Govt policies to aid banking sector, BOC says

By LI XIAOYUN in Hong Kong | China Daily | Updated: 2024-04-03 09:07

The central government's supportive policies are expected to gradually improve business sentiment, boosting domestic demand and laying a solid foundation for the steady development of the banking industry, Bank of China said.

The bank's operating income reached 624.14 billion yuan ($86.26 billion) in 2023, a year-on-year increase of 6.42 percent, the mainland-based lender said during a briefing on its annual financial performance, in Hong Kong on Tuesday.

Net interest income and net fee income both rose, while profit after tax reached 246.37 billion yuan, up 4.07 percent on a yearly basis, it said.

As of year-end 2023, its total assets stood at 32.43 trillion yuan, a growth of 12.25 percent compared to 2022.

Domestic renminbi loans increased by 16 percent, or 2.28 trillion yuan, while liabilities rose 12.7 percent to 29.68 trillion yuan, with domestic renminbi deposits increasing by more than 15 percent, or 2.4 trillion yuan.

While the global economic situation is expected to remain complex in 2024, the central government has proactively rolled out an array of policies aimed at stabilizing business sentiment, fostering growth and ensuring employment, which can contribute to economic recovery and the steady development of the banking industry, BOC President Liu Jin said.

"In Hong Kong, BOC will further enhance its services for both the local market and international clients, supporting the city's position as a leading international financial center," Liu added.

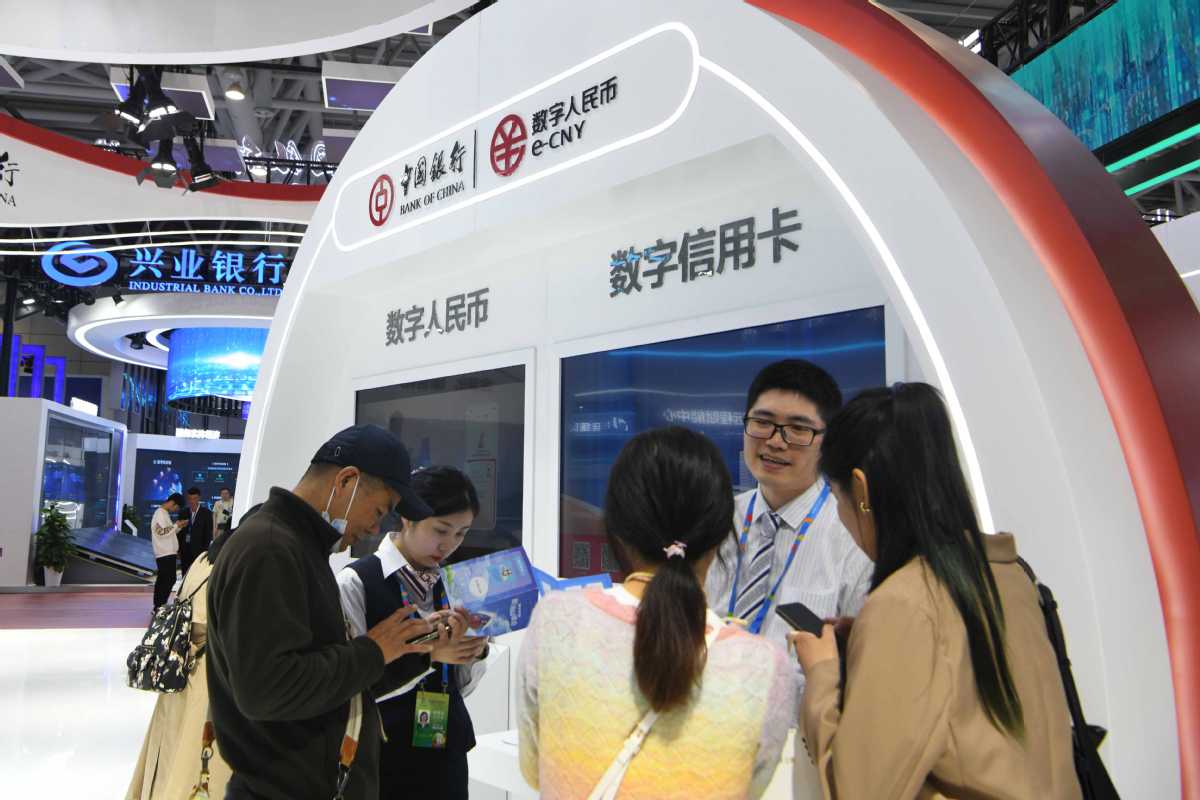

The bank will continue to ramp up efforts in technology finance, green finance, inclusive finance, pension finance and digital finance, in a bid to accelerate the development of new quality productive forces and enhance its capabilities to serve the real economy, BOC Chairman Ge Haijiao said.

"The bank has focused on directing credit toward sectors such as technology and innovation, advanced manufacturing, green development, and providing support to small and micro-sized enterprises," said Wang Yifeng, an analyst at Everbright Securities.

According to analysis by Zhongtai Securities, China's six major State-owned banks, including Bank of China, have reported growth in profits in 2023.