Chinese enterprises compete to achieve 8K television supremacy

By Fan Feifei | China Daily | Updated: 2020-10-21 09:53

5G-powered 8K ultra-high definition TV is the future of displays and a source of growth from now on-and China's high-end television manufacturers are expected to compete fiercely for market share, industry experts said.

Chinese electronics majors and appliance makers such as Skyworth Group, Sichuan Changhong Electric Holding Group, Hisense Group and TCL Technology Group Corp are all beefing up efforts to excel in this new premium TV niche.

Despite continued evolution of 4K into a viable TV format, 8K is on its way into living rooms throughout the world, more so because of the advent of superfast 5G telecom technology, they said.

5G has the advantages of high speed, large capacity and low latency, which presents an opportunity to popularize 8K, the format for ultrahigh definition TV.

"Superfast 5G technology can solve content transmission, compression and decoding problems of 8K displays and provide solutions for various fields covering entertainment, medical imaging, broadcasting, security monitoring and remote education," said Ai Weiqi, research manager of consumer electronics at market consultancy AVC.

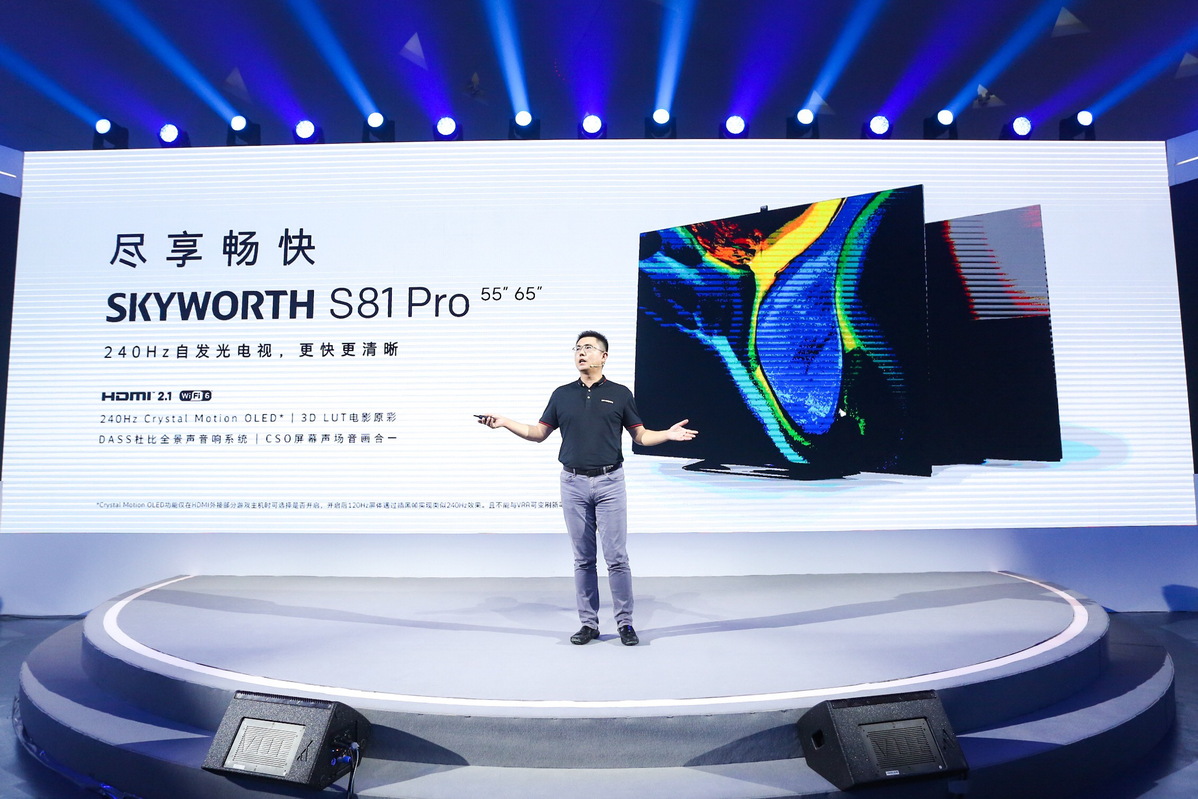

Skyworth is in fact developing the whole industrial chain in 8K TVs, said Wang Zhiguo, chairman and president of Shenzhen Skyworth-RGB Electronic, a subsidiary of Skyworth Group.

The company, he said, is committed to providing a complete range 8K solutions covering video cameras, monitors and cloud operating systems.

This strategy is expected to help Skyworth expand applications of the 8K technology to a wide range of fields like aerial photography, education, healthcare and advertising. Skyworth will also create high-definition content fit for 8K devices.

Ai of AVC noted that Chinese TV manufacturers have accelerated their efforts in 5G, 8K and self-developed chips. This will help brands cultivate core technical strengths and enhance market competitiveness. New technologies could also help relieve operational pressures.

In September, Skyworth unveiled the Q71, its new 8K TV product with built-in 5G connectivity. Priced from 11,999 yuan (around $1,760), the TV sets come in 65-inch and 75-inch screen versions, and support 8K signal reception, decoding, image signal processing and screen display.

"5G offers technological support for the adoption of 8K, while 8K is one of the best application scenarios of the superfast wireless technology," said Wu Wei, chief engineer at Skyworth.

In April, Changhong Electric launched its new 5G-8K TV products, which are equipped with the world's first 5G-powered video modules developed by Changhong. They use HiSilicon's 8K chips, which allow video acquisition, encoding, transmission, decoding, display and other "end-to-end" 8K chip solutions.

In November, Hisense will launchan image processing chip that supports 8K TVs. Over the next two years, the company will launch six AI-powered chips with the usage rate of its self-developed image chips exceeding 90 percent.

But, the domestic 8K TV industry is still considered nascent, experts said. Skyworth will intensify research and development of 8K chips to improve the clarity, contrast and brightness of images, company executives said.

According to Wu of Skyworth, the emerging 8K TV segment will likely see rapid development next year in the run-up to the 2022 Winter Olympics in Beijing and other marquee sporting events.

As for matching content, China's ultra-high definition video industry is expected to exceed 4 trillion yuan by 2022, according to an action plan issued by the Ministry of Industry and Information Technology, the National Radio and Television Administration and China Media Group.

The plan said breakthroughs will be made in the R&D of products and the industrialization of 8K technology by 2022. A cluster of internationally competitive companies will be fostered in the field.

According to market consultancy IHS Markit, 8K TV shipments globally will reach around 2 million units, with more than half of them being models with 60-inch or larger screens.

AVC data showed TV sales volume reached 20.89 million units nationwide in the first half, down 9.1 percent year-on-year, while sales revenue was 51.6 billion yuan, down 22 percent year-on-year.

"The competition in China's TV industry is very intense. The production capacity of both panels and TVs is continually increasing, but demand from consumers who aspire to switch to new TV sets is declining," said Ai of AVC. Liang Zhenpeng, an independent consumer electronics analyst, said as the prices of 8K panels fall and related content gets enriched, 8K TVs will rise in popularity.