Time to revisit economic rationale for industrial policy and subsidies

By Zhao Zhongxiu | CHINA DAILY | Updated: 2023-11-08 07:35

The global economy has reached a new critical juncture, where techno-nationalist industrial policies are regaining popularity, while de-risking and the fragmentation of global value chains seem to be the unfolding reality. At this point, we need to revisit the economic rationale for industrial policy, from the triple perspective of theory, history and policy.

The developed world, particularly the United States, used to favor laissez-faire over government intervention and aggressively promoted the free market doctrine, better known as the "Washington Consensus", among developing countries. Free-market advocates often dismiss the necessity for industrial policy, citing information barriers and potential rent-seeking as powerful arguments against it.

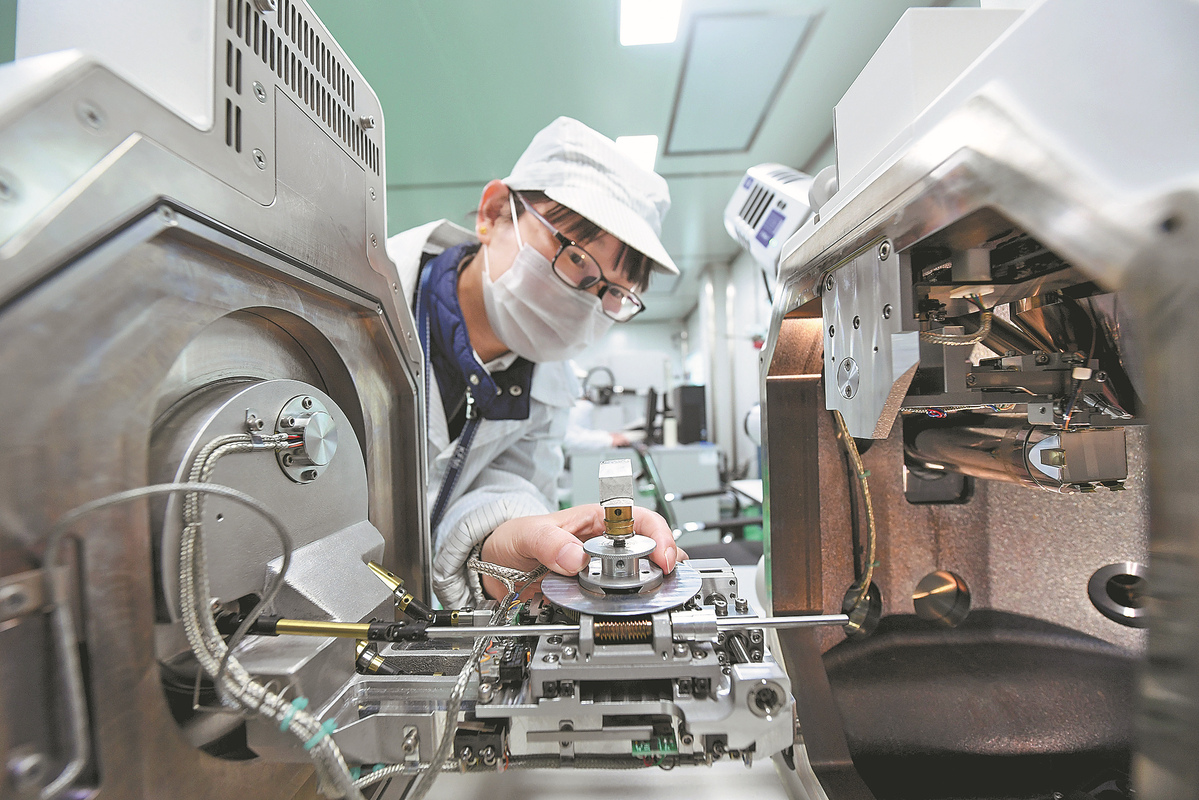

However, in the face of the intensified competition for technological supremacy and increasing geopolitical complexity, and in order to address a variety of issues — competition with China, resilience of supply chains and green transition — there has been a self-conscious resurgence of industrial policy in the developed world in recent years, most notably industrial policy toward the semiconductor industry (as exemplified by the Chips and Science Act in the US, and the European Chips Act in the European Union).

Through techno-nationalist semiconductor industrial policies, primarily in the form of direct subsidies and tax credits, all major developed economies in the world have been pushing for the "reshoring" of advanced chip manufacturing capacity, as well as the localization or friend-shoring of their respective semiconductor supply chains.

While this process is still unfolding, the following phenomenon is already emerging: the global race among countries has led to the fragmentation of the global semiconductor value chains and markets, which in turn may result in halting innovations, increasing overcapacity and underutilization, and global technological bifurcation. It could even jeopardize the highly efficient business and innovation model of the semiconductor industry that has been operating on the basis of delicate specialization along the semiconductor GVC.

Poor industrial policy can stifle innovation, result in misallocation of capital, give rise to inefficiency, intensify market concentration and distortion, and waste valuable taxpayers' money. To economists, it has been of much interest to explore and identify, both theoretically and empirically (historically), the conditions (necessary and sufficient) under which the industrial policy can achieve its objectives, policy implementation can be made more efficient and welfare-enhancing and Pareto-improvement can be achieved.

In recent years, there has been a revival of scholarly interest in industrial policy (for a recent sample, see Willy C. Shih's September article in Harvard Business Review), and a substantial body of research has emerged that offers more robust empirical evidence on the functioning and impacts of industrial policy (for a review, see National Bureau of Economic Research Working Paper 31538). This literature improves on the earlier empirical work, which was plagued by causal ambiguity and interpretational issues, and offers in general a much more positive take on industrial policy.

More importantly, it provides a more nuanced and contextualized understanding of industrial policy, enabling economists to engage more productively in debates on the subject in a way that adds light rather than heat.

In a nutshell, while the early literature on East Asia's experience was sharply divided, more recent studies tend to demonstrate more convincingly that certain types of industrial policy have been quite effective in driving structural change in countries such as Japan, the Republic of Korea and China.

However, these success stories are highly contextualized and sensitive to local opportunities and constraints, particularly institutional differences, and are difficult to generalize out of context, tending to call for a broadly strategic and dynamic approach to the industrial policy practice.

Moreover, recent studies, too, tend to suggest that the debate on industrial policy should probably focus on how (how should industrial policy be implemented), rather than whether (whether governments should adopt industrial policy).

On the more practical policy side, various financial incentives, especially industrial subsidies, have been the major tools for implementing industrial policy. Amid the recent resurgence of techno-nationalistic industrial policy worldwide, the ramping up of subsidies by some of the world's largest economies has contributed to the significant increase in global trade tensions, raising concerns over the potential for subsidy wars — subsidy competition that leads to a race to the bottom.

However, history, especially the period preceding the conclusion of the Tokyo Round Subsidies Code in 1979, has taught us that competitive subsidization leads to mutually wasteful expenditure and a lose-lose situation, thereby reducing the overall welfare of the world. In view of past experiences, it is essential that policy advisers and policy makers review the justifications for, and limits of, industrial subsidies, as well as the appropriate subsidization procedure.

Also, it's high time major economies worked together to reach a consensus on the rules governing industrial subsidies within a multilateral framework (for example, the World Trade Organization system), so as to prevent efficiency-weakening competitive subsidization. It is widely recognized that within the WTO system, there are strict rules (the Subsidies and Countervailing Measures Agreement) governing export subsidies and import substitution subsidies, but the rules for more general industrial subsides (that is, subsidies "specific" to a company, industry or group of industries) are at best a gray area (generally permitted yet actionable if found to cause adverse effects on trade).

In short, in the face of rising industrial policies across the globe, the world (and the WTO in particular) needs an updated toolbox. Fortunately, the major economies and international organizations (such as the WTO, International Monetary Fund, World Bank and the Organization for Economic Cooperation and Development) seem to have taken note of the issues and have started to work in this direction.

The author is president of the University of International Business and Economics. The views don't necessarily reflect those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn or comment@chinadaily.com.cn.