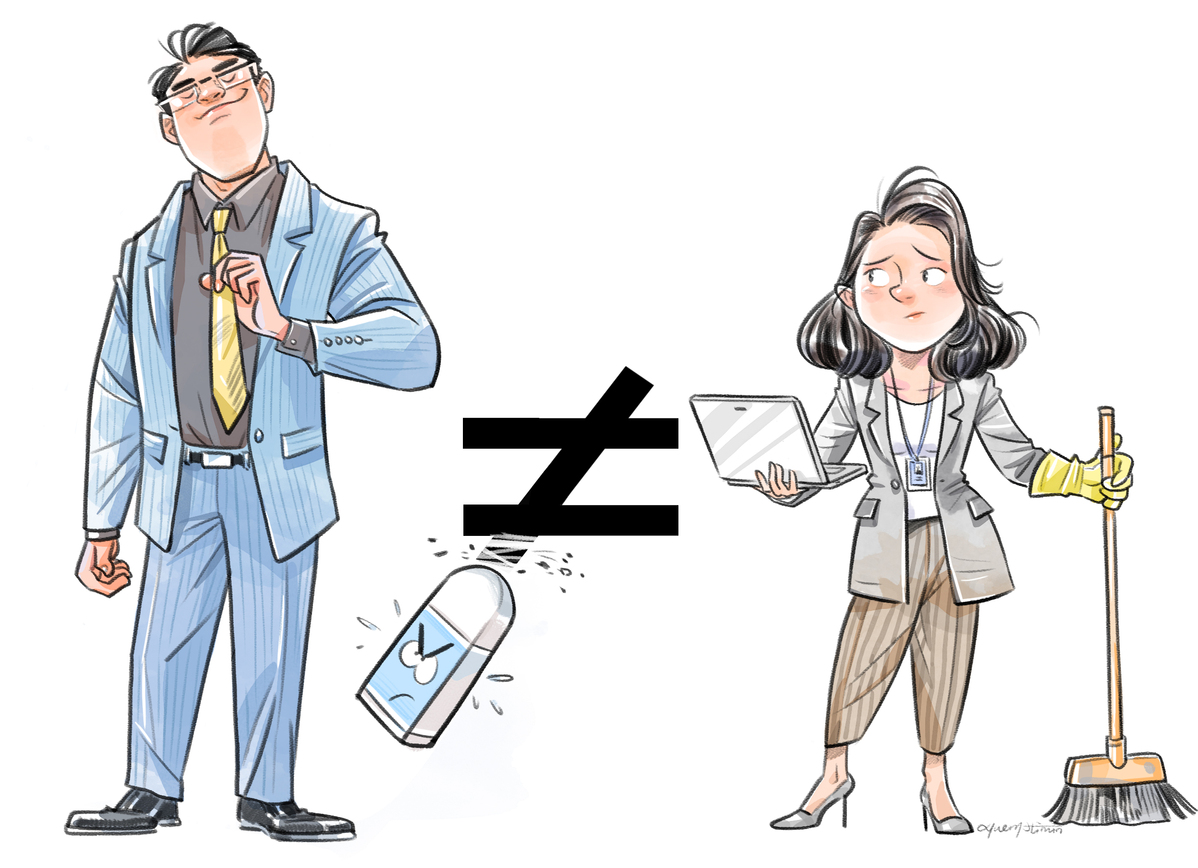

Simple, smart ways of closing gender gap in finance

By Zhou Lanxu | China Daily | Updated: 2021-04-12 09:16

As a female financial journalist, I think I'm naturally drawn to any new developments or events that signal women are closing the financial gap with men.

So, it was disappointing to note a couple of recent surveys that revealed the gap might not close any time soon.

It transpires that Chinese women are more conservative than men in investing and forecasting future financial wellness.

These findings seem to feed the rising concerns that the COVID-19 pandemic is widening gender inequality globally.

On second thoughts, however, I'd contend that women's cautious optimism can prove a formidable weapon that can win personal battles for a lifetime of financial security.

One of the surveys is the global Women & Money study released in March by asset manager Fidelity International. It said the average value of investments held by male respondents in the Chinese mainland is 6 percent higher than that of women, though the latter have more savings.

Data provided by Lufunds, a domestic online fund sales platform, also indicated that women are more conservative in investing. Lufunds' female users are more likely to invest in the less risky bond-focused funds than male users.

Some have argued that women's cautious approach to investing will mean that they often find it harder to achieve top life and financial goals. This has been exacerbated by the greater income and career damages that women have suffered due to COVID-19 compared to men.

A survey released by the Renmin University of China's Chinese Academy of Financial Inclusion last month, for instance, said Chinese women feel greater financial pressure than men. Up to 26 percent of male respondents said they are not pressured by financial issues, higher than the 20 percent of female ones.

In my view, however, females in China, and perhaps in other parts of the world, can totally become more confident of safeguarding their personal financial health as reasonable prudence can be translated into outstanding long-term investment results.

Indeed, due to physiological and psychological features, women in general have a stronger tendency to avoid losses and are more likely to be satisfied with seemingly ordinary but stable returns. This prudent investment mindset may not help women investors capitalize on the soaring prices of assets like, say, Bitcoin, but can shield them from potential huge losses that characterize volatile assets.

Basic calculations will show that a moderate annual return that sustains for years will, in the long run, outperform the once stellar but bumpy returns that often pierce through the gain-or-loss line.

Warren Buffett, the world's most celebrated investor, has shown that the secret of accumulating huge wealth does not lie in achieving astonishing but short-lived returns but in compounding, which refers to maintaining a moderate return and avoiding losses as much as possible over decades.

Female investors' focus on pursuing long-term, stable returns can also help women capture the upside potential when the market reaches or nears its bottom.

As Lynda Zhou, chief investment officer for equities in China at Fidelity International, said, women's willingness to tolerate short-term fluctuations for long-term returns makes them more likely to buy into securities after a sharp market decline and reap the profits as the prices recover over time.

Nevertheless, my intent here is not to argue that women are better than men in wealth management as both genders have their pros and cons in investing.

If a female investor is way too cautious and reluctant to take any risks or starts investing too late in her life, it'd be hard to argue she will succeed in making her investments produce high returns.

The point is, if women get themselves financially educated and turn active investors as early as possible, they would be able to take control of their own financial destiny.

In my view, women should rise above the usual suspects like predictable challenges and stereotypes and look to learn from real-life success stories. More importantly, they should fully recognize and leverage their own priceless natural assets like caution and long-term outlook.

That, ladies (and gentlemen), is the way to first narrow and then close that gap.