Top Biz News

Copper drops amid tightening concerns

(China Daily)

Updated: 2010-02-03 08:04

|

Large Medium Small |

Copper for three-month delivery declined as much as 0.9 percent to $6,727 a metric ton on the London Metal Exchange, after gaining as much as 0.7 percent earlier.

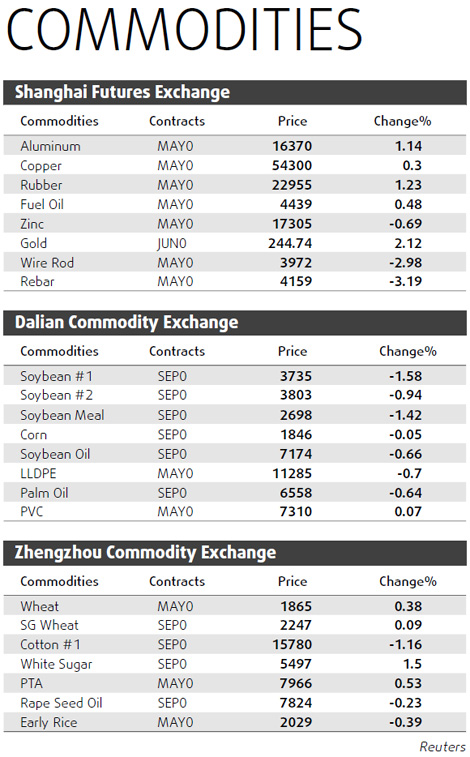

The May-delivery contract on the Shanghai Futures Exchange fell for a fourth day, losing 0.3 percent to close at 54,300 yuan ($7,953) per ton.

Chinese banks advanced a record 9.59 trillion yuan of new loans last year, helping spur record imports of metals such as copper and aluminum from the country. The regulator has capped new loans at 7.5 trillion yuan for 2010 and took steps to curb lending last month.

"The downward correction might not have completed yet," said Cao Yanghui, an analyst at Nanhua Futures Co in Hangzhou, Zhejiang province. "Investors are still eager to place their sell bets in anticipation of more credit curbs from China."

Copper prices are headed for a "catastrophe" as speculators unwind positions and global inventories grow, David Threlkeld, president of metals trader Resolved Inc, said. The price of the metal will drop below $1 a pound, Threlkeld said. The target is equivalent to a price of less than $2,205 a ton.

London copper rebounded from the lowest price since Nov 16 on Monday after a report showed US manufacturing expanded at the fastest rate in five years and as the dollar dropped from a six-month high against a basket of major currencies.

The US is the second-largest user of the metal used in homes, cars and appliances.

Copper climbed from a 10-week low in Shanghai earlier as declines lured buyers from China.

| ||||

Aluminum added 0.2 percent to $2,090 a ton in London and was 0.2 percent up at 16,370 yuan a ton in Shanghai.

"With the large inventory buildup, aluminum prices could go beneath the cost of production," Li Ye, an analyst at Jiuheng Futures Co, said from Shanghai. Still, the metals market is "being guided by macro-economic factors rather than supply and demand," he said.

Zinc tumbled 1.9 percent to $2,105 a ton in London, lead slid 0.2 percent to $2,041 a ton, nickel retreated 0.1 percent to $17,975 a ton and tin was 0.3 percent up at $16,200 a ton.

Bloomberg News