Correcting the record on China's 'social credit system'

By Elyar Najmehchi B.A. | chinadaily.com.cn | Updated: 2019-11-29 14:43

Western media's China coverage has been dominated by two topics in recent times: the Hong Kong riots and the trade war. But yet another topic that has gotten increased attention in the west is the rollout of China's so-called "Social Credit System". An image of a dystopian control system has been painted, surveilling citizens at will. US Vice President Pence even described it as "Orwellian" in a speech in 2018. Unfortunately, the reporting on it is inaccurate at best and a total fabrication at worst.

If we take a closer look, we can observe at many times the portrayal of this topic, especially in the West, goes so far as to completely distort its core meaning and intention. This article will debunk some common misconceptions about the system and take a closer look at its intended purpose.

Origins of the Social Credit System

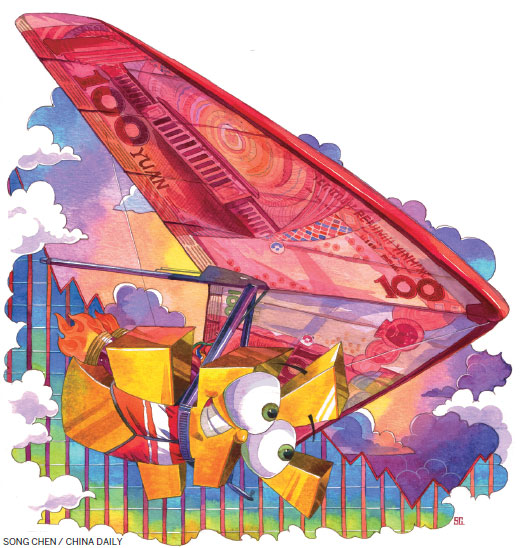

There are many reasons for Chinas economic success in recent years. However, most are connected to explicit measures, regulations and policies by the Chinese government. The Corporate Social Credit System is one measure ensuring economic stability by creating a safer and more reliable business environment in China through a more sophisticated regulatory framework. It is not a rushed, last-minute measure – on the contrary, it has been planned since the late 1990s.

In the reform and opening-up era of the early 1980s, China entered the international market with an economic framework that was originally tailored for the domestic market. Therefore, the Chinese economy was confronted with new issues. Especially from the 1990s onwards, officials recognized China was still missing the infrastructure to tackle international market problems such as corruption, fraud, copyright infringement, consumer safety, disregard for contracts and a low-trust market environment. They understood all these problems are connected, and the key to fight the lack of integrity in the marketplace is to create an infrastructure for a new, holistic self-regulating system.

This culminated in China's State Council announcing announcing the establishment of a national Social Credit System in 2014: a landmark data-driven platform to collect financial and behavioral data on companies, with punishment mechanisms for offenders and rewards for exceptional compliance. It is intended as a tool to create trustworthiness and transparency in the business sphere, mainly focusing on market behavior of companies, not individuals.

A reliable business environment: The SCS's core purpose

Since its announcement in 2014, the Corporate Social Credit System has been further developed and prepared, for its planned debut by the end of 2020. Its main pillar will be a database called the National Credit Information Sharing Platform, which collects all available data on market entities in China one single place. Based on this data, credit records of individual companies will be compiled.

Previously, this data on companies was spread out among different government agencies with insufficient intercommunication. One main function of this new database is to make it convenient for regulators and agencies to get a holistic picture of a market entity and its record of compliance in other sectors. With the new system, regulatory compliance data will be collected, compiled and rated by intelligent algorithms, erasing the possibility of human error.

There will be rewards and benefits for those who comply with regulations and possible punishments for those who do not. Companies who already have sophisticated internal control mechanisms of ensuring compliance in place, such as adherence to environmental regulations, will see benefits from this system. Companies who might have previously been notorious avoiders of such regulations will see harsher punishments in the future, forcing them to adapt. The so-called system of "joint sanctions" will allow cross-departmental punishments to take place. For example, the Department of Energy could raise electricity fees as punishment for polluters until they can prove compliance and a commitment not to offend again. In severe cases, companies who endanger public safety or are committing serious crimes such as major tax evasion or import/export offences such as smuggling can be jointly blacklisted or even banned from the market. On the other hand, companies who can prove excellent and consistent compliance can be red-listed, meaning they could receive benefits such as speedier bureaucratic procedures.

This creation of a more transparent and fair playing field for compliant companies also aims to attract new foreign investors who previously might have been hesitant to enter the Chinese market. Most of the collected data on companies was public in the first place, but not as easily accessible. For example, companies can now easily check business partners' compliance scores and decide if they are trustworthy. All in all, the purpose is to create a self-regulating environment of trustworthiness in the market sphere.

Myths and misconceptions about the Social Credit System

1.Everyone has a single credit score

A common myth making the rounds in Western media is that in China today, every individual has a score assigned to them by the central government to rate their behavior and determine their place in society. This is simply not the case. First of all, it should be stated around 80 percent of all data stored relates to companies, not individuals. Also, as of now, these data sets don't accumulate into one single metascore (like 1-100) for companies, rather they are evaluated and stored as multiple different distinct credit records. The only credit scores ever assigned to citizens are those by local governments in experimental pilot cities, which are still part of research efforts of different kinds of scoring systems and in an early stage. There has been no indication the national government will implement a nationwide scoring system. Furthermore, criticism of the system by the public has been invited and there is an active discussion taking place. As long as there are possible abuses of the system, it will not be implemented nationally.

2.The Social Credit System is a tool for surveillance or political grading

The claim a score is created based on surveillance records of individual citizens or companies is simply incorrect. The database for companies is already publicly accessible on the internet, — namely the National Enterprise Credit Information Publicity System — and it only consists of public compliance records, as well as blacklists for companies who violated numerous government regulations. Individual scores in pilot cities focus mostly on aspects such as criminal records, debt repayment and court offenses. There are also no political categories or guidelines for corporate values. As long as companies in China adhere to the law, they are free to choose their own corporate values.

Analysis: the SCS has great potential

In many ways, the Corporate Social Credit System presents a uniquely Chinese solution to a modern problem of market instability. The idea of "self-regulation" through a system of trustworthiness, where the "trustworthy will roam under heaven, while the discredited can't take a single step" embodies certain age-old Confucian ideals. It is a holistic solution for a more harmonious society. This being said, implementation has to be adjusted to modern-day circumstances. Its guidelines should be made extremely precise and applied equally to all, to ensure fair treatment of everyone and no possibility of abuse. If done right, the system can create a market environment that can self-regulate through competition, eliminating unfair and illegal business practices.

On the other hand, one should not overestimate or sensationalize the system too much. At its core, it just an improvement of the tracking, enforcement and punishment mechanisms for market regulations through modern technology.

As for scoring of individual citizens, there are still some potential issues. Any possibility of abuse, especially if scoring is linked to human input — increasing the chance of corruption — should be eliminated before the system is implemented. Also, credit scoring should be strictly linked to the rule of law and not allow space for extra-legal, moral behavior. It should always be based on what is legal and illegal instead of what is "good" and "bad" behavior, since these can be victim to subjectivity. One should note, however, that contrary to certain misconceptions the national government has not accepted any of the scoring approaches of the pilot cities for national policy.

Many critics of the system, especially from the West, apply a "what-could-happen" point of view, instead of analyzing what is actually happening. However, such worst-case scenario thinking could be applied to anything. Accusations of surveillance and a Big Brother mentality are especially hypocritical when coming from the United States, where government agencies have illegally collected private data not only of its own citizens, but even citizens of other countries.

The author is a masters' degree student in Economy and Society of East Asia at the University of Vienna.

The opinions expressed here are those of the writer and do not represent the views of China Daily and China Daily website.