|

|

|

|

|||||||||||

|

A boy guiding his father as he fills in an application form for a job at a Chinese company's overseas project while the boy's mother looks on. Many of these projects are in Africa and other developing economies, where, because of a shortage of material goods, there isn't much to spend money on so many send much of their earnings back home.[Photo/China Daily] |

China soon expected to top list for remitting wages from overseas

If it was not for the risks of getting malaria and being robbed in the streets, Yu Peng's job in East Africa's Tanzania would be the envy of most young Chinese office workers.

The 27-year-old works as a manager on a highway project contracted to a large Chinese State-owned enterprise and receives a hardship allowance of $4,000 a month on top of his basic salary.

The place in which Yu and his colleagues live is in a seaside villa area and is one of the most affluent communities in the country where more than 90 percent of the population still live in rural areas.

However, a shortage of material goods and the fact that every journey is an adventure means that shopping is not on the to-do list for these highly paid workers.

"You can barely find a place to spend more than $100, unless you want to buy jewelry for friends at home," said Yu, adding that all necessary living expenses are covered by the company.

As a result, there is only one option left for Yu to deal with his salary - to send it home.

"Rather than enjoying a luxurious life in Africa, I prefer to repay my mortgage loan in Beijing," he said.

It's Yu and millions of other hard-working overseas Chinese around the world who have pushed the country to second place in the league of overseas workers who send their money to their home country. It is soon expected to hold the top position.

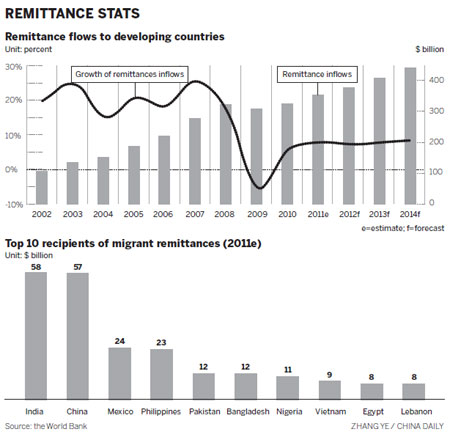

According to a report titled Migration and Development Brief by the World Bank in late 2011, officially recorded remittance flows to developing countries were estimated to have reached $351 billion in 2011, up 8 percent over 2010.

China received an estimated $57 billion in global remittances last year, 11.8 percent up from the previous year, and is closing in on India, the current top destination for sending money home. It received $58 billion in global remittances last year, 5.5 percent more than in 2010.

This is the first time since the global financial crisis that the remittance flows to all developing regions saw increases, said Hans Timmer, director of development prospects at the bank.

Following this rebound in 2011, the growth of remittance flows to developing countries is expected to continue at a rate of 7 to 8 percent annually to reach $441 billion by 2014, when the worldwide remittance flows, including those to high-income countries, is expected to exceed $590 billion the report said.

However, with the surging figure come higher costs, the World Bank said. The average cost of global remittances saw an increase of 5 percent year-on-year as of March 2011 to a total of $16 billion.

China was also among the regions with heavy duties on global remittance, with every $200 remittance from overseas facing an average cost of $11.57, a sum that includes transaction fees and currency conversion charges.

The cost is 53 percent higher than remitting the same amount of money to India, where it is only $7.56.

Gao Jianhua, director of China and Mongolia with Western Union Co, a leading global money transfer network, believes that China will continue playing a major role in the global remittance market with more Chinese enterprises acquiring overseas businesses.

"We should not forget that China's current runner-up place was achieved when many transactions were conducted via underground networks run by illegal banks, which are not included in the official data," Gao said.

According to statistics from the Ministry of Foreign Affairs, the number of China's outbound personnel, which is growing 30 percent a year on average, reached 75 million in 2011.

There are more than 4 million Chinese working overseas, among which, data from the Ministry of Commerce showed, a total of 812,000 workers are employed by Chinese companies working abroad as of the end of 2011.

It is widely accepted that there is also a group of people of a similar size, if not more, making a living without a permit or even legal identities, and their remittances can only be made via underground networks.

As in Tanzania, Yu said, Chinese overseas workers are employed by a wide range of companies from State-run firms to small private enterprises. There is therefore a large disparity in salaries.

"But even a lower level worker on our project, such as a tile layer, could earn a monthly salary of around 8,000 yuan ($1,270), which still outstrips the payment of a similar position in the domestic market by three to four times," he said.

To avoid high remittance charges, or simply not knowing how to send money home, many workers return to China with their money tied around their waists, Yu said.

Gao said there is great potential for China if this invisible market is explored.

Western Union will continue focusing on business in China and will deepen its cooperation with Chinese partners such as the Postal Savings Bank of China and the Agricultural Bank of China Ltd to provide more channels to facilitate the increasing need for overseas remittances, he said.

weitian@chinadaily.com.cn

|