Top Biz News

Copper loses gleam as greenback rallies

(China Daily)

Updated: 2010-02-02 08:06

|

Large Medium Small |

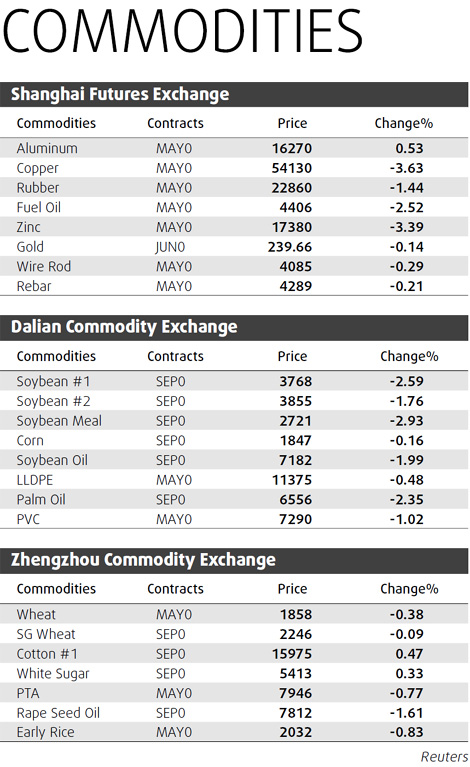

The contract for three-month delivery on the London Metal Exchange (LME) declined as much as 2.2 percent to $6,600 a ton, the lowest level since Nov 16. The metal posted the biggest monthly drop since December 2008 last week. London zinc, lead and tin hit multi-month lows and Shanghai copper tumbled the daily limit.

The dollar reached a six-month high against a basket of major currencies after a report showed the US economy grew at the fastest pace in six years. China took steps to curb lending last month in an effort to control credit growth and prevent asset bubbles.

"The dollar's rally and China's tightening are a double whammy to the copper market, which may continue a downward correction for another two months," said Jing Chuan, a trader at Great Wall Futures Co.

The May-delivery contract on the Shanghai Futures Exchange tumbled by the 5 percent daily limit from the previous settlement price to 53,360 yuan ($7,817) a ton. It closed 2 percent down at 54,470 yuan.

China's manufacturing grew in January at the second-fastest pace since 2008, figures from the Federation of Logistics and Purchasing showed. The Purchasing Managers' Index dropped more than economists forecast to a seasonally adjusted 55.8 in January from 56.6 in December. A number above 50 indicates an expansion.

"The manufacturing data may add to concerns that the government will take more steps to rein in liquidity, which drove the metals rally last year, not consumption," Jing said.

| ||||

"The firmer dollar, rising LME stockpiles and bearish impact of tighter monetary policy in China offset the unexpectedly strong US data," analysts Mark Pervan and Natalie Robertson said.

Among other LME metals, zinc slipped as much as 1.7 percent to $2,074 a ton, the lowest since Oct 19, lead tumbled as much as 3.2 percent to $1,960 a ton, the lowest since Aug 24 and tin slumped as much as 6.4 percent to $16,100 a ton, the lowest since Dec 24. Nickel slid 0.5 percent to $18,400 a ton at 3:02 pm in Shanghai.

Aluminum added 0.1 percent to $2,080 a ton. Aluminum Corp of China Ltd expects Chinese demand for aluminum to grow 23 percent to 17 million tons in 2010 from a year ago, Citigroup Inc said yesterday.

Bloomberg News