Walmart reports strong Q3 growth

By WANG ZHUOQIONG | China Daily | Updated: 2024-11-22 09:01

Walmart Inc has delivered strong growth in its fiscal third quarter, driven by a steady performance from its membership-only store chain Sam's Club and e-commerce operations in China.

The retailer reported a 5.5 percent increase in revenue to $169.6 billion and an 8.2 percent rise in operating income to $6.7 billion compared to the same period last year.

Globally, e-commerce spearheaded the growth with a 27 percent increase.

Membership income grew 22 percent globally, led by gains in key markets such as Flipkart in India, Walmex in Mexico, and China, according to Walmart's third-quarter results report.

International sales were up 8 percent to $30.3 billion, while global revenue for Sam's Club climbed 3.98 percent to $22.9 billion.

The retailer's performance in China stood out.

Its net sales climbed 17 percent year-on-year to $4.9 billion, with comparable sales up 15 percent and net sales of e-commerce rising 25 percent, bolstered by robust growth during the Mid-Autumn Festival holiday.

Both Sam's Club and its hypermarkets saw steady gains in offline traffic, according to Walmart China.

Its net sales in the first three quarters totaled $15.2 billion, a number that is expected to exceed last year's revenue of $12 billion.

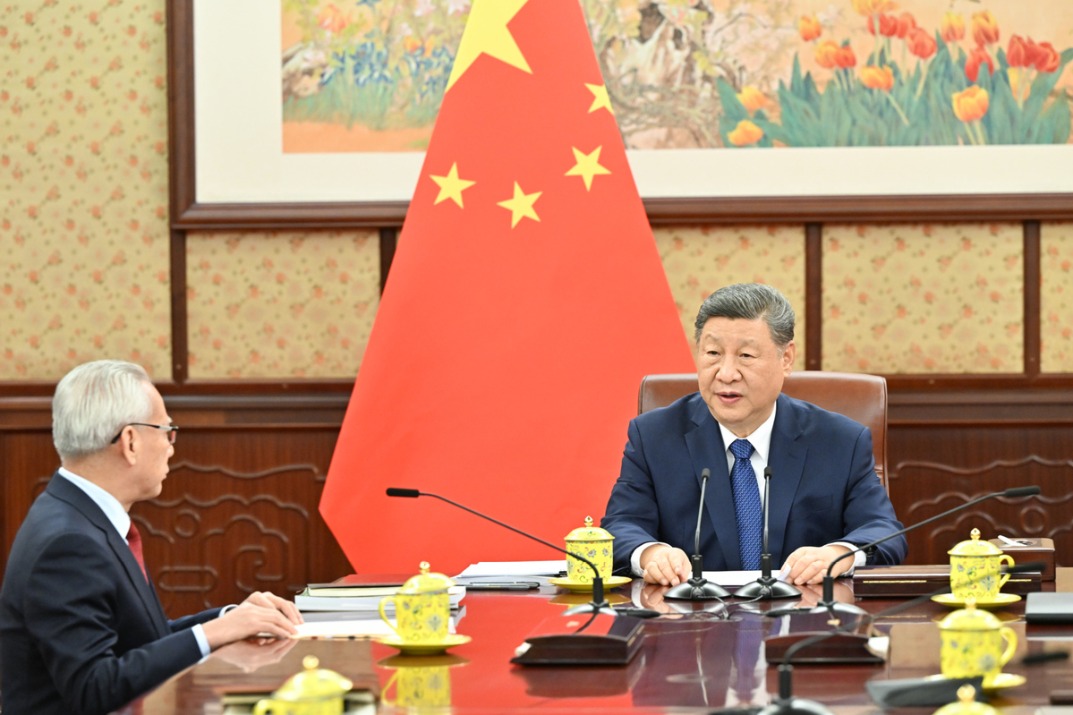

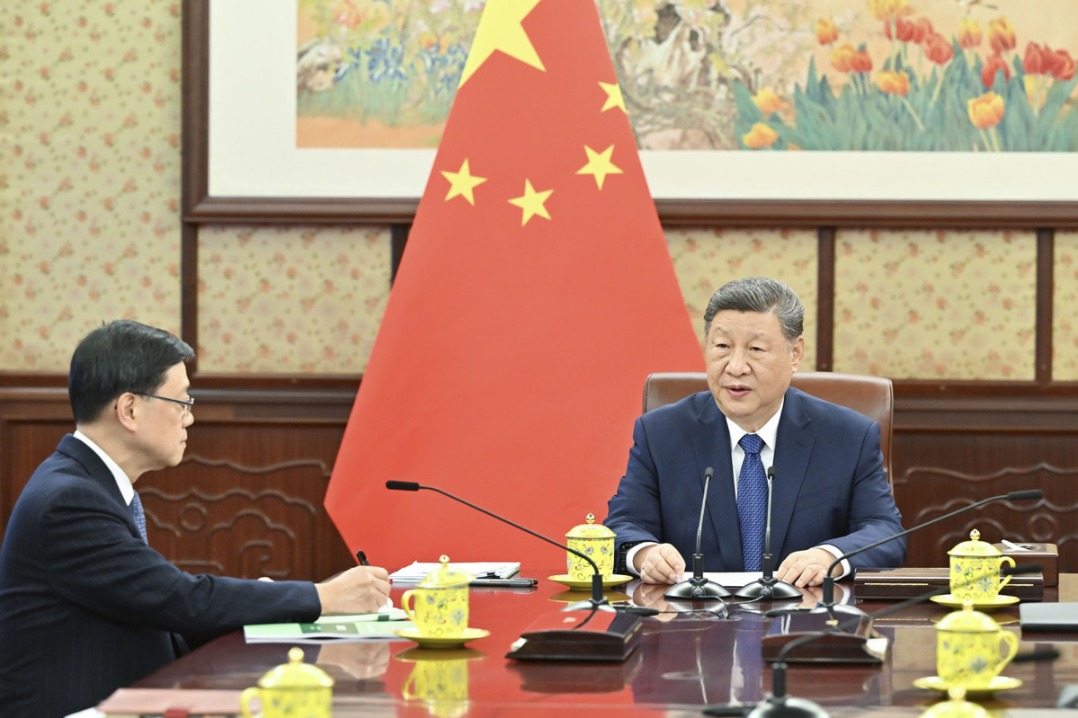

During a recent trip to China, Walmart CEO Douglas McMillon inaugurated the company's 50th Sam's Club store in the market with some 60,000 members.

"All 50 clubs are performing well, and we have more to come," McMillon said.

"About half our sales in China are digital, thanks in part to our network of over 350 club distribution points, which provide one-hour delivery service to members, extending the reach of our traditional clubs."

He said the company has learned a lot from operating around the world, and continues to learn from places like China, where social commerce, including livestreaming, is growing quickly.

John David Rainey, executive vice-president of Walmart Inc, said membership income in China grew more than 30 percent as customer numbers continued to rise.

Jason Yu, general manager of Kantar Worldpanel China, a research institute on fast-moving consumer goods, said Sam's Club has outpaced other membership store operators, thanks to its strong merchandise offerings and rapid expansion into more cities.

"The retailer's localized distribution points, which enable delivery within 30-60 minutes, now account for over half of Sam's Club's revenue in China, and are complementary to its stores."

The country's retail landscape showed steady growth during the quarter. Urban consumer goods sales were up 3.3 percent in the first three quarters, according to the National Bureau of Statistics.

Modern trade, which rose by 3.6 percent in sales in the first three quarters, continued to show a trend of fragmentation with small supermarkets and convenience stores maintaining their excellent performance, according to Kantar.

Increased consumption has been seen in lower-tier markets and Chinese consumers maintained their proximity shopping habits, according to Kantar's report.

Sam's Club's sales growth in smaller cities is significantly higher than in upper-tier cities, indicating an increasing demand for the membership store model in lower-tier markets, it said.

Another membership store operator MCG — formerly known as METRO — said its store traffic had grown nearly 30 percent this year, and the ratio of private brands has reached 70 percent, with more stores in the pipeline.

Major retailers are exploring new development strategies including premiumization, digitalization and multiformat operations.

For example, some retailers are transforming and innovating by accepting adjustments from Chinese supermarket chain Pangdonglai, or through self-improvement. Yonghui Group has adjusted and upgraded its stores nationwide with the assistance of Pangdonglai and its successful experience.