Reimagining business via digitalization

By Ralph Hamers | chinadaily.com.cn | Updated: 2022-03-25 14:26

Digitalization is often described as a trend — one happening across many industries and locations, but a trend nonetheless. This suggests digital transformation is a line of development, a currently popular growth method that may one day be replaced with the next best thing. But, in reality, digitalization is much bigger than that. It's the only way forward.

Let me give you an example.

Development of new sectors of the economy such as consumer, healthcare, education and information technology is a big component of China's national strategy. This will involve a significant wealth shift — a move away from manufacturing toward a services-led growth model. And that will mean a huge uptick in new economy entrepreneurs and institutions.

A digitalized financial firm

These entrepreneurial and institutional clients have very specific needs. They need access to capital markets which large financial institutions can provide. They need to get financial advice on-the-go and with regular updates. They need to transact money or process loans quickly and from whatever device they have on hand. They need to be matched with potential investors and opportunities before they even know where to look for them. In short, they need services that can only be provided by a digitalized financial enterprise.

That is a huge opportunity. Currently, China's services sector represents only about 52 percent of GDP, compared with countries such as the US where it represents about 87 percent. So it is set to grow, by a lot. Any global financial enterprise that ignores the needs of these new sectors of the economy and doesn’t make efforts to evolve its business and operations to meet them will lose out both in terms of current clients as well as potential ones.

This is just one example of a change that is occurring globally. Many sectors, including banking, are embarking on a digital revolution. The goal is to re-imagine what they do using cutting-edge digital technologies to change their business models and capture new opportunities and revenues.

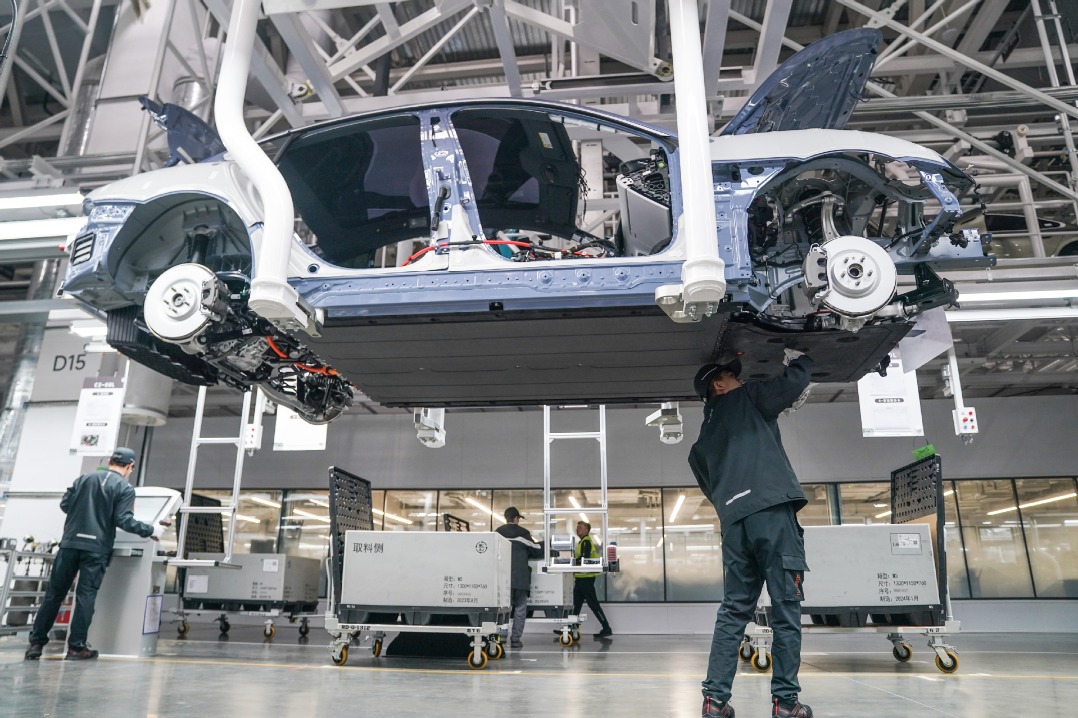

Already, we are seeing signs of digital transformation across industries. Crop production is becoming increasingly automated. Healthcare is using big data to support better integration of medical services and insurance products. And the financial sector is using cloud technology, blockchain, artificial intelligence and robotics to become more efficient and better serve clients.

Business models coping with a new normal

Since the onset of the COVID-19 pandemic, these changes have become absolute necessities. Business models are shifting to cope with a new normal. Global supply chains are being disrupted. Inflation is rising. And both investors and consumers are hesitant, lacking confidence when faced with the uncertainties of the future.

No wonder consultants predict that by 2024, more than 50 percent of all IT spending will go directly into digital transformation and innovation — that’s up from 31 percent in 2018. All of this means, that change is happening fast. And we are likely to see more digital transformations, and at a much faster pace, over the next decade than we witnessed in the previous 100 years.

So what are the tools enabling this transformation?

One is the worldwide rollout of 5G. China, the United States and much of Europe are already enabled. As more and more people are working from home for lengthy periods, reliable connectivity and more bandwidth have become vital to continued, effective operations at many companies.

Massive increase in mobile payments

The shift to using mobile devices is another tool that has fast forwarded many digital trends. In the financial sector, for instance, mobile payments have increased significantly. Also, more clients are using mobile advice and portfolio management platforms, and, in general, there is an expectation that certain processes, such as loan or mortgage approval, be accessible through mobile devices.

There are more than 5.2 billion unique mobile phone users worldwide, and 79 percent of them made at least one mobile payment in the past six months. Global digital payment users reached 3.8 billion in 2021, with total payments amounting to about $6.68 trillion (more than 50 percent of the payments market), according to Statista. And according to GSMA Intelligence and Square, mobile payments are expected to reach $8.94 trillion by 2027.

AI is another tool that will play a bigger role in the world of lending and financial services. By using AI and custom machine-learning models, lending institutions will be able to create new opportunities for a wider range of consumers. We’ve already seen the speeding up of loan processing and approval time. At UBS, for example, since introducing digital Lombard loans in July 2021, more than 2,400 clients in China’s Hong Kong, Singapore, Switzerland and Germany have been using this feature, covering $5.3 billion of outstanding loans.

In addition, chatbots and virtual assistants are being used to facilitate increasingly complex client conversations, and cloud computing is being adopted by banks and other industries to provide more flexible, scalable and cost-effective opportunities.

For financial institutions, the transition to digital is more than just an enabler. It’s a differentiator, a true competitive advantage. At UBS, we know that clients today are used to things being personalized, relevant, on-time and seamless, similar to their experience with platform companies.

They expect that from their financial services as well. There’s even a whole group of next-generation clients that doesn’t want to interact in the traditional way. They’re not always interested in having a conversation with an adviser but prefer to get advice through digital platforms. Developing our digital channels will provide us with access to a new set of clients.

It’s clear that hybrid working arrangements are set to continue. Many industries, including the finance industry, have proven that employees can be just as, if not more, productive working from home. For example, at UBS, we expect about one-third of our staff to continue working from home at least part of the time.

As we learn to live with COVID-19, hybrid working models will become the norm, and flexibility in choosing where and when to work is going to be a game-changer in terms of attracting and retaining top talents, but also from a business continuity management perspective.

Headwinds could make sailing choppy affair

However, digital innovation is not going to be all smooth sailing. Increased digitalization will mean higher exposure to cybersecurity and data breaches.

Already, since the onset of the pandemic, there’s been a massive rise in cyberattacks on banks and on cloud servers. We have seen global disruptions in the supply of certain products in recent months, and this will likely increase as geopolitics become more and more volatile. With fewer employees working onsite on the same secure network, companies need to beef up their networks and take measures to better safeguard their cybersecurity, making sure home networks and mobile work-from-home devices are covered.

That said, this is also an opportunity. Take, for example, physical and behavioral biometrics. This solution is coming of age as the next big step for cybersecurity. By investing in these new technologies, companies can better protect their businesses while creating seamless interactions with their clients.

Analysts at UBS (Q-series) estimate that cybersecurity spending in the Asia-Pacific region could reach $35-45 billion (up from $23 billion), as it catches up to be more in line with the US and global averages.

Keeping up with compliance and regulation will be another challenge. Compliance costs are likely to increase as companies invest in cybersecurity and managing data privacy. And companies could face significant fines for data breaches as regulators clamp down. While increased regulations are good, because they will align markets with best global practice, the cost of compliance and building infrastructure to cope them will be a challenge.

Overall, UBS analysts found three trends resulting from increased regulations: Regulations across the US, the European Union and the Asia-Pacific are largely in line with each other, but the level of enforcement is lower in the Asia-Pacific; where enforcement has happened, the remedies have been similarly applied on a global basis; and China and increasingly the rest of Asia, have been the first to introduce sector-specific rules and penalties to rein in digital platforms. We expect this to become a global norm over time.

Currently, the speed of digital transformation is far outpacing the headwinds. The severity and longevity of the pandemic has had a dramatic impact on global supply chains, on how we work, on how we do business, on how we manage our health, our finances, even on how we eat.

One thing is for certain: our world and how we interact with it are changing — in ways undreamt of even a decade ago. The need for digital innovation isn't going away. Industries are being presented with a very clear choice: either disrupt yourself and change or accept the fate facing all things that refuse to evolve. And I believe the first option is better.

The author is group CEO of UBS.

The views don’t necessarily reflect those of China Daily.