All amped-up and ready to go

By LI FUSHENG | CHINA DAILY | Updated: 2023-04-24 07:11

International auto parts suppliers charged with enthusiasm at developments in China's market

Global auto parts suppliers are planning to scale up their business in China, as smart and electric vehicles are developing rapidly in the world's largest vehicle market.

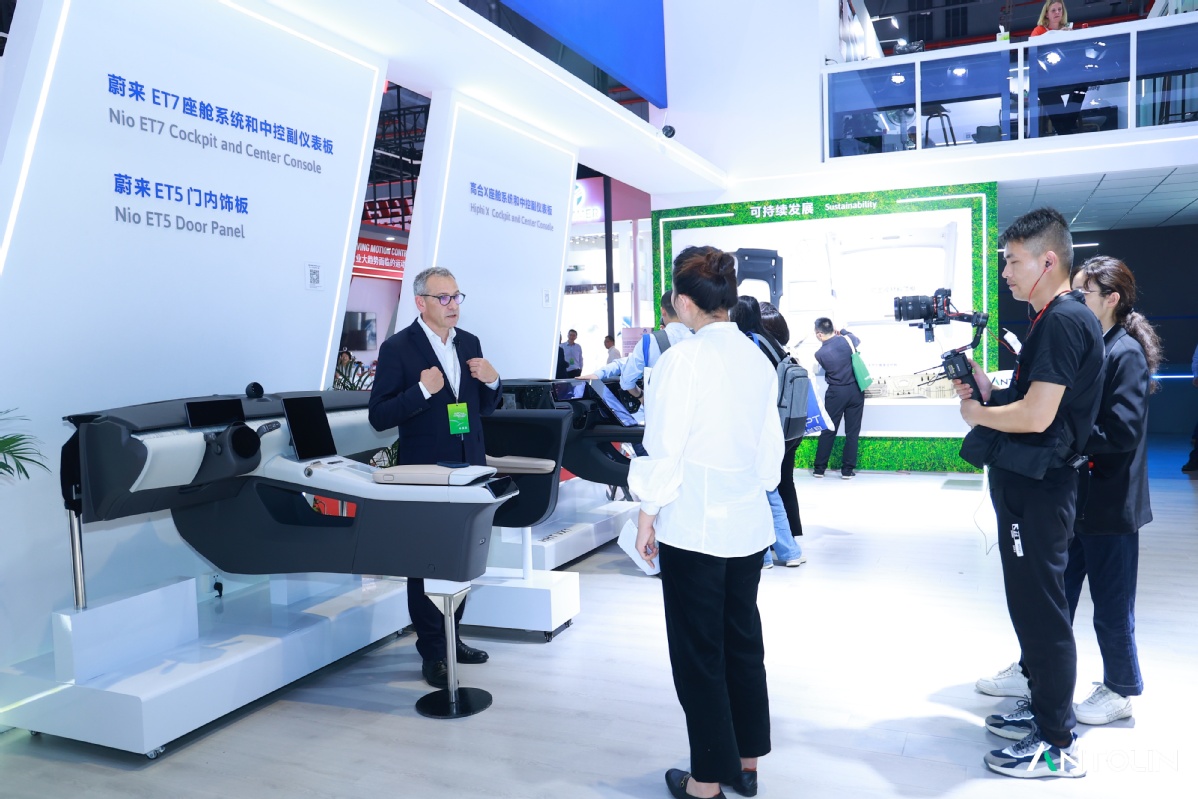

Antolin, one of the world's leading names in the car interiors market, has shown its technologies and resolved to grow its presence in China at the Shanghai auto show.

Its exhibits include a vehicle access system as well as a smart sliding floor console at the biennial event that runs from April 18 to 27.

"Forty percent of the electric vehicles produced in 2022 worldwide had some Antolin products. So Antolin is part of the new technology, of the new electric mobility in the world," said company CEO Ramon Sotomayor.

"We want to double our presence in terms of sales in China. And we think we can do that because the market is growing significantly, because we have a strong position that allows us to be close to all the OEMs (original equipment manufacturers) in China," he said.

Growth in China is crucial to its plan to raise the proportion of its global revenue coming from Asia to 20 percent, up from 16 percent now.

"I think we can do more in China. We will invest more in China. We will strengthen our position in China, not only with our production footprint, which we will, but also with our engineering capabilities," said Sotomayor.

Antolin entered the Chinese market in 2003 and has since expanded its local footprint. It now has 25 plants and three technical centers in the country, employing more than 3,600 people.

Forvia, which was created based on the merger of Faurecia and Hella around a year ago, expects to draw on the long history of the two companies' presence in China to boost their business in the country.

With localization as one of its strategies, Forvia has forged a very strong relationship with more than 40 major car manufacturers in China, including global and Chinese local brands.

Faurecia and Hella combined have more than 28,000 employees at more than 80 production and research and development facilities in more than 30 cities in the country.

Patrick Koller, CEO of Faurecia, said: "Both companies have more than 30 years of history in China. So Forvia has a strong and lasting relationship with the market. We are looking forward to inspiring mobility with OEMs in China."

For Forvia, China is leading the transition addressing megatrends in electrification and automated driving, and the company said that Chinese carmakers are playing an increasingly important role in the global automotive market and demonstrating strong growth potential.

Statistics show that Forvia's first-quarter sales this year in China reached 1.07 billion euros ($1.18 billion), representing an organic growth of 15.2 percent year-on-year.

The company said its growth is mainly driven by its lighting and seating business, with its clients primarily Chinese carmakers including BYD.

Likewise, French auto parts supplier Valeo "has always placed China in an important development position and will continue to increase investment in China," said Gu Jianmin, chief technology officer of its China operations.

China is Valeo's largest single market, representing 18 percent of the group's sales in 2022.

Last year, the company identified four strategic directions in its business plan: electrification, advanced driving-assist systems, interiors and lighting.

These are at the center of the evolution of the automotive industry in China.

Valeo China CEO Zhou Song said the company saw its sales in 2022 grow 7 percent year-on-year, outperforming the market.

German auto parts supplier Brose is expecting its business in the country to account for one-fourth of its global total by 2025, said CEO Ulrich Schrickel.

"Most of our business (in China) was from international OEMs years ago. Now, we have changed that.

"We will have at least one-third (of our local business) from Chinese OEMs by around 2027," he said.

The fast-changing and growing Chinese market is expected to boost Brose's business, which has been growing at 6 percent over the past three years.

In 2023, its turnover in China is expected to reach 1.3 billion euros and the figure is expected to grow to more than 2 billion euros in 2027, Schrickel said.

The company's global turnover is forecast to grow from 7.5 billion euros to more than 10 billion euros in 2025.