Capital market set for sound development

With 600m investors buying fund products, sustainability, society enter bourses' lexicon

By SHI JING in Shanghai | CHINA DAILY | Updated: 2024-04-08 07:08

Now that the first quarter of this year is history, insiders of China's A-share market are convinced the challenges and chaos that seemed daunting at the beginning of the new year remain stiff, with quick solutions appearing unlikely.

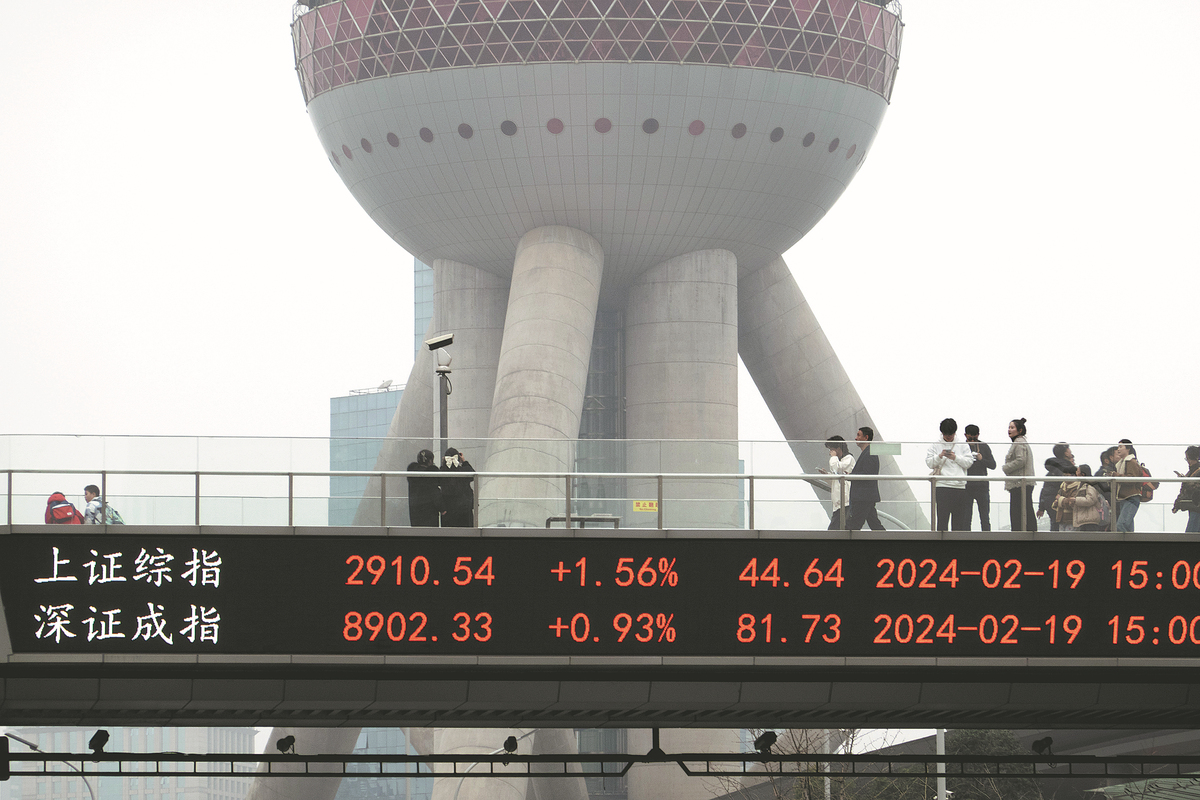

Investors' nerve was initially shaken by the benchmark Shanghai Composite Index sinking to below 2,700 points. The bumpy trading eventually ended in early February with the "national team" — mainly the sovereign wealth fund's investment arm Central Huijin — injecting more liquidity and regulators straightening up trading rules. This helped the SCI regain the psychological fulcrum of 3,000 points shortly after Spring Festival in early February.

While trading becomes active again as indexes rise, talk on the high-quality development of the A shares, on which will depend a sustained long-term bull market, has picked up heat again.

Looking back at the chaos at the beginning of the year, market mavens blamed it all on inadequate market liquidity. The collective redemption of mutual fund products due to their declining net asset value, the collective knock-in of auto-callable notes (meaning investors needed to increase investment or confront forced closing of positions for this structured product) and the closing positions for many margin trading-based products, had dragged down the SCI and seriously impaired market sentiment, resulting in panic and a sell-off.

Now, the focus has shifted to the anticipated introduction of a stock market stabilization fund.

Liu Yuhui, a council member of the China Chief Economist Forum, compared today's Chinese stock market to a "voting machine" that reflects investor confidence. The anticipated market stabilization fund, or even a simple announcement about its introduction, will likely profoundly improve investor sentiment, he said.

"When the market is jittery, the stabilization fund may not make any move at all. The fund itself serves as a symbol of bolstered confidence. People do not really care about how much money is poured into the stabilization fund. The felt solid government presence behind the fund is what investors truly value," he said.

Market entities, nevertheless, have their own expectations of the fund's corpus. CITIC Securities estimates that a stabilization fund valued between 2 trillion yuan ($277 billion) and 5 trillion yuan will be enough as such a fund usually takes up 3 percent to 6 percent of the stock market value in other mature markets.