Tech giant Samsung shifts its focus to emerging fields

By Fan Feifei | China Daily | Updated: 2019-01-02 09:12

South Korean technology giant Samsung Electronics Co Ltd is adjusting its strategy in China as it has closed one of its smartphone manufacturing plants in Tianjin and plans to invest $2.4 billion to build new battery and capacitor plants in the city, in order to shore up its business in China.

Industry insiders said the tech heavyweight has faced pressure from local competitors that offer reasonably priced smartphones, and the choice to close its plant in Tianjin and expand its presence in the core components and industry chain will be a significant shift for Samsung in China.

They added that the new plant shows Samsung's confidence to invest in Tianjin, and apart from mobile phone business, the company owns many competitive products, such as chips, capacitors, batteries and display screens in the world's largest smartphone market.

Samsung said in a statement that as part of ongoing efforts to enhance efficiency in production facilities, it had arrived at the difficult decision to close the manufacturing plant in Tianjin.

The plant, which currently employs around 2,600 workers, was scheduled to be closed by the end of last year. The company said it would offer compensation packages to the employees and also provide opportunities for them to transfer to other Samsung facilities.

Media reports said Samsung ended production in Shenzhen, Guangdong province, in April. The company said it would continue to operate another Chinese smartphone factory in Huizhou, which is also in Guangdong province.

Despite being the world's biggest smartphone maker, Samsung's sales are close to negligible in China. According to market consultancy Strategy Analytics, in the second quarter, Samsung sales made up less than 1 percent of the Chinese market.

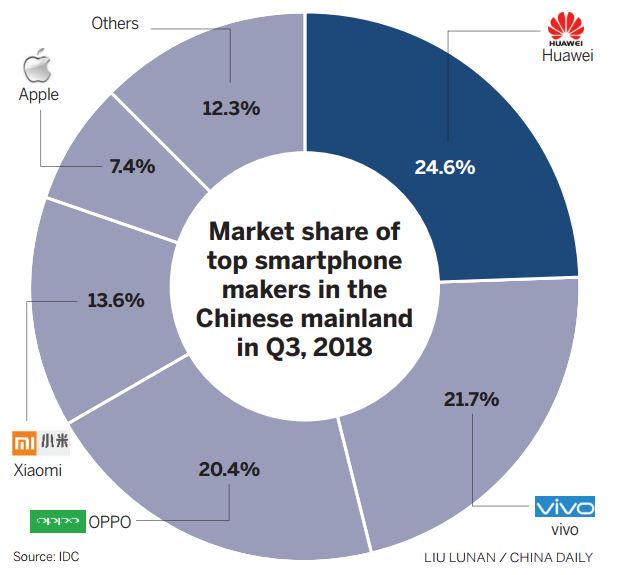

Statistics from market research firm International Data Corp showed that Huawei Technologies Co Ltd continued to lead China's smartphone market during the third quarter of this year, with a 24.6 percent market share, followed by Vivo and Oppo. However, Samsung is losing most ground on mid-range and cheaper smartphones.

Samsung has shifted its attention to emerging businesses such as batteries and other electronic components in China. Its $2.4 billion investment in Tianjin will be used to expand power battery lines and establish a multi-layer ceramics capacitors factory for automotive electronics in the city, according to the Tianjin municipal government.

Samsung SDI, a storage battery maker, will invest $800 million in the battery project which is expected to cover 100,000 square meters. The batteries will mainly be used in energy storage systems, electric cars and electric tools.

Wang Jingbin, director of the management school at Tianjin University of Technology, said: "Samsung has an upper hand in chips, capacitors, batteries and display screens, apart from its smartphone business."

Its shift to core components is of great significance and would create more value, said Wang, adding that automotive electronics devices will be a new direction for the company.

"Samsung still lags behind its local competitors in smartphone sales and should make more efforts to strengthen brand building, as well as expanding offline and online retail channels," said Jia Mo, a research analyst with technology consultancy Canalys.