen. |

While the PC and Web game markets are occupied by the industry behemoths, apps stores have mostly become a platform for small- and medium-sized developers, although individual competitors are also flooding into the field.

Zhang's first app, Doctor Dot, was released on the iTunes apps store in November. The game cost 99 US cents per download and has been downloaded 200 times so far. "The money I've earned (from Doctor Dot) almost covers my membership of the Apple iTunes app store for two years," he said.

Theoretically, that means that every future download should see Zhang make a profit, but he considers his first product a failure, partly because he didn't raise awareness of the product through marketing and promotional activities.

"More indies are coming to the market. Although that may result in an unprecedented number of new products, there will be many failures and few developers will make it in the end," he said. That's sobering news for the estimated 6,000 indie app companies on the Chinese mainland, for whom generating a single, rudimentary game app usually requires the involvement of four to 10 IT engineers, over a period of three to six months.

One notable challenge facing all game development companies is that Chinese consumers are notoriously reluctant to pay for downloads, preferring to use free products instead.

And although independent developers are making great strides in terms of innovation, many web game developers are also entering the arena.

Wesley Bao is the co-founder of Coconut Island Studio, established in 2009 in Shanghai just one year after Apple allowed independent developers access to the iTunes app store.

Initially, Bao was Coconut Island's sole employee, having ploughed 200,000 yuan of his savings into the idea. However, a partner later came on the scene and the company now has a staff of four.

Since its inception, several of Coconut Island's apps have gained top ranking on the iTunes app store's weekly most-downloaded lists. For example, iDragpaper topped the European and US download charts in the first week it was available.

Having worked for a number of foreign-based Web game companies, Bao decided to develop his own ideas for games applications. Registering the company after the name his wife uses on her personal blog, Bao formulated a clear business plan, based in part on the vagaries of the Chinese market.

For example, because Chinese consumers are reluctant to pay for apps, Coconut Island's pay products, such as iDragpaper and Mister Frog, are only available overseas. However, all the apps the company makes available through the Chinese iTunes store are free, and half of Coconut Island's global revenue comes from selling advertising space at the bottom of the interface of free-to-play apps.

However, most games only remain fashionable for around six months. "We always keep in mind ways of improving the playing experience to intrigue players and keep them coming back for more," said Bao.

Big fish, small pool

Because game companies can't survive on ad revenues for very long, many adopt a second revenue stream, called In-App Purchasing, a practice that has existed almost as long as Internet games have been available.

When customers download one of these apps free of charge, they are only allowed access to a number of basic levels, not the full game. The companies hope that the limited access will get players hooked on the game and they will be happy to pay for access to the higher levels, or for tips, hints and other information.

It's really only when gamers begin to pay for in-app purchases that the smaller developers finally begin to make money from their creations.

The free-to-play/in-game purchasing model has now been adopted by a number of international companies as they seek to introduce their products to the mobile market. The practice is especially popular with so-called console players whose games are usually better known on static platforms, such as Nintendo's Wii or Sony's Playstation.

"We are seeing some very interesting trends in mobile gaming. The smartphone is now well and truly in the hands of mainstream consumers," said Jim Lee, general manager and publisher of the games company EA Mobile China. More than 80 percent of the phones sold in the Chinese market now are smartphones.

"We are learning about a lot of local developers. They have created or perfected many innovations and we will continue to marry these with what we do best; big brands and blockbuster quality. I believe this will be a winning formula."

As bigger fish come into the pool, it's becoming increasingly difficult for local developers to benefit from their products. Giants such as Electronic Arts, the parent of EA Mobile China, and Unisoft Corp, a leading game company from France, are already well known and enjoy strong customer loyalty. That's not the case with independent Chinese developers, who have to work hard to make their products much more visible.

In response, some Chinese developers pay Internet users to post positive comments about their products online as a way to raise the profile and boost the rankings on games' lists. Usually, however, it costs 5,000 yuan to hire a group of "Zombies", as they are known, for a day, a price few smaller developers can afford.

Despite the presence of large and small game app developers and the huge size of the Chinese market, Wesley Bao believes the promised land is still far away. "The Chinese market is just as complicated as ever. While I see plenty of opportunities, I also see plenty of risks."

Contact the writer at zhangyuchen@chinadaily.com.cn.

|

|

|

|

|

|

|

|

Op Rana

Op Rana Berlin Fang

Berlin Fang Zhu Yuan

Zhu Yuan Huang Xiangyang

Huang Xiangyang Chen Weihua

Chen Weihua Liu Shinan

Liu Shinan