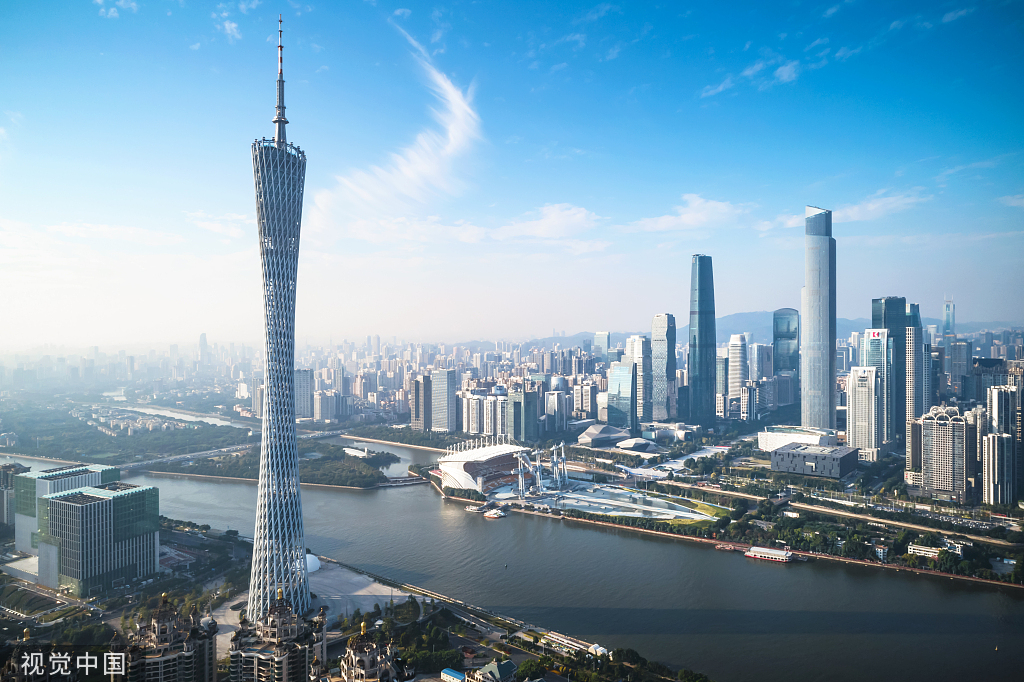

Pilot financing move expands in Guangdong

By QIU QUANLIN in Guangzhou | China Daily | Updated: 2022-06-09 09:29

Fresh program to facilitate overseas lending for more innovative firms

A pilot program on facilitating eligible high-tech enterprises to borrow money from overseas has been expanded to the entire Guangdong province, according to sources with the People's Bank of China, the central bank.

High-tech enterprises, along with "specialized, sophisticated, distinctive and innovative" companies included in the pilot program in Guangdong, an economic powerhouse in South China, will not be restricted by the scale of their net assets, according to the sources.

The amount of foreign debt such enterprises can independently borrow will be increased from the previous $5 million to $100 million, helping further facilitate small, medium-sized and micro high-tech enterprises to make full use of international capital.

Earlier, such a pilot program only targeted enterprises in nine cities in the Guangdong-Hong Kong-Macao Greater Bay Area, which include Guangzhou, Shenzhen, Foshan, Zhuhai, Dongguan, Huizhou, Zhongshan, Jiangmen and Zhaoqing.

The expansion of the program followed a circular issued by the State Administration of Foreign Exchange in late May on supporting high-tech enterprises and specialized, sophisticated, distinctive and innovative enterprises to carry out cross-border financing services.

According to the circular, the program will be expanded to the provinces of Jiangsu, Shandong, Hubei, Guangdong, Sichuan, Shaanxi, Zhejiang, Anhui, Hunan and Hainan and the cities of Beijing, Chongqing, Tianjin, Shanghai, Shenzhen, Qingdao and Ningbo, covering 80 percent of the country's high-tech and "specialized, sophisticated, distinctive and innovative" enterprises.

The pilot program was first introduced in early 2018 in Beijing's Zhongguancun Science Park to allow cross-border funding by eligible small and medium-sized high-tech firms.

Expansion of the program is expected to help domestic institutions, especially small and medium-sized enterprises and "specialized, sophisticated, distinctive and innovative" companies, to raise funds through multiple channels and ease their financing strain amid the COVID-19 pandemic, according to the SAFE circular.

The program will also help improve the high-quality economic development of Guangdong, as high-tech enterprises with small net assets are allowed to borrow foreign debt at the initial stage of growth, which is conducive to enterprises in reducing financing costs and increasing investment in research and development, according to sources with the PBOC.

Enterprises may apply to local foreign exchange bureaus for foreign debt signing registration with an application form, a copy of a business license and other materials, and then carry out cross-border financing business at financial organizations.

Guangdong will further expand enterprises' cross-border financing channels and support eligible high-tech and emerging tech companies to carry out trials on the facilitation of foreign debt quotas, according to a policy package of 131 specific measures to further stabilize the economy, which was issued in early June by the provincial government.

Pan Gongsheng, vice-governor of the PBOC, said it used to be difficult to raise funds from abroad for small and medium-sized high-tech enterprises due to their small net assets.

"Therefore, we have issued a special policy, which is not calculated according to the net assets of these enterprises, but to give a certain amount in which enterprises can independently borrow foreign debt," Pan said during a news conference in early June.