China Life Insurance ready to meet market demands

By Jiang Xueqing | chinadaily.com.cn | Updated: 2021-01-30 22:29

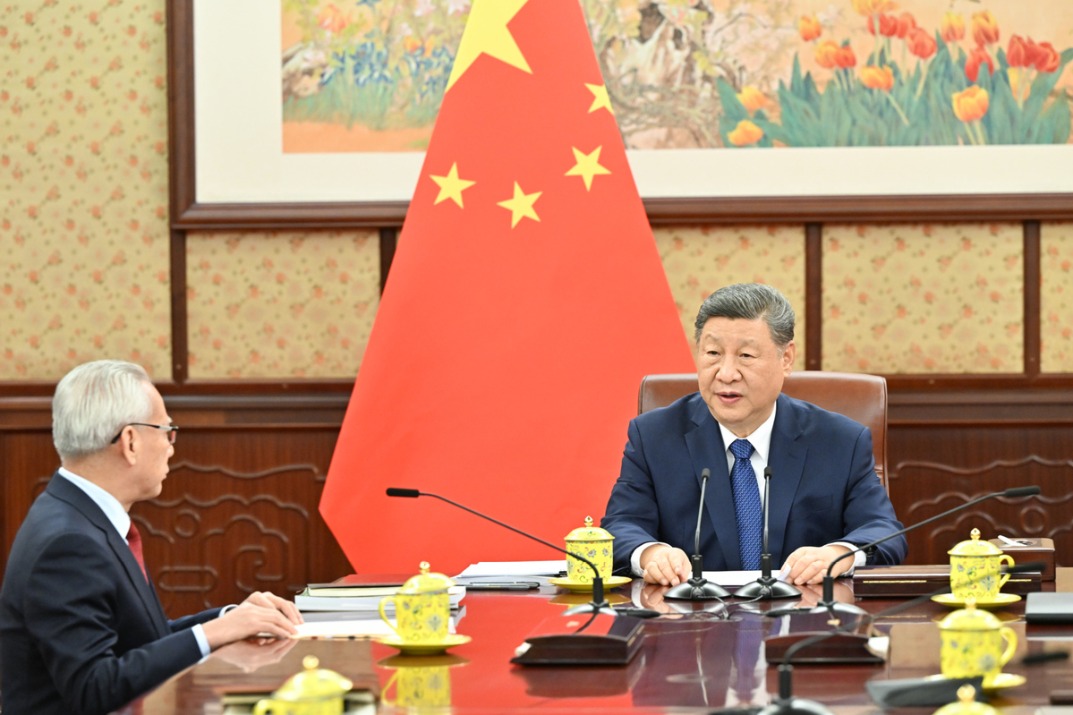

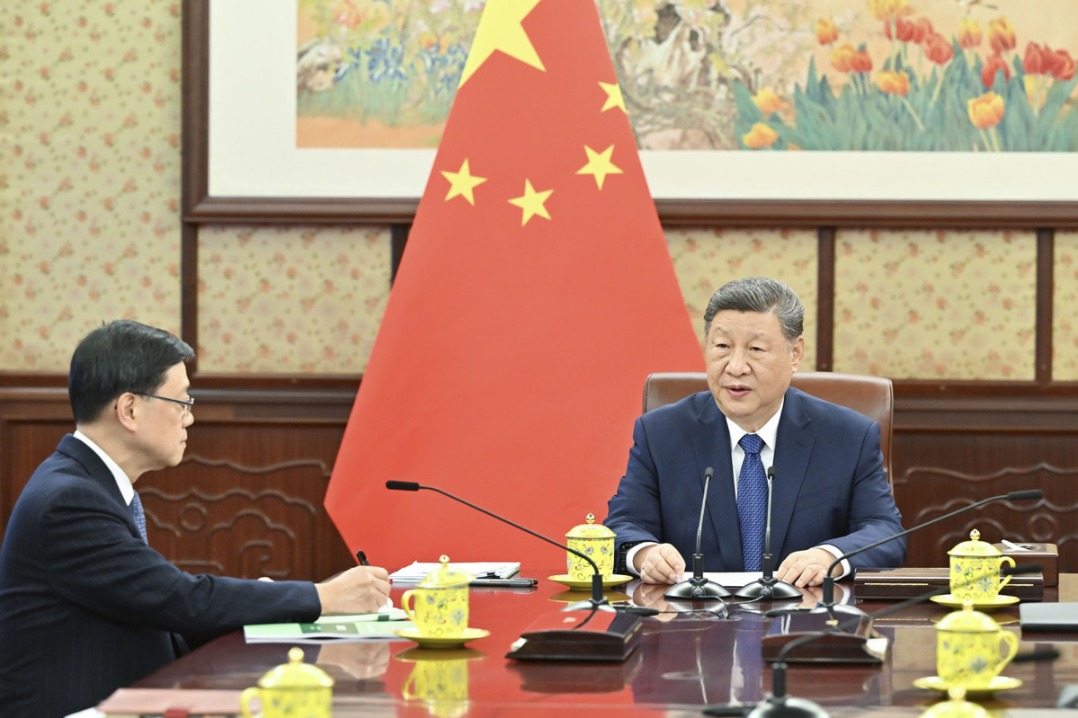

China Life Insurance (Group) Co will blaze a new path to high-quality development, said Wang Bin, chairman of the country's largest State-owned financial services and insurance group.

The group must put the new development concept into practice and promote the concept of innovative, coordinated, green, open and shared development. It must adhere to the systemic mindset to achieve the unification of the quality, structure, size, speed, benefit and safety of development, Wang said.

Embracing cutting-edge technologies to meet market demands, the group will promote in-depth digital transformation, optimize its layout of internationalization and try to serve as a bridge for the high-level two-way opening of China's financial market, he said at the group's annual work conference earlier this week.

Last year, China Life endeavored to support the implementation of major national development strategies and effectively served the development of the real economy, the part of the economy that produces goods and services, he said.

The group invested in 282.2 billion yuan ($43.9 billion) of ultra-long government bonds and invested a total of more than 1.16 trillion yuan in key regions to promote coordinated regional development. Its existing direct investments exceeded 2.8 trillion yuan, and its balance of loans to micro and small enterprises whose total credit lines are up to 10 million yuan per borrower was 128.5 billion yuan by the end of 2020.

The group recorded consolidated total assets of more than 5 trillion yuan last year. Consolidated third-party assets under the management of the Beijing-based insurer amounted to 1.8 trillion yuan. Its consolidated operating income was nearly 1 trillion yuan and consolidated premium income exceeded 750 billion yuan.

Liang Tao, vice-chairman of the China Banking and Insurance Regulatory Commission, said the country's banking and insurance sectors continued to enhance the quality and efficiency of serving the real economy in 2020.

The insurance sector provided 8.7 quadrillion yuan worth of insurance, an increase of 34.6 percent on a yearly basis. The sector made a combined compensation of 1.4 trillion yuan, up 7.9 percent year-on-year, said Liang at a news conference held by the State Council Information Office on Jan 22.