Xi launches financial reforms

China Daily | Updated: 2017-07-17 05:11

Maintaining stability, serving the real economy, expanding revisions crucial

|

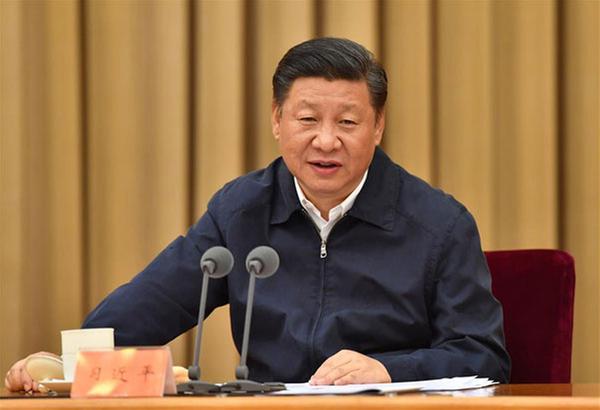

| President Xi Jinping speaks at the National Financial Work Conference in Beijing July 15, 2017.[Photo/Xinhua] |

China unveiled reform plans on Saturday to improve the financial sector's capabilities and serve the real economy while guarding against systemic risks.

China must strengthen the leadership of the Communist Party of China over financial work, stick to the basic tone of seeking progress while maintaining stability and respect the rules of financial development, President Xi Jinping said at a two-day National Financial Work Conference that ended on Saturday.

The conference has been convened every five years since 1997 and is widely considered to set the tone for financial reforms.

Three tasks were highlighted in the meeting, including making the financial sector better serve the real economy, containing financial risks and deepening financial reforms.

Serving the real economy is the bound duty and purpose of the financial sector and the fundamental way to guard against financial risks, Xi said.

The financial sector should improve service efficiency and quality and channel more resources into major and weak areas of economic and social development, he said.

Developing direct financing will be prioritized while the indirect financing structure should be optimized by accelerating strategic transformation of state-owned major banks and developing small and medium-sized banks and private financial institutions, Xi said.

Reiterating the role of the financial sector points out its development direction, and emphasis on direct financing also is reassuring for the stocks and bond markets, according to Li Huiyong, a senior analyst with Shenwan Hongyuan Securities.

Xi said guarding against systemic financial risks is the eternal theme of financial work and the government should make a stronger effort to monitor, warn against and deal with risks in a timely manner.

China will accelerate developing laws and regulations governing the financial sector, improve macro prudential management and emphasize functional as well as behavioral regulation, Xi said.

The government will continue to deleverage the economy by firmly taking a prudent monetary policy and making it a priority to reduce leverage in state-owned enterprises, Xi said.

The country also will deepen financial reforms, including improving financial regulation coordination and shoring up weak links in supervision.

China will set up a committee under the State Council to oversee financial stability and development and the central bank will play a stronger role in macro prudential management and guarding against systemic risks, Xi said.

The introduction of the State Council financial stability and development committee will help improve regulation effectiveness and address regulation challenges brought by increasingly mixed financial services, according to Lian Ping, chief economist at the Bank of Communications.

Reforming the financial regulation framework should be based on China's domestic conditions and all financial businesses will be put under supervision, according to Premier Li Keqiang.

The world's second-largest economy will further open up its financial market to promote the internationalization of the yuan and capital account convertibility in a steady pace, Xi said.

China also will increase efforts to improve legal framework, credit mechanisms and talent development for the financial sector to help the Chinese economy expand steadily, Li said.

Xinhua