Alibaba carries out second buyback in year

By HE WEI in Shanghai | China Daily | Updated: 2022-03-23 09:43

E-commerce giant Alibaba Group Holding Ltd said on Tuesday it expanded its share buyback program to $25 billion from $15 billion, as it emphasized "confidence in the company's continued growth".

The increase-the second such move in less than a year-came as shares tumbled amid a flurry of global issues and following Beijing's enhanced antitrust supervision over tech companies more than a year ago.

As of Friday, the company has purchased 56.2 million American depositary shares under the previously announced buyback program of $9.2 billion, the company said in a statement.

The largest buyback in Alibaba history will run for two years through March 2024, and the board has authorized the program, according to the company.

"The upsized share buyback underscores our confidence in Alibaba's long-term, sustainable growth potential and value creation," said Alibaba Deputy Chief Financial Officer Toby Xu in a statement.

"Alibaba's stock price does not fairly reflect the company's value given our robust financial health and expansion plans," he added.

During a share repurchase program, a company buys back its own shares from the marketplace, shrinking the number of outstanding shares.

As of Feb 28, Alibaba had about 21.5 billion ordinary shares issued and outstanding, so the repurchase equates to around 2 percent of the issued share base.

The expanded buyback is among the largest shareholder-reward programs in China's internet industry, and it came on the heels of Beijing's latest efforts to shore up market confidence and support the economy.

Last week, the State Council's Financial Stability and Development Committee said positive progress had been made regarding US-listed Chinese companies amid continued smooth communication between Chinese and United States regulators.

The two parties are dedicated to reaching a concrete cooperation plan. The Chinese government continues to encourage Chinese firms to seek overseas listings, and maintains its support for those Chinese enterprises already listed abroad, said the committee.

"We stay 'overweight' on China on well-anchored growth expectations or targets, easing policy, depressed valuations or sentiment, and low investor positioning," Goldman Sachs Group Inc strategists wrote in a note.

Hong Hao, managing director and head of research at BOCOM International, said that the US stock market still remains a very important platform for Chinese tech companies to finance their growth.

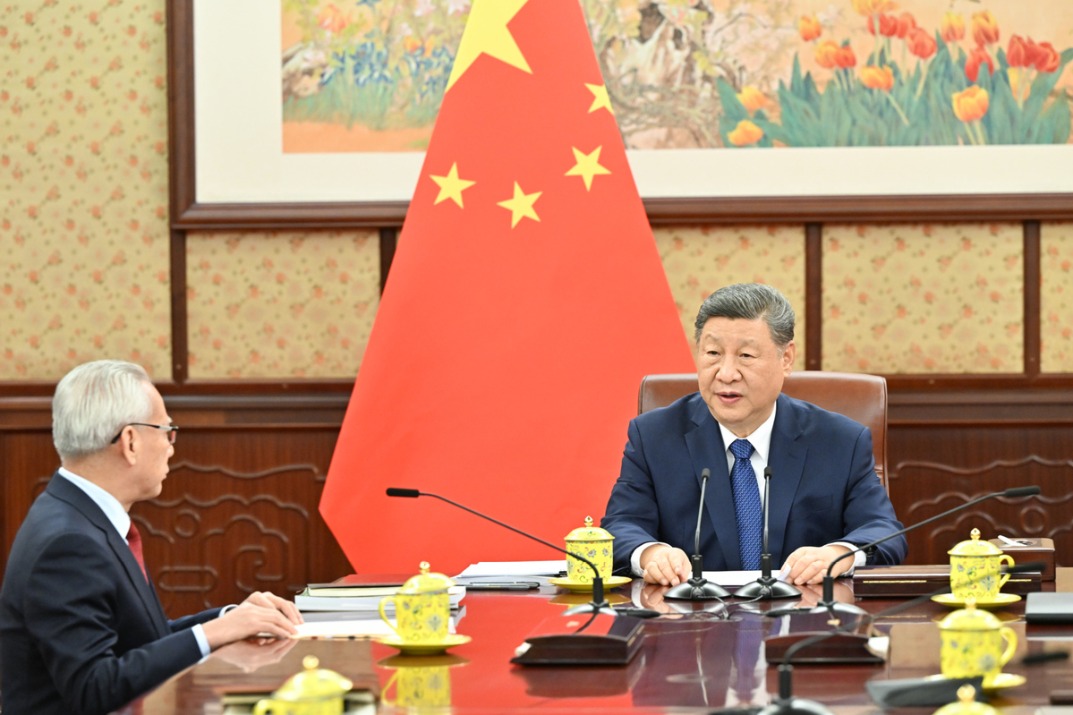

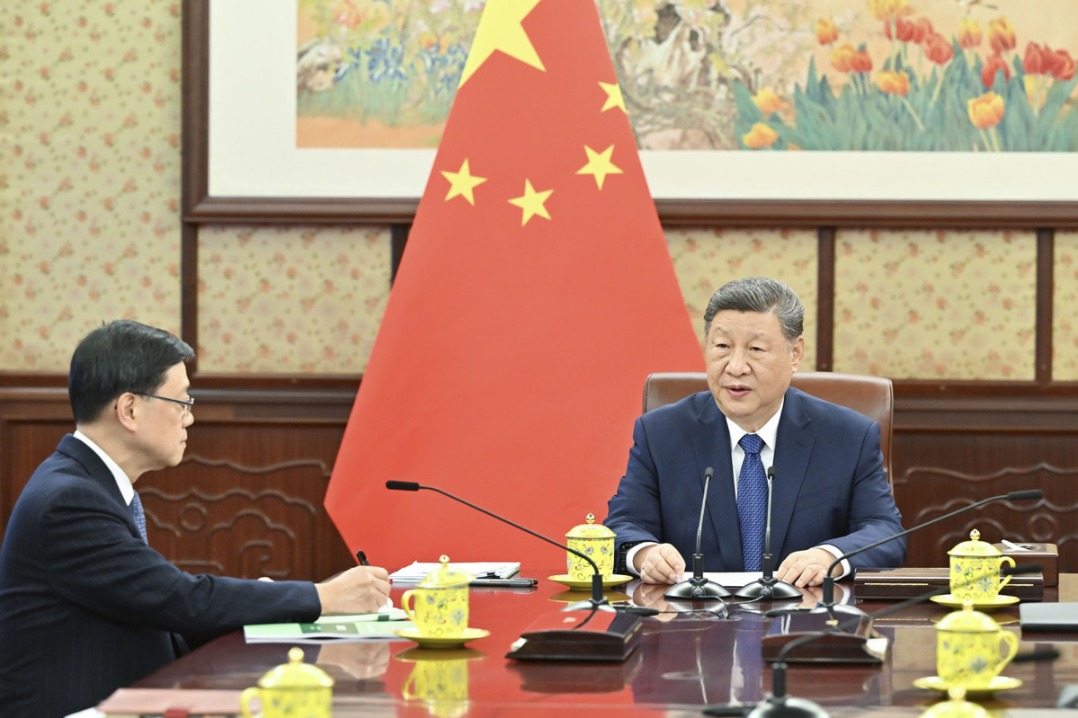

Meanwhile, China will balance incentivizing and regulating the "platform economy" to bolster its healthy development over the long term, and the governance of the platform economy should abide by the principles of market orientation, rule of law and internationalization in a stable manner, it was decided at a recent meeting chaired by Vice-Premier Liu He.

The buyback "signals where company management sees value, and it may also be a bellwether for where they see regulatory action. Perhaps we are coming closer to the end of it," Justin Tang, head of Asian Research at United First Partners in Singapore, told Bloomberg News.

Meng Lei, a strategist at UBS Securities, said the implementation of the above government signals will influence short-term market performance and foreign investors' trading moves.

"If Chinese and US regulators can come to a consensus regarding cross-border auditing supervision, recent foreign investor withdrawals from US-listed Chinese companies can be reversed," Meng said.