Bonds, innovative products providing support

By Jiang Xueqing in Chengdu | China Daily | Updated: 2019-06-26 09:49

Apart from offering project loans and working capital loans, commercial banks are stepping up support for green companies and projects that are engaged in energy conservation and environmental protection through bond issuance and innovative financial products.

Industrial Bank Co Ltd, a Fuzhou-based joint-stock commercial lender that is also known as CIB, has underwritten and subscribed bonds totaling 2 billion yuan ($291 million) for Chengdu Xingrong Environment Co Ltd since they started cooperation in 2008.

"We will expand our cooperation to more areas of financial services based on the development needs of the company and the actual situation of its projects," said Gu Bin, president of a subbranch of CIB in the Chengdu Hi-tech Industrial Development Zone.

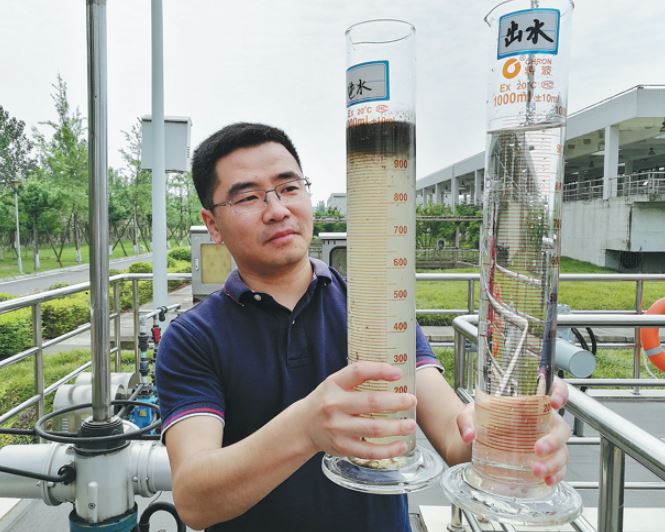

Providing water utilities and environmental services in China, Xingrong Environment has a wholly owned subsidiary called Chengdu Drainage Co Ltd that operates eight sewage treatment plants in Chengdu, capital of Sichuan province. The daily sewage treatment capacity of these plants totals 2 million metric tons.

Chengdu No 9 Water Purification Plant, one of the eight plants, has the largest sewage treatment capacity of its kind in downtown Chengdu - 1 million tons per day. Of all the reclaimed water, 700,000 tons drain into the river and 300,000 tons are recycled to return water to dwindling rivers or irrigate the meadows at the plant.

"The quality of the reclaimed water flowing out of the drainage outlet at our plant is much better than the quality required by the highest discharge standards of pollutants for municipal wastewater treatment plant in China," said Yan Min, assistant manager of Chengdu No 9 Water Purification Plant.

The operator of the plant, Chengdu Drainage Co Ltd, is now in the middle of constructing an integrated sewage treatment plant. With planned investment totaling 1.85 billion yuan, the second phase of the project will be completed at the end of 2020, and its sewage treatment capacity will reach 300,000 tons per day.

"Xingrong Environment issued green bonds in the interbank bond market to raise money for the project. Many commercial banks including CIB took an active part in the subscription of the bonds," said Liu Jie, deputy general manager of Chengdu Drainage.

Besides, CIB has also developed innovative financial products that cater to the special needs of environmental protection companies and projects.

The bank allowed qualified companies to use their carbon dioxide emissions quotas as collateral for secured loans or to pledge future proceeds from energy performance contracting, a financing technique that uses cost savings from reduced energy consumption to repay the cost of installing energy conservation measures.

It also launched financial leasing and trust products to raise funds for green projects, said Wang Yifeng, a division chief of CIB's green finance department.