Washington uses dollar to maintain global hegemony

By Benyamin Poghosyan | China Daily | Updated: 2022-09-15 08:23

Since the establishment of the Bretton Woods system in 1944, the US dollar has been the global reserve currency. Even when the United States terminated convertibility of the dollar to gold, effectively bringing the Bretton Woods system to an end and making the greenback a flat currency, the dollar's global hegemony continued.

Since 1971, the dollar's hegemony has been based mostly on one fact: almost all commodities in the world, especially oil, are traded in the dollar. Despite the growing economic problems of the US, including the stagnation of the income of the middle class, increasing inequality, and the ballooning of the country's national debt, the US has maintained its position as the largest economy in the world with high per capita GDP.

The collapse of the Soviet Union and the end of the Cold War ushered in a new era of US hegemony. In the 1990s and the 2000s, thanks to its economic and military power, the US adopted an assertive and aggressive foreign policy of "promoting democracy" across the world marked by NATO's bombing of Serbia, American invasion of Afghanistan and Iraq, and the destruction of Libya.

However, the 2008 global financial crisis marked the beginning of the end of the US' absolute hegemony. The US' decline and "the rise of other economies", primarily China, but also Russia, India and Brazil challenged American primacy. The establishment of new international organizations and groupings, such as the Shanghai Cooperation Organization, BRICS and BRICS-plus has created new platforms to help establish a multipolar world.

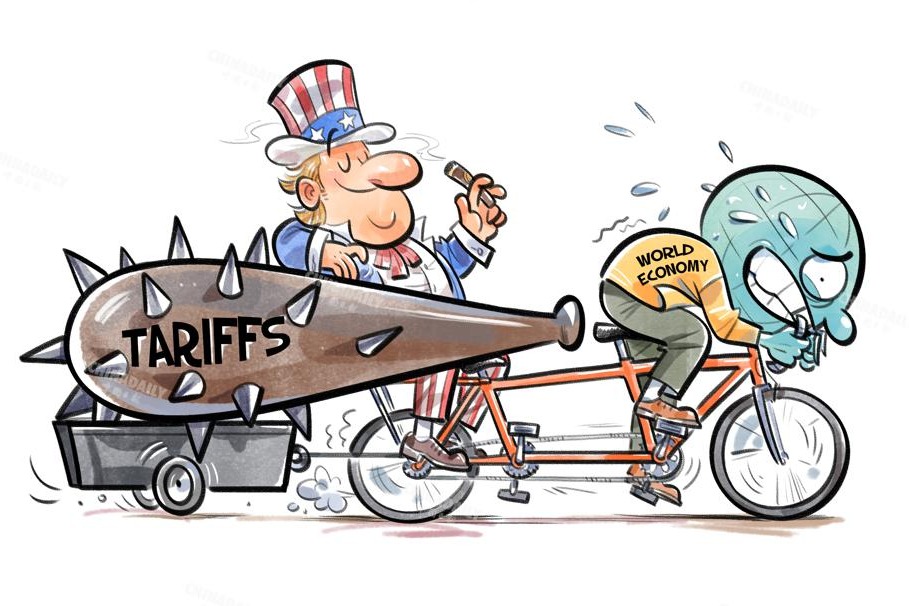

But as the US started facing growing competition from other centers of power, it decided to exploit the role of the dollar as a global reserve currency in a bid to contain the rise of other countries and maintain its hegemonic role worldwide.

To achieve its goals, the US used economic sanctions against other economies. The critical tool for the US was the introduction of the so-called "secondary sanctions", which targeted not only specific countries and companies but also third-party states and organizations. Using the dominant position of the dollar in the international market, the US threatened to exclude some countries and companies from the international financial system if they did not follow Washington's policies and diktats.

The first victim of this policy was Iran, which faced severe US economic sanctions. Now the US is using sanctions against China, particularly against Chinese telecommunications companies, such as Huawei and ZTE, which are significant competitors for US information and telecommunications technology giants in such areas as 5G networks and artificial intelligence.

Since February, the US and its allies and partners have imposed severe sanctions on Russia. Here again, the US exploits the role of the dollar as a global reserve currency, excluding Russian banks from international financial markets, and using secondary sanctions as a primary tool to force other countries to follow its rules and policies.

But since the economic situation of the US continues to deteriorate and the country's economy needs the injection of significant financial resources to stay afloat, the US Federal Reserve implemented an aggressive policy of interest rate hikes, thus stimulating the significant flow of capital from European and Asian markets to the US.

This policy resulted in a significant devaluation of many countries' currencies including the euro, which reached its lowest level in the last 20 years. The US' aggressive financial policy triggered significant inflation in many countries, causing widespread economic disruptions and a rise in poverty, especially in the developing world.

However, as the US government has been more often using the dollar as a primary tool to safeguard its geopolitical interests and contain the rise of other economies, the trust in the dollar is declining, and many developing countries have been trying to abandon the dollar as the primary currency for trade.

While China and Russia have started using the yuan and ruble as mediums of exchange in bilateral trade, Saudi Arabia is considering using the yuan as a negotiable instrument in its oil trade with China. And Egypt has decided to issue yuan-denominated bonds.

Also, countries such as India and Iran are discussing the possibility of using their national currencies in regional and international trade. This means that despite the dollar still being the most common global reserve currency, the process of de-dollarization in global trade has accelerated. Incidentally, the US policy of using the dollar as a tool of economic coercion and geopolitical confrontation significantly accelerated this process.

The post-Cold War order will result in the establishment of a truly multipolar world and the end of the US' absolute hegemony. It could also mark the end of the position of the dollar as the leading and strongest global reserve currency.

The author is chairman, Center for Political and Economic Strategic Studies, Yerevan, Armenia.

The views don't necessarily reflect those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.