Time to shed anxiety, embrace new investment philosophy

By Shi Jing | China Daily | Updated: 2023-08-14 09:26

I've been reporting on China's capital market for several years now, and I can almost instinctively sense it when anxiety grips A-share retail investors. I can sense it now. But this time around, it's a different kind of anxiety. I can sense that too.

Typically, investors turn anxious when there's a sense of impending gloom or doom. But now, they seem to be anxious that what should have been a long-term bull run by now is still nowhere in sight.

COVID-19 control measures were optimized in December, followed by supportive government policies. Economy has been recovering against odds. Yet, China's major stock indexes don't indicate bulls have been on the rampage, despite the bounce in late July. What gives?

Well, I can theorize that in the era of COVID-19 and big data, market veterans wouldn't like to act in a hurry either way. Sudden surges or dives are a thing of the past. If you recall, recovery from the impact of COVID-19 on the market sentiment took its own time.

China's stock market is faced with a rising number of challenges that seem to heighten existing complexities and uncertainties. For instance, the protracted Russia-Ukraine tensions have been taking a heavy toll on commodity prices. Soaring inflation may lead to possible economic recession in major economies.

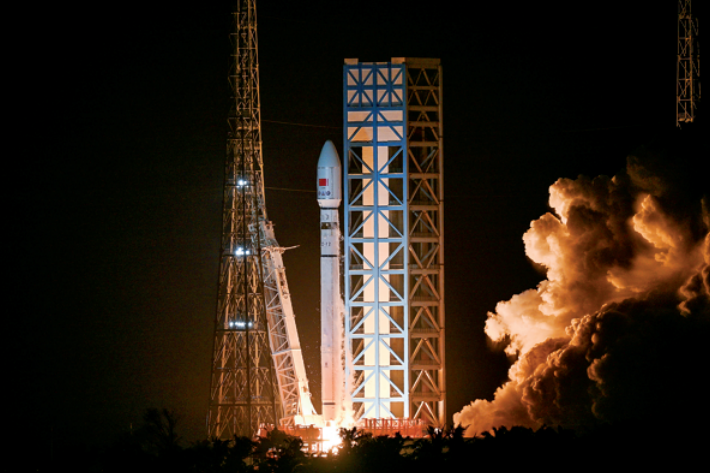

Another key factor is China's economic transformation. Since 2017, focus has shifted from growth rate to high-quality development. The improvement in overall innovation capability, industrial capacity and sustainable development has been phenomenal.

But, the impact of the three-year pandemic seems to be so overwhelming that people tend to overlook or forget the transition, which the pandemic has slowed down. Combined with other black swan or grey rhino cases over the past three years, the pandemic impact has served to underline that economic restructuring may be more "painstaking" than we had imagined.

Peter Thiel, the legendary founder of Paypal and a veteran investor, wrote in his bestselling book Zero To One that the process of innovation is more time-consuming and requires more efforts than normal. But it's the best way for companies to make profits. The process from "one to n" is easier, as it's simply about replicating what has been achieved during the "zero to one "process, which we call innovation.

I'd argue the same rule applies to economic growth. As China now prefers innovation to play a bigger role in its growth, more time should be allowed for that process because healthy and sustainable growth is the only way to a long-term bull run.

Thiel's take on his business practices appears to be in line with the basic macroeconomic theory: Solow growth accounting equation. It states three major variables affect an economy's GDP growth: labor, capital and technological progress.

After years of rapid development, China's competitiveness in terms of lower labor cost is decreasing, which is complicated by an aging nation. The function of capital investment is also weakening marginally, given the economy is getting larger. In this context, technological progress or innovation should get the spotlight and make a bigger difference.

Given all these factors, retail investors should rest assured the long-term outlook is positive, for China is definitely progressing on the right track. Its long-term development goal reflects an investment philosophy: stick to emerging industries and invest in companies that are technologically advanced.

Over the past few years, some retail investors may have gotten used to reaping short-term profits from a stock's fluctuations. Mind you, that requires more time and efforts than normal. Now, in the post-COVID-19 scenario, however, retail investors do not seem to have that kind of time to monitor the market ups and downs during work hours. Worse, these days, asset management firms, which command market-moving ability, leave short-term investing to algorithm-powered trading software.

All in all, now is probably the best time for retail investors to align with the country's growth pace and development focus, and transition to a new investment philosophy: make long-term, value-oriented investments.