Course in 'cannibalism' a steep learning curve

By Yang Yang ( China Daily ) Updated: 2013-07-30 09:57:13Venture capital

While an influx of venture capital has fueled this runaway growth, it hasn't necessarily improved the quality of teaching.

In 2004, a venture capitalist, Tiger Management Corp, also known as the "Tiger Fund", entered China's private education industry. Its first investment target was Yu's New Oriental, which in 2006 became the first Chinese education provider to go public overseas when it listed on the New York Stock Exchange.

Since 2006, spurred by New Oriental's listing and the high expectations for the Chinese training market, eight organizations, including Ambow Education Holdings and the TAL Education Group, have listed in the United States.

Company statistics show that by May 2012, New Oriental had established 55 schools and more than 600 training centers nationwide and, since the 1990s, it had provided training for 13 million people.

However, during the last fiscal year, New Oriental opened 238 centers, registering quarterly growth of more than 40 percent, a "horrible" rate of expansion, according to Li Ying, a veteran educational industry analyst quoted by South City News. New Oriental predicts that fiscal 2012/13 will see revenue grow by 25 to 30 percent.

That growth has been the source of a number of problems, according to a teacher who insisted on using the pseudonym Zhang Yichi. He has taught a wide range of English courses at New Oriental's Nanjing branch since graduation two years ago.

"I think one of the problems is that the scale is so large that the company needs more teachers, but it can't guarantee the quality of its recruits. Years ago, the level of teaching was higher. Now, some teachers' English language abilities are unacceptable. Their pronunciation, grammar, aural and spoken skills are awful, but they are still allowed to teach vocabulary courses," he said.

Another employee, who declined to give her name, said, "After the listing, the company became so large that I felt only a financial relationship existed between the teachers and the company. There are no corporate values, the teacher-appraisal system is unworkable and the pay and benefits are not good enough. Many of the teachers have left and gone to other institutions."

As Dong Shengzu, dean of the Non-Government Education Research Institute of Shanghai Academy of Educational Sciences, explained: "Venture capital investors are not philanthropists. The quest for profits and the rapid expansion of training institutes will result in the social value of education being overlooked."

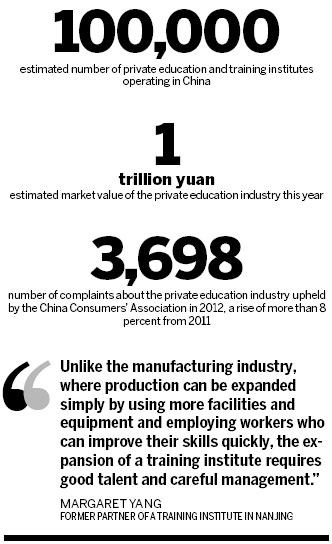

The pressure to become profitable has led some operators to engage in illegal activities such as the use of misleading publicity materials, unfair competitive practices and even embezzlement. This has damaged the credibility of private educational and training institutes and harmed the interests of consumers, he said.

|

|

|

|

|

|

|

|

Op Rana

Op Rana Berlin Fang

Berlin Fang Zhu Yuan

Zhu Yuan Huang Xiangyang

Huang Xiangyang Chen Weihua

Chen Weihua Liu Shinan

Liu Shinan