Short-term pain for long-term gain

China Daily | Updated: 2021-11-17 07:52

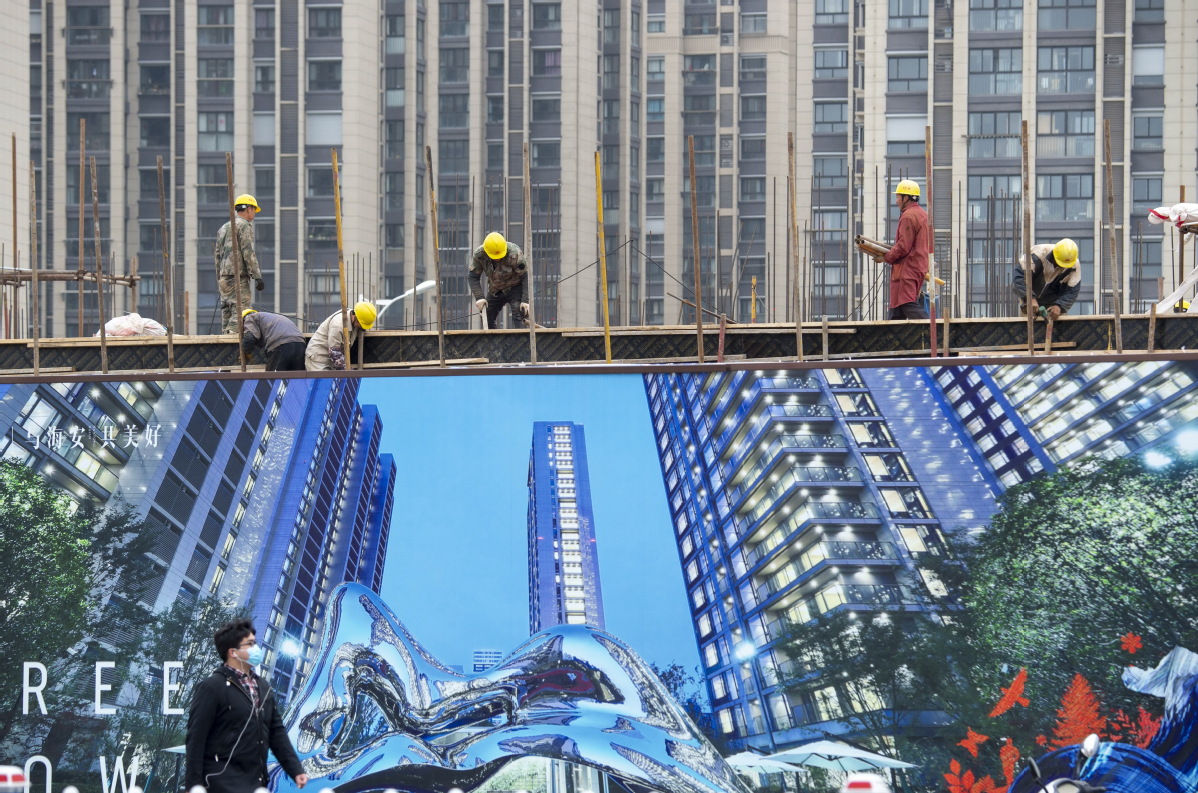

The area of newly started housing projects in the country decreased by 7.7 percent year-on-year from January to October, and the area of land purchased by real estate enterprises decreased by 11 percent.

Some argue that the bankruptcy of the real estate enterprises will make the Chinese economy self-defeating and shut down an important engine of economic growth.

However, it should be seen that this mode functions at the cost of the continuous accumulation of debt leverage. The risks generated by continuing to rely on this model to maintain growth and employment under the old economic structure will be far greater than the so-called benefits.

It's a self-reinforcing pattern. In order to promote GDP growth, some local governments actively use credit to carry out urban infrastructure construction, so that when land prices rise they use the increasing income from land sales to repay loans.

These practices create the false impression that house prices will rise forever, which necessarily increases the backlog of debt and the risk of default in the downward cycle.

The continuous investment in real estate and infrastructure stimulates cyclical over-investment in the traditional heavy industries, which squeezes other investment and accumulates a large amount of excess capacity and debt risks.

The debt ratio of the residential sector is already as high as 72 percent, and the real debt ratio of urban residents may be even higher if the difficulties rural residents face in borrowing money is taken into account. As they lack collateral and stable employment, banks are unwilling to lend to them.

Unlike Western countries, which magnify the wealth effect and stimulate consumption with the rise of housing prices, China's rising housing prices and the rise in household debt ratio advance simultaneously, resulting in a large amount of capital flowing into the real estate market, which restrains consumption.

This mode proved its unsustainability in Japan in the 1990s, where the government debt continues to snowball to this day.

It is necessary for the central government to promote scientific and technological innovation, and green technology development, and increase investment in new infrastructure.

The country needs to gradually wean itself off its dependence on infrastructure and real estate investment and achieve a "soft landing" of the property market.